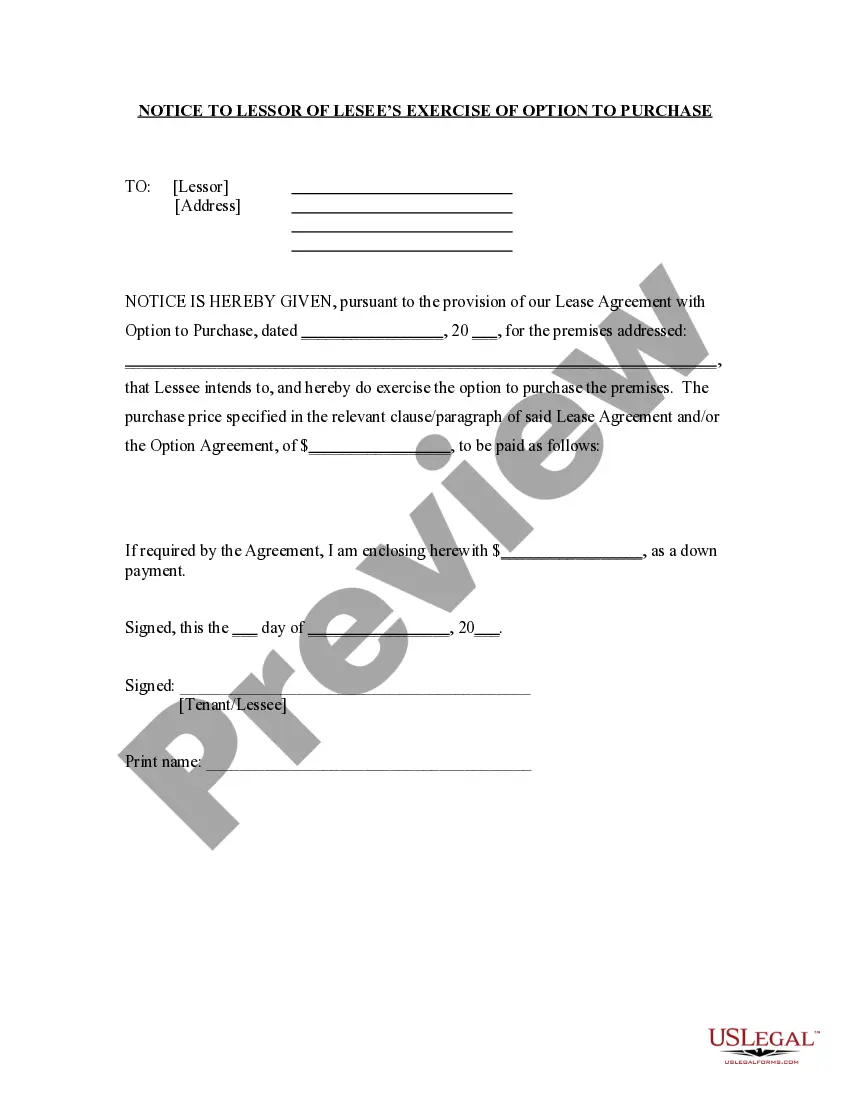

Legal notice to Lessor of exercise of option to purchase by Tenant. This is a notice to the Landlord of Tenant's right to purchase the real estate as agreed to in the initial contract. This letter acts as a legal notice and complies with state statutory laws.

An option is a contract to purchase the right for a certain time, by election, to purchase property at a stated price. An option may be a right to purchase property or require another to perform upon agreed-upon terms. By purchasing an option, a person is paying for the opportunity to elect or "exercise" the right for the property to be purchased or the performance of the other party to be required. "Exercise" of an option normally requires notice and payment of the contract price. The option will state when it must be exercised, and if not exercised within that time, it expires. If the option is not exercised, the amount paid for the option is not refundable. Sometimes an option is the right to renew a contract, such as a lease or some other existing business relationship. A "lease-option" contract provides for a lease of property with the right to purchase the property during or upon expiration of the lease.