Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

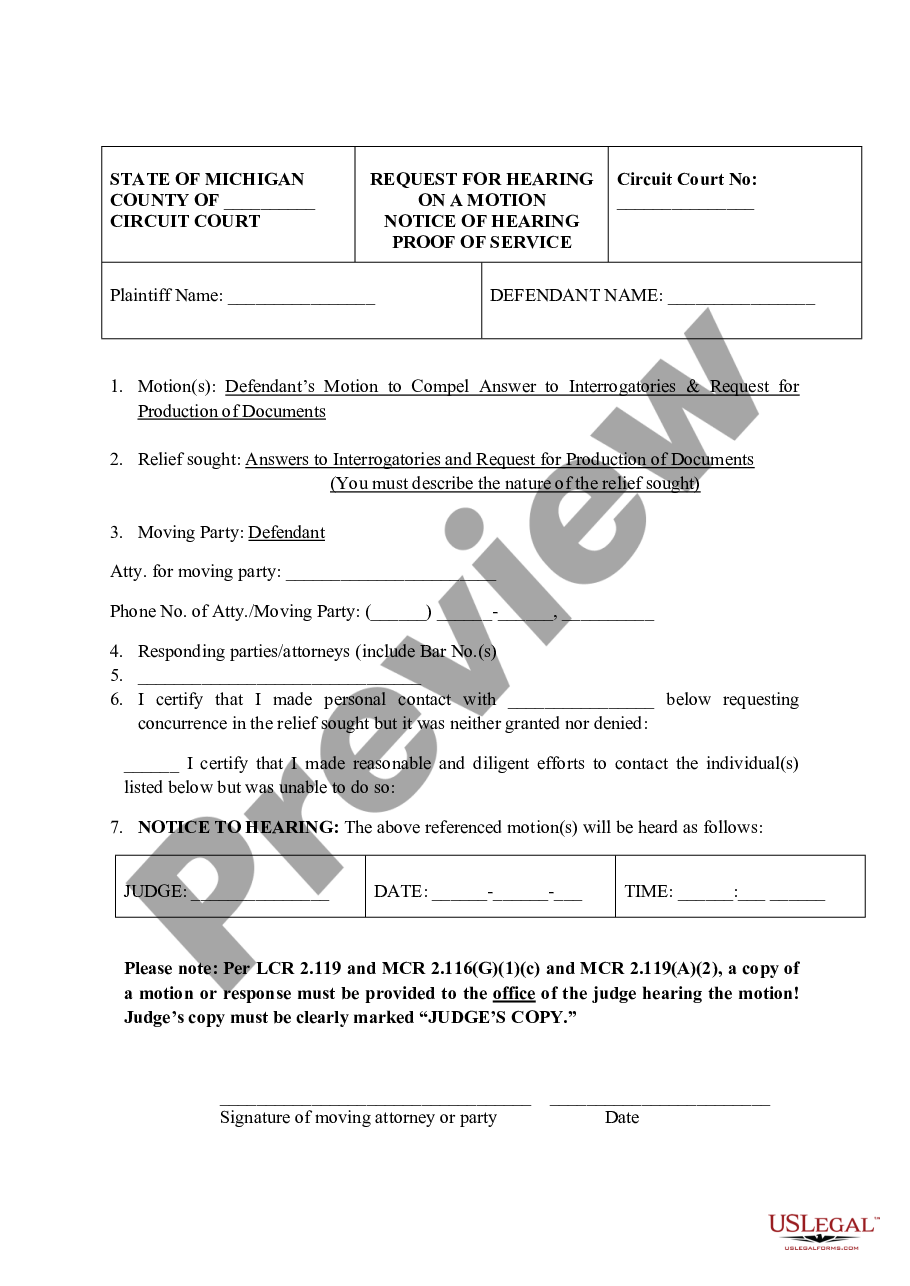

Missouri Sample Letter for Change of Venue and Request for Homestead Exemption

Description

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

Are you currently in a position in which you need to have files for either enterprise or personal purposes nearly every day? There are plenty of lawful document web templates accessible on the Internet, but discovering ones you can rely is not straightforward. US Legal Forms provides thousands of kind web templates, like the Missouri Sample Letter for Change of Venue and Request for Homestead Exemption, that happen to be written in order to meet state and federal specifications.

In case you are presently knowledgeable about US Legal Forms website and get an account, simply log in. After that, you can acquire the Missouri Sample Letter for Change of Venue and Request for Homestead Exemption web template.

Unless you offer an accounts and wish to begin using US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for that appropriate area/state.

- Utilize the Preview switch to analyze the shape.

- Read the description to actually have chosen the proper kind.

- In case the kind is not what you are looking for, utilize the Lookup field to get the kind that fits your needs and specifications.

- Once you find the appropriate kind, click Buy now.

- Select the rates plan you want, submit the necessary info to create your account, and purchase your order utilizing your PayPal or bank card.

- Choose a hassle-free data file format and acquire your backup.

Get all the document web templates you have purchased in the My Forms food list. You may get a extra backup of Missouri Sample Letter for Change of Venue and Request for Homestead Exemption any time, if required. Just go through the needed kind to acquire or produce the document web template.

Use US Legal Forms, by far the most extensive variety of lawful types, in order to save efforts and steer clear of errors. The support provides skillfully created lawful document web templates that you can use for a variety of purposes. Produce an account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

The MO PTC form is an application for the Missouri Property Tax Credit, which helps eligible homeowners and renters offset their property taxes. Completing this form accurately is crucial to ensure you receive the benefits you deserve. To aid in your application, you might find a Missouri Sample Letter for Change of Venue and Request for Homestead Exemption useful for clarity and organization. USLegalForms offers templates that can assist you in preparing your MO PTC form correctly.

In Missouri, the senior citizen exemption allows eligible homeowners aged 65 and older to reduce their property tax burden. This exemption is designed to assist senior residents in managing their property taxes more effectively. If you are considering applying for this exemption, you may benefit from a Missouri Sample Letter for Change of Venue and Request for Homestead Exemption to guide your application process. USLegalForms can provide you with the necessary documentation to streamline your application.

Yes, you can file the Missouri Property Tax Credit (PTC) online through the Missouri Department of Revenue's website. This online platform simplifies the process, making it easier to submit your application for the PTC. Additionally, using a Missouri Sample Letter for Change of Venue and Request for Homestead Exemption can help you understand how to prepare your documents effectively. If you need assistance, consider using USLegalForms for reliable templates.

In Missouri, to qualify for a homestead exemption, you must own and occupy the property as your primary residence. You can utilize a Missouri Sample Letter for Change of Venue and Request for Homestead Exemption to formally apply for this exemption. Typically, you will need to provide proof of residency, such as a utility bill or driver's license, along with your application. Meeting these requirements can significantly reduce your property taxes.

Transferring venue in Missouri involves filing a motion with the court that currently holds your case. You can reference a Missouri Sample Letter for Change of Venue and Request for Homestead Exemption to help draft your motion. This letter should clearly state your reasons for the transfer, such as convenience or fairness. After filing, the court will evaluate your request and make a determination based on the merits.

To obtain a Missouri tax exempt letter, you need to submit a formal request that outlines your eligibility for tax exemption. You can use a Missouri Sample Letter for Change of Venue and Request for Homestead Exemption as a template to ensure your request is clear and comprehensive. Additionally, you should include any required documentation that supports your claim. Once submitted, the relevant authorities will review your request and issue the letter if you qualify.

To change your address for personal property tax in Missouri, you need to notify your local assessor's office promptly. This typically involves submitting a written request that includes your old address, new address, and any applicable identification. Incorporating the Missouri Sample Letter for Change of Venue and Request for Homestead Exemption can provide clarity and support your request. For a smooth process, consider utilizing US Legal Forms, where you can find templates to assist with your address change.

Filling out a tax exemption certificate in Missouri requires careful attention to detail. Start by gathering your documents, including any relevant identification and property information. You will need to include the Missouri Sample Letter for Change of Venue and Request for Homestead Exemption as part of your application to help clarify your request. Using a reliable platform like US Legal Forms can streamline this process, ensuring you complete the certificate accurately and efficiently.

In Missouri, seniors can qualify for property tax exemptions starting at age 65. This exemption helps reduce the financial burden of property taxes for older adults. To take advantage of this benefit, it's essential to submit the necessary paperwork, including the Missouri Sample Letter for Change of Venue and Request for Homestead Exemption, to your local assessor's office. By doing so, you can ensure you receive the tax relief you deserve.

To obtain a tax exempt letter in Missouri, you should start by completing the necessary forms for the homestead exemption. First, gather relevant documentation that proves your eligibility, such as proof of ownership and residency. Next, you can utilize the Missouri Sample Letter for Change of Venue and Request for Homestead Exemption, which provides a clear template to guide you. Finally, submit your application to your local tax office, and they will process your request accordingly.