Minnesota Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form

Description

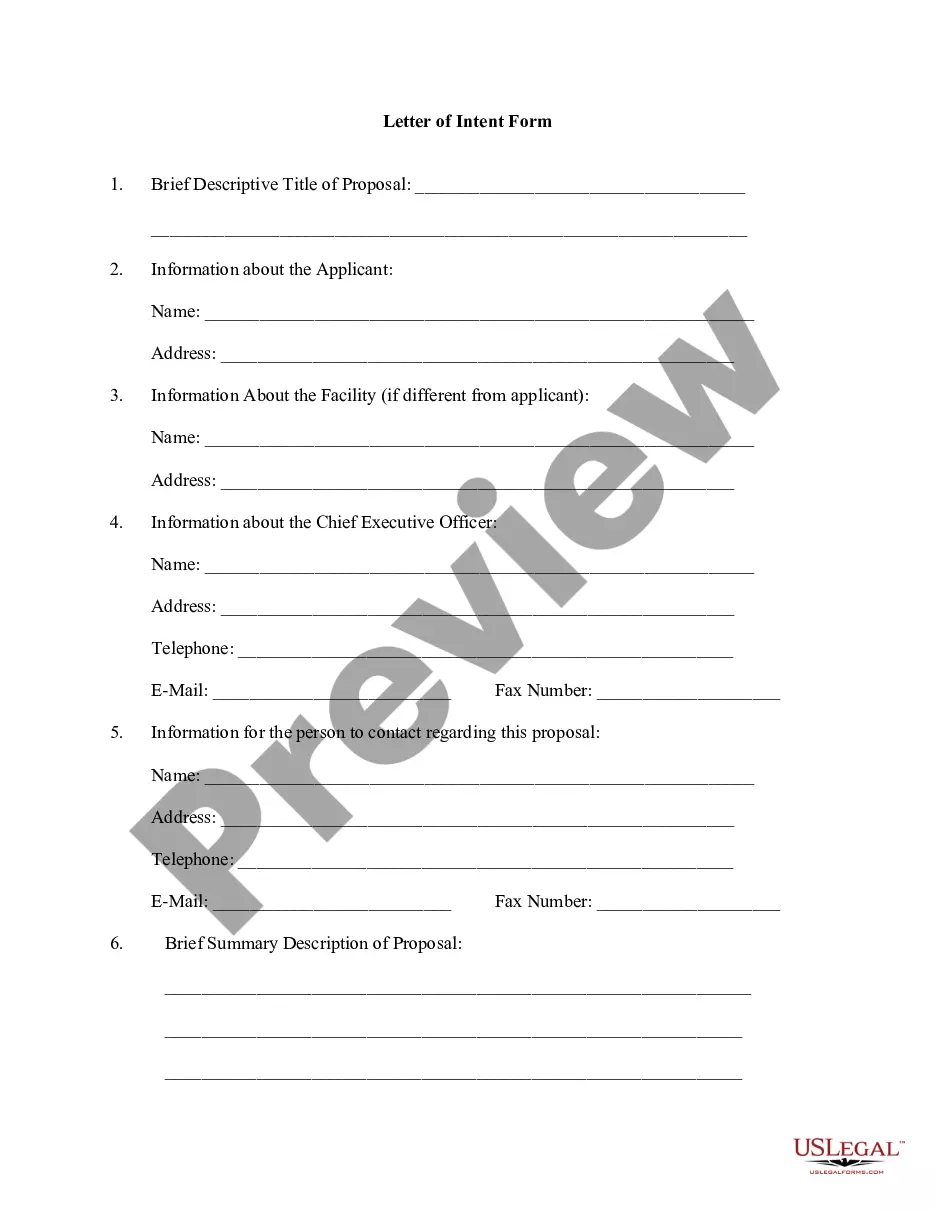

How to fill out Assignment Of Overriding Royalty Interest Out Of Working Interest With Multiple Leases And Limited Warranty - Long Form?

