Missouri Employment Application for Actor

Description

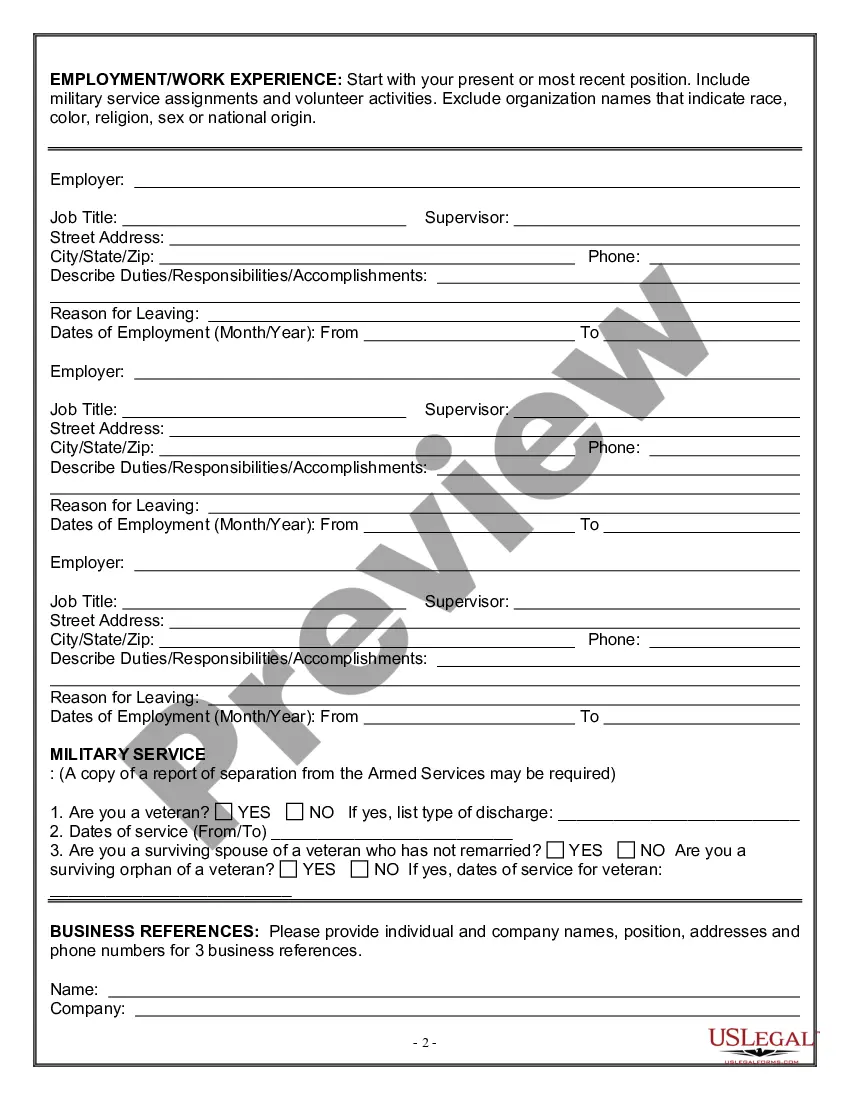

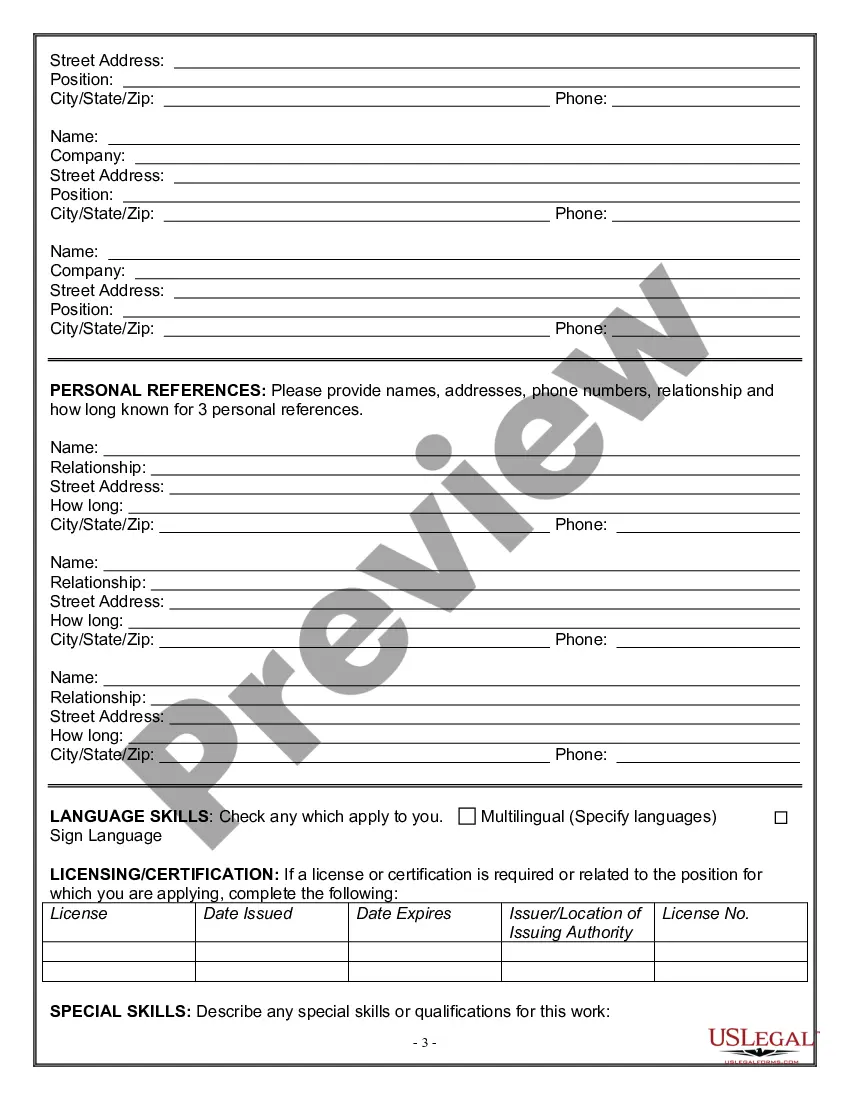

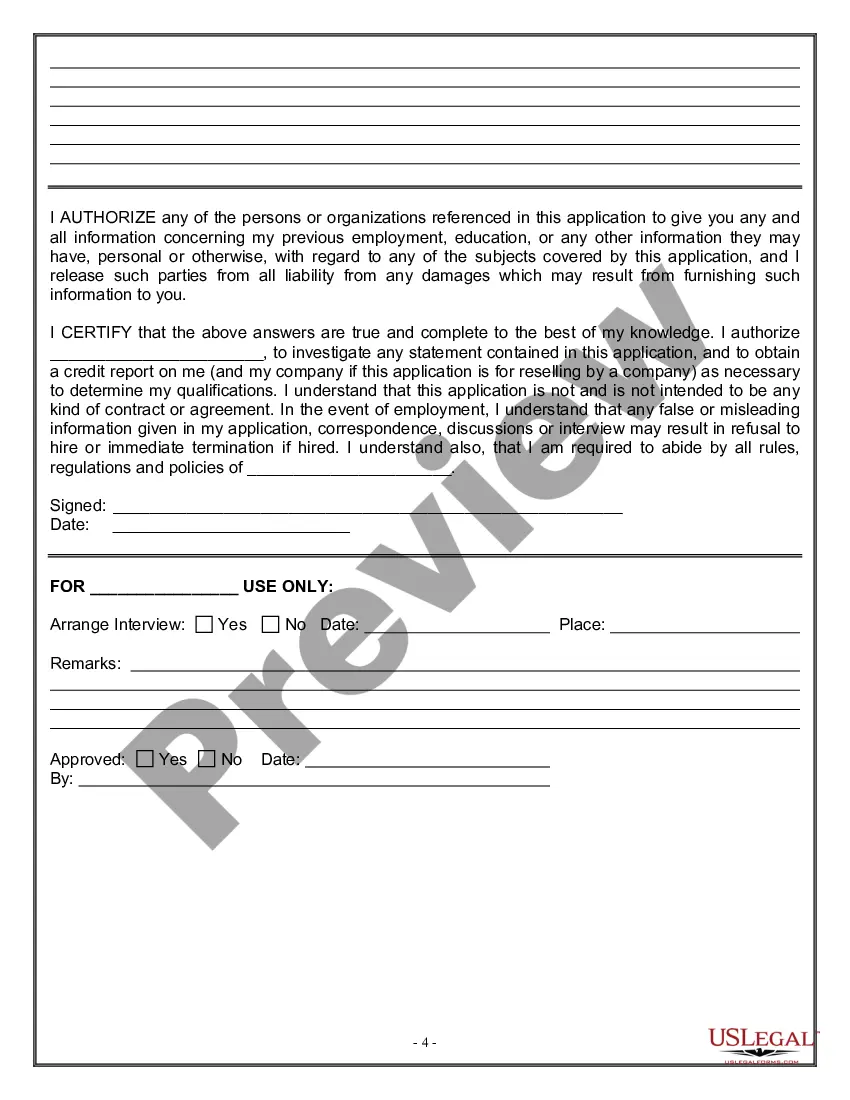

How to fill out Employment Application For Actor?

Selecting the appropriate legal document format can be quite challenging. Clearly, there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Missouri Employment Application for Actor, suitable for both business and personal purposes.

All of the forms are reviewed by experts and comply with federal and state regulations.

If the form does not meet your needs, utilize the Search field to locate the appropriate form. Once you are sure the form is correct, click the Get now button to obtain the document. Select the pricing plan you wish and enter the required information. Create your account and complete your purchase using your PayPal account or credit/debit card. Choose the file format and download the legal document template for your records. Finally, complete, edit, print, and sign the acquired Missouri Employment Application for Actor. US Legal Forms boasts the largest repository of legal forms for you to find various document templates. Use the service to obtain professionally crafted paperwork that adheres to state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Missouri Employment Application for Actor.

