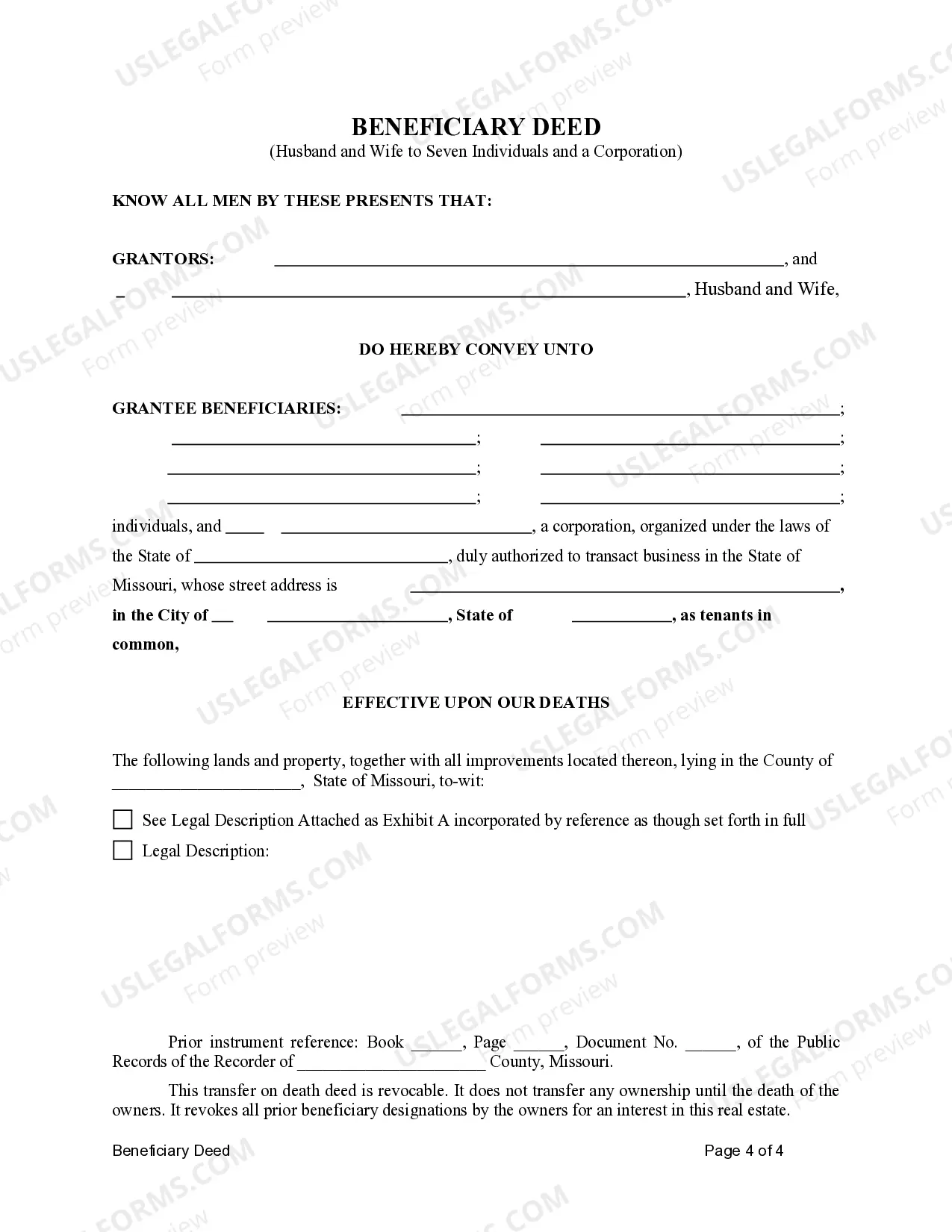

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantees are seven individuals and one corporate beneficiary. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The Grantees take the property as tenants in common. This deed complies with all state statutory laws.

Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary

Description

How to fill out Missouri Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Seven Individual Beneficiaries And A Corporate Beneficiary?

Obtain any variant from 85,000 legal records such as Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Seven Individual Beneficiaries and a Corporate Beneficiary online with US Legal Forms.

Each template is prepared and revised by state-licensed legal professionals.

If you hold a subscription, Log In. Once you arrive at the form’s page, click the Download button and navigate to My documents to access it.

With US Legal Forms, you will consistently have quick access to the appropriate downloadable template. The service provides you access to forms and categorizes them to simplify your search. Utilize US Legal Forms to obtain your Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Seven Individual Beneficiaries and a Corporate Beneficiary swiftly and efficiently.

- Verify the state-specific requirements for the Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Seven Individual Beneficiaries and a Corporate Beneficiary you intend to use.

- Review the description and examine the sample.

- When you’re confident the template meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your budget.

- Establish a personal account.

- Make a payment using one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

The TOD rule in Missouri allows property owners to transfer their property to designated beneficiaries upon their death without going through probate. This rule is particularly beneficial as it simplifies the transfer process and can help avoid delays. With a Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary, you can designate multiple beneficiaries easily. Understanding this rule can help you make informed decisions about your estate planning.