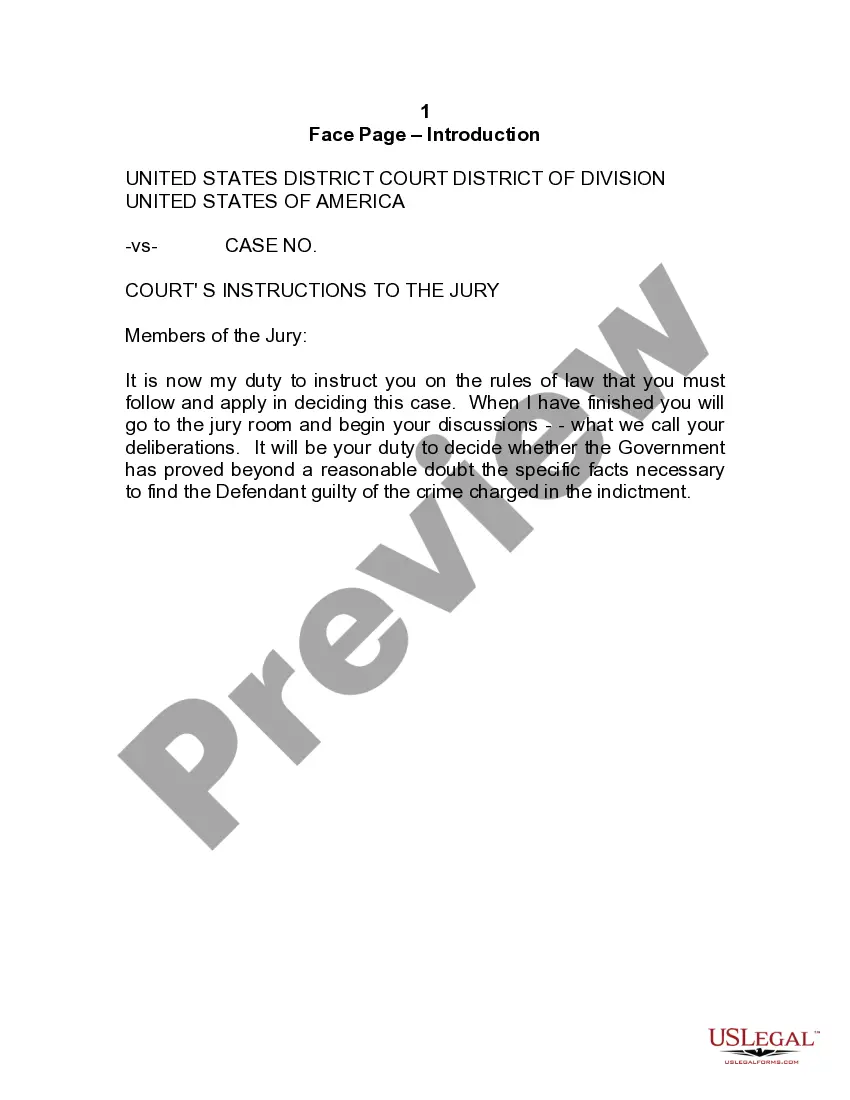

Have you been within a placement that you need to have files for sometimes organization or individual functions virtually every working day? There are a variety of legitimate papers web templates available on the Internet, but getting versions you can trust is not simple. US Legal Forms delivers thousands of form web templates, like the Minnesota Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form, that happen to be published to fulfill state and federal demands.

In case you are presently informed about US Legal Forms website and have an account, merely log in. After that, it is possible to down load the Minnesota Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form template.

Unless you offer an bank account and would like to start using US Legal Forms, adopt these measures:

- Find the form you need and make sure it is for that right town/area.