- Use your account to search the legal forms you have previously purchased.

- Visit the My documents tab in your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your area/county.

- You can preview the form using the Review button and read the form details to verify its suitability.

Form popularity

FAQ

Go to the PUA Reassessment section on the UI Online homepage to review the complete list of federally approved COVID-19 reasons and select any that apply to you. You will also be asked to confirm the date your business, employment, or self-employment was first interrupted as a direct result of COVID-19.

Who can qualify for PUA Benefits? Eligibility for PUA includes those individuals not eligible for regular unemployment compensation, extended benefits, or pandemic emergency unemployment compensation (PEUC), including those who have exhausted all rights to such benefits.

If an employee is required to fill out a W-4 form, that employee must be reported. New hire reporting is mandated by federal law under Title 42 of U.S. Code, Section 653a of the Personal Responsibility and Work Opportunity Reconciliation Act and by the Revised Statutes of Missouri, Sections 285.300 to 285.308.

Independent contractors whose businesses have been impacted by the coronavirus are encouraged to apply for unemployment assistance at .

Benefits can be paid within 22 days after establishing a new claim or renewing an established claim, unless an issue is being investigated. Any situation that requires a determination to be made regarding your eligibility to receive benefits is called an issue. An issue can take on average 4-6 weeks to be completed.

You may also call 1-888-663-6751....You may use one of the following reporting methods:Mail the W-4 or equivalent form to the Missouri Department of Revenue, PO Box 3340, Jefferson City, MO 65105-3340;Fax copies of the W-4 or equivalent form to (573) 526-8079;Electronically report employees via Secure File Transfer.

The easiest way to do that is online at uinteract.labor.mo.gov. You can also file a claim over the phone the Springfield number is 417-895-6851 but you might be on hold for a while. Once you've started, you'll want to keep an eye out for the part where they ask about the states where you've worked.

Verify your identity.Select Driver's License, State ID, Passport, or Passport Card. You can take a photo with your mobile device or upload from your computer.

The Missouri Department of Labor and Industrial Relations' (DOLIR's) Division of Employment Security (DES) is now processing unemployment claims for the self-employed, gig workers, independent contractors, and those who otherwise do not qualify for regular unemployment benefits and have been impacted by the coronavirus

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.