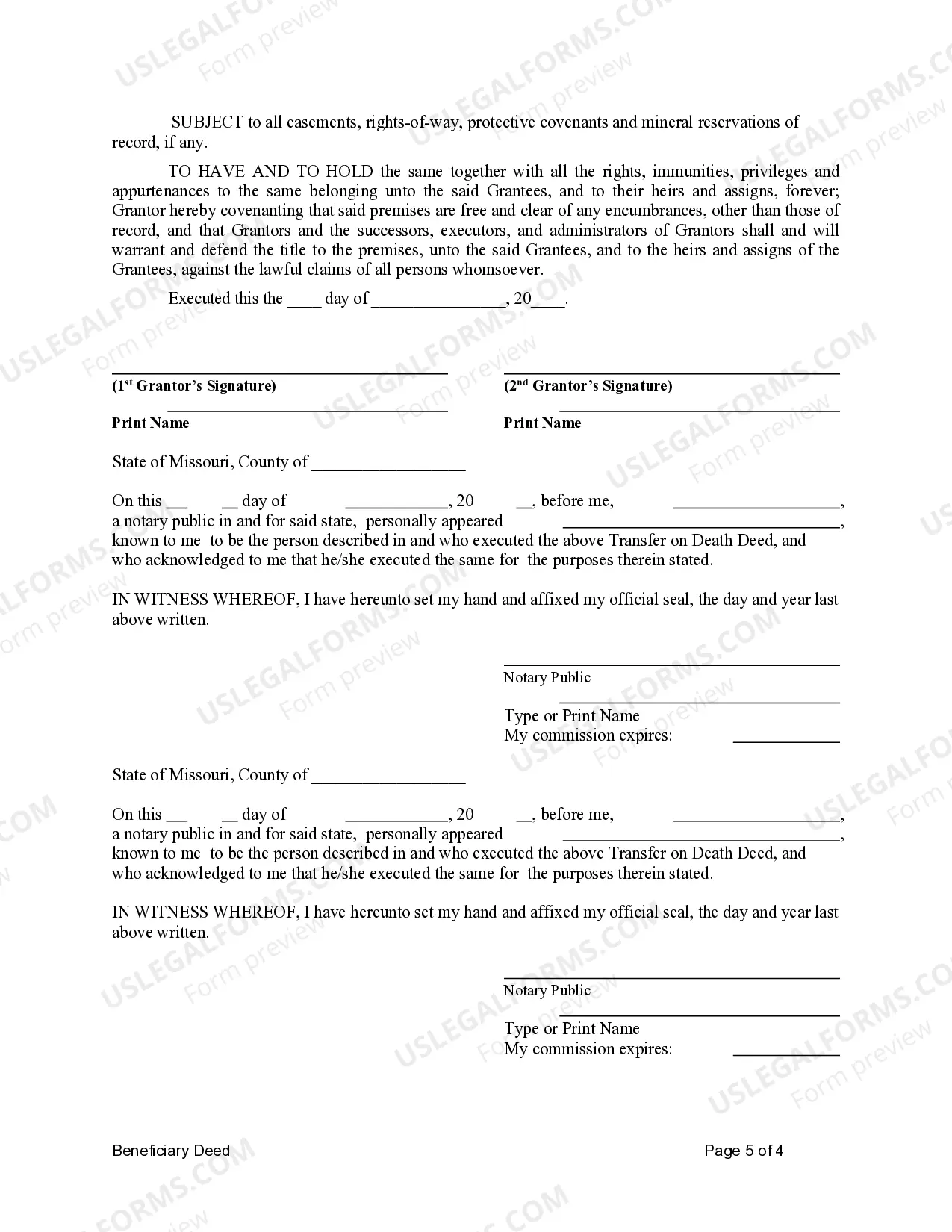

To fill out a transfer on death deed form, you will need to include your personal details, the legal description of the property, and the designated beneficiaries. It’s important to state that the deed is a transfer on death deed clearly. After completing the form, don't forget to sign it in front of a notary. Utilizing resources from platforms like uslegalforms can simplify this process and ensure all necessary steps are followed correctly.

Filling out a Missouri beneficiary deed form requires clear identification of the property and the beneficiaries. Start by providing your name, the property's legal description, and the names of the beneficiaries. Ensure that the form is signed and notarized to make it valid. You can find user-friendly resources on platforms like uslegalforms to guide you through the process smoothly.

Using a Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary can have some disadvantages. For instance, the transfer only occurs upon death, meaning property management during your lifetime remains unchanged. Additionally, if you have debts, creditors may still seek claims against the property. Therefore, it’s essential to consider your entire estate plan before making this choice.

Yes, you can designate multiple beneficiaries on a Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary. This flexibility allows you to distribute your property among different individuals and entities according to your wishes. By naming multiple beneficiaries, you ensure that your assets are divided in a way that reflects your intentions. If you need assistance with this process, uslegalforms can provide the necessary resources and templates to create your TOD deed effectively.

Perhaps the simplest way to avoid Probate is to utilize Missouri's Non-Probate Transfer Law. Simply put, Missouri (and many other states) allow you to designate beneficiaries to receive property or assets upon your death.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

A beneficiary deed is generally used for avoidance of probate, although it may be used to remove a particular property from a probate estate.

The Beneficiary Deed transfers an owner's interest in real estate to named beneficiaries upon the owner's death without need for the probate process. This saves the family both the time and money associated with the Probate Process.