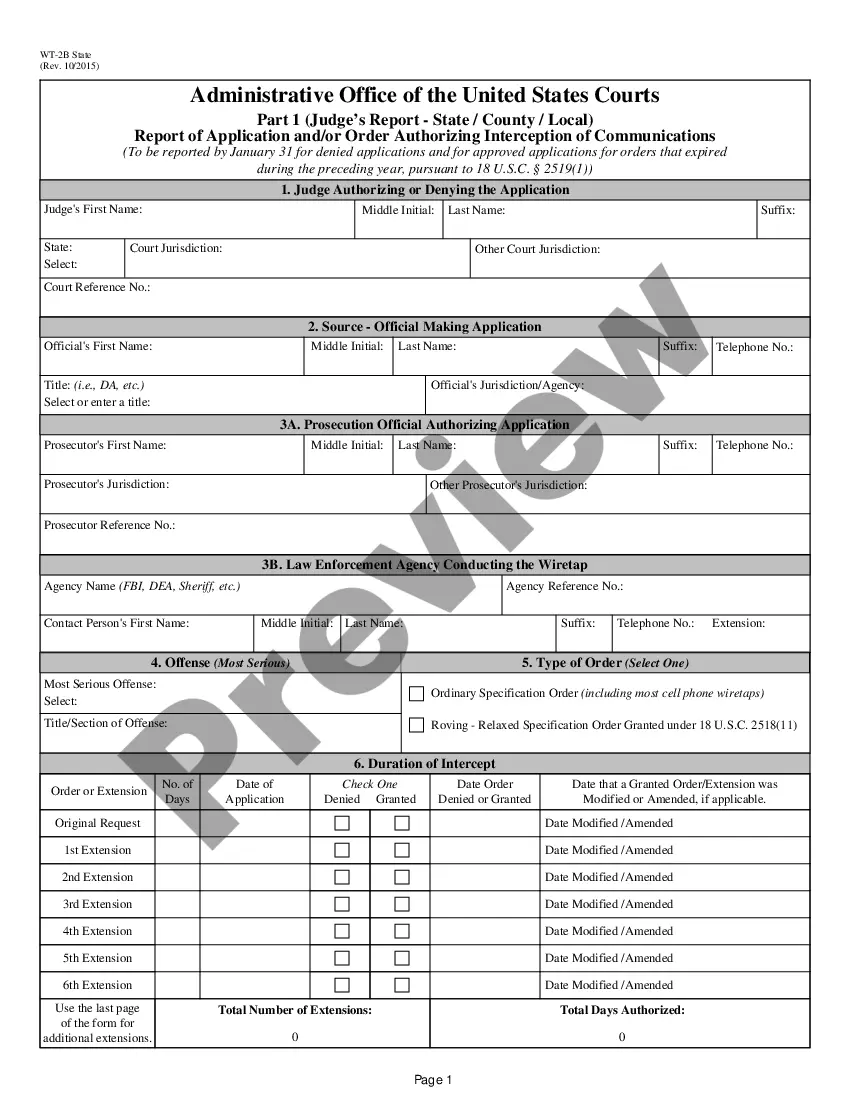

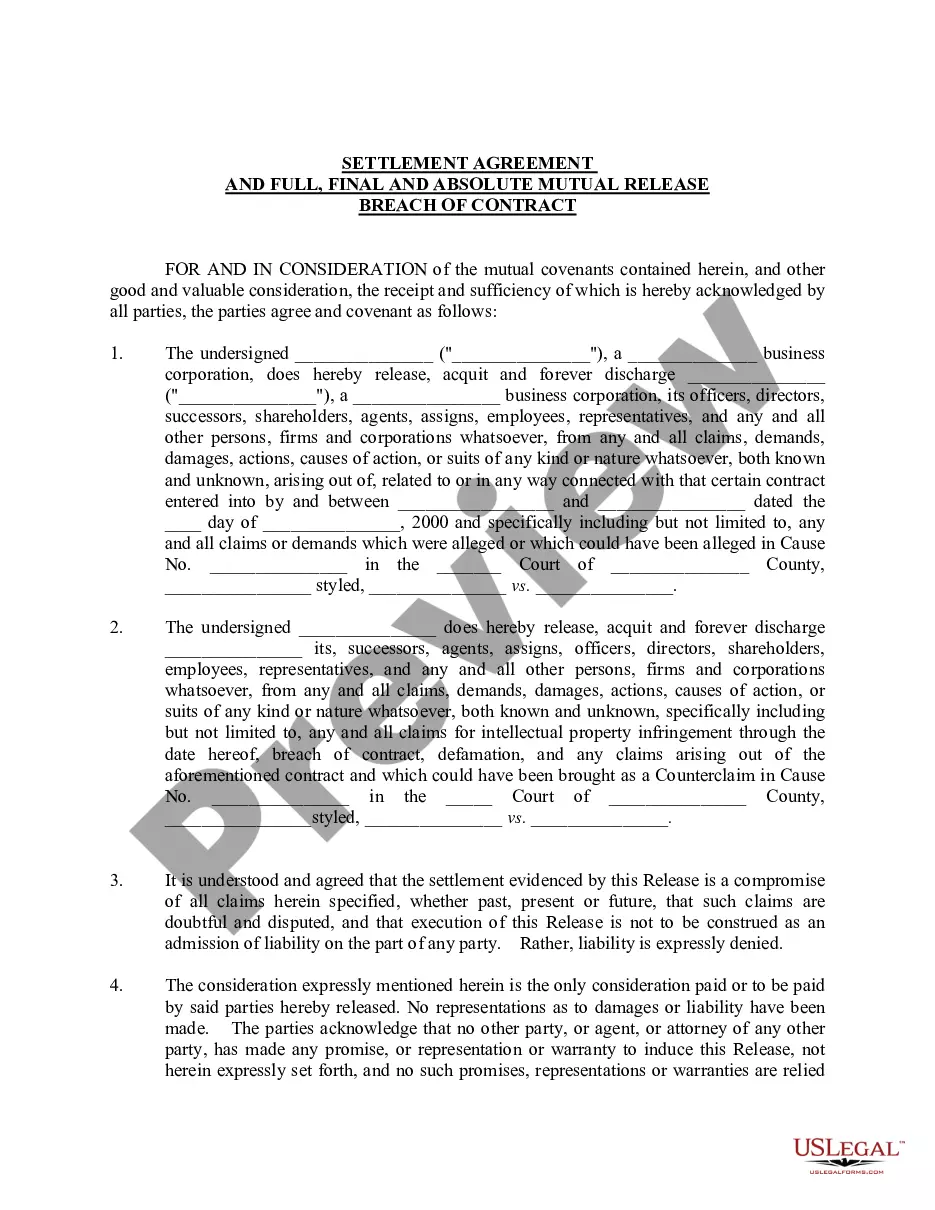

- Utilize the Review button to check the form.

- Look at the explanation to ensure that you have selected the appropriate form.

- When the form is not what you are seeking, use the Search area to discover the form that fits your needs and demands.

- Once you obtain the right form, just click Acquire now.

- Pick the costs prepare you need, fill out the desired information and facts to create your account, and pay for the order making use of your PayPal or credit card.

- Decide on a handy paper formatting and down load your duplicate.

Find each of the papers web templates you might have bought in the My Forms food list. You may get a more duplicate of Minnesota Assignment of Overriding Royalty Interest Out of Working Interest with Multiple Leases and Limited Warranty - Long Form any time, if needed. Just click the necessary form to down load or produce the papers template.

Use US Legal Forms, one of the most extensive selection of legitimate varieties, to save lots of time as well as avoid mistakes. The service delivers skillfully produced legitimate papers web templates which can be used for a range of functions. Create an account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

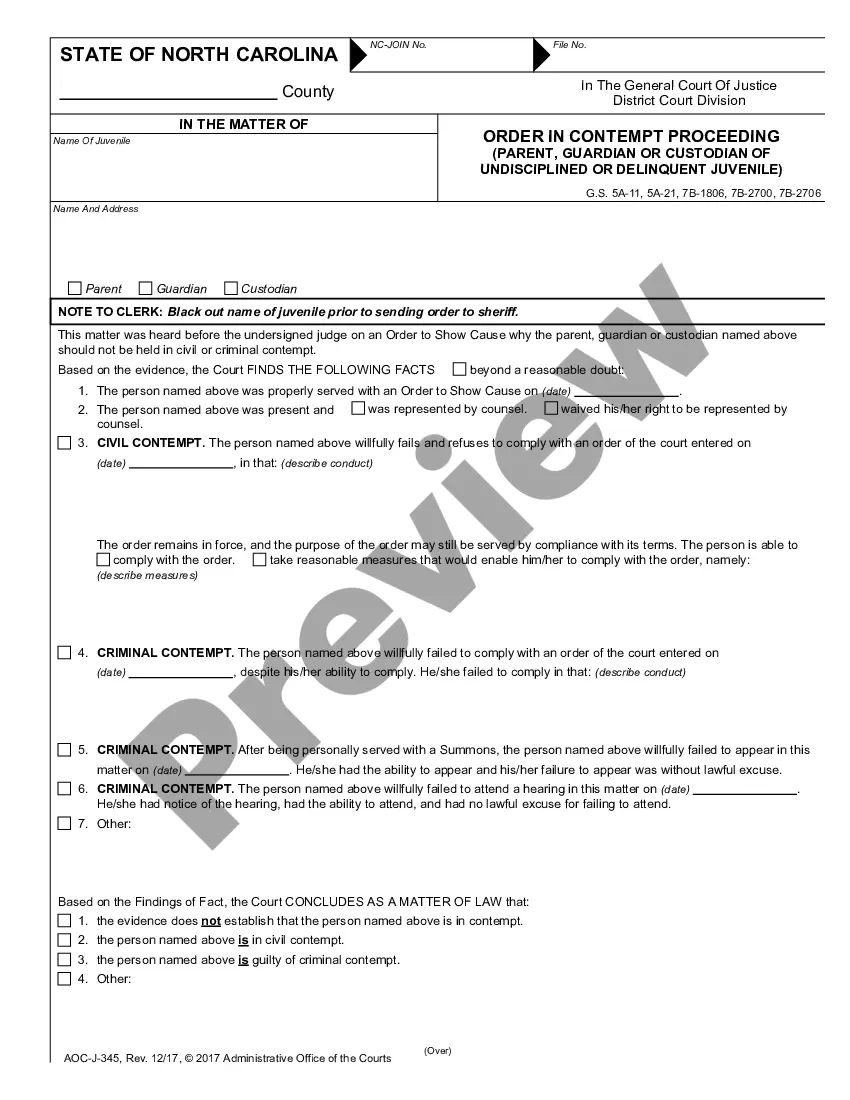

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

: an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.

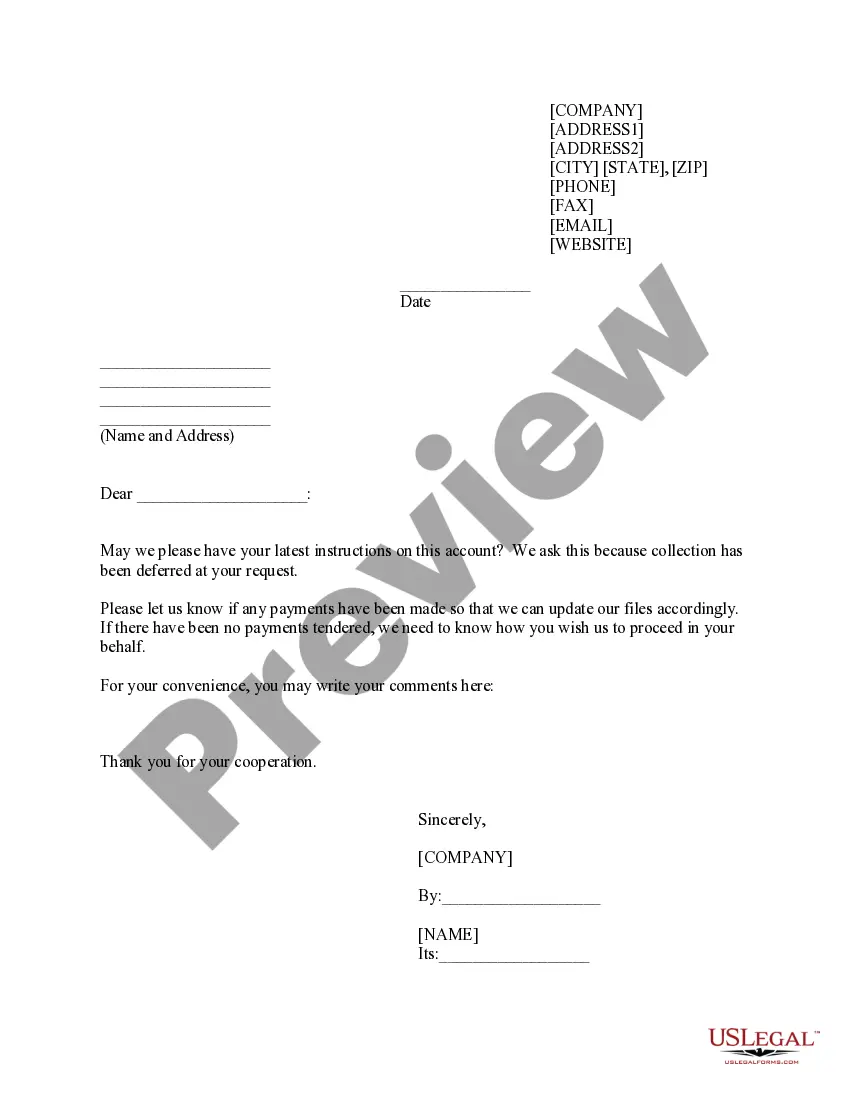

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.