This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Minnesota Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

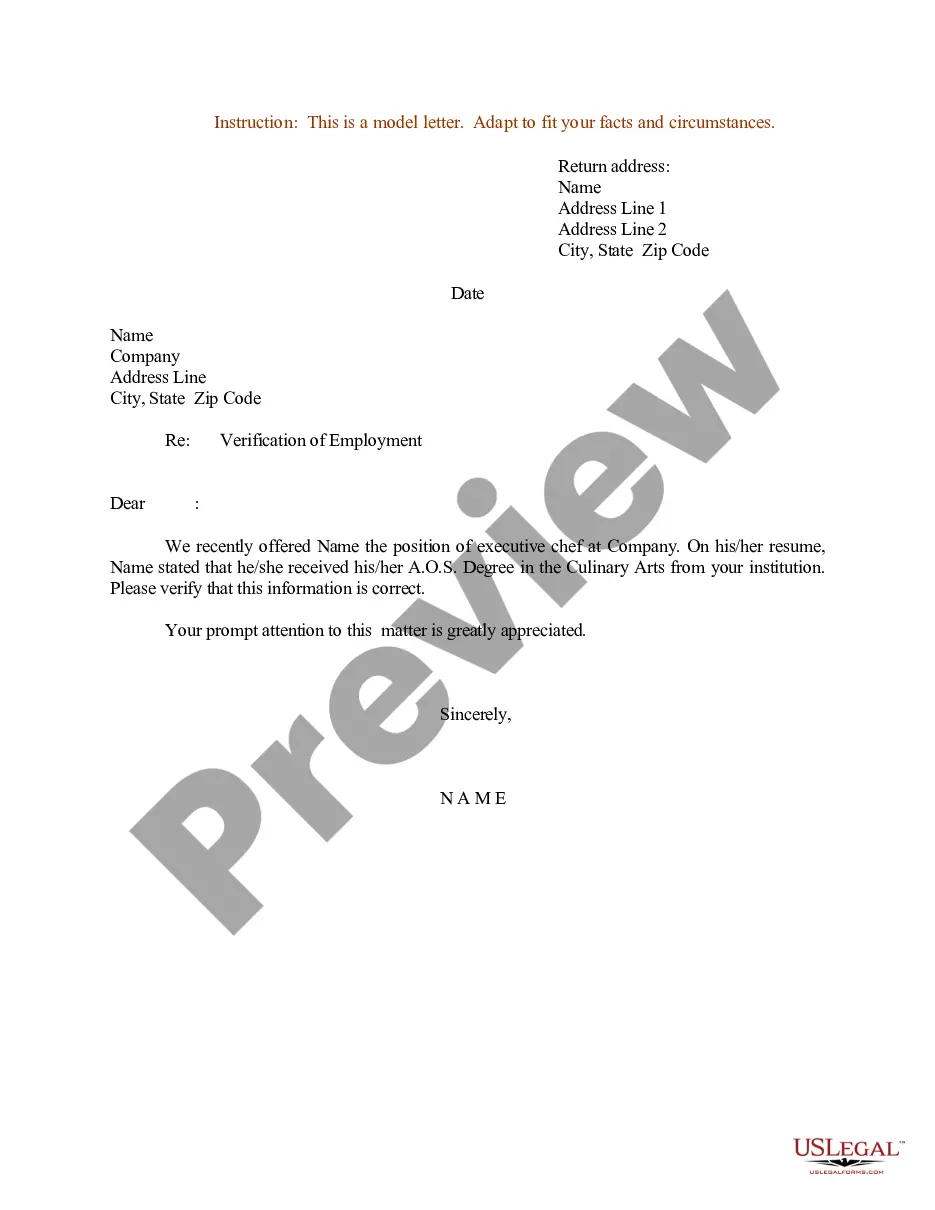

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

It is possible to devote hours on-line looking for the authorized document web template that fits the federal and state demands you want. US Legal Forms offers a huge number of authorized varieties that happen to be analyzed by pros. You can easily acquire or print out the Minnesota Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries from your services.

If you have a US Legal Forms account, it is possible to log in and click on the Obtain key. After that, it is possible to comprehensive, modify, print out, or indication the Minnesota Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries. Every single authorized document web template you get is yours permanently. To get yet another backup of the obtained develop, go to the My Forms tab and click on the related key.

If you use the US Legal Forms web site initially, follow the straightforward instructions below:

- Initially, be sure that you have selected the right document web template to the state/town of your choice. Look at the develop information to ensure you have picked out the appropriate develop. If readily available, take advantage of the Preview key to appear through the document web template at the same time.

- If you would like find yet another model from the develop, take advantage of the Lookup field to obtain the web template that meets your requirements and demands.

- Once you have found the web template you want, click on Purchase now to proceed.

- Choose the prices plan you want, type your accreditations, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal account to cover the authorized develop.

- Choose the structure from the document and acquire it for your device.

- Make adjustments for your document if possible. It is possible to comprehensive, modify and indication and print out Minnesota Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

Obtain and print out a huge number of document templates using the US Legal Forms Internet site, which provides the biggest variety of authorized varieties. Use expert and state-specific templates to deal with your business or individual needs.

Form popularity

FAQ

If the beneficiary of a trust or will passes away, the person who established the trust or will is required to amend their estate plan. The estate plan will still be in effect if this occurs. There are two paths for the inheritance to take when naming beneficiaries for an estate plan when a will or trust is created.

MN Probate Accounting Not only are heirs of the estate entitled to know that probate is happening, but they can also demand to know how the estate was handled. It might even be that the executor was required by the state to administer the accountings of the estate to the beneficiaries.

Transferring property out of a trust is the trustee's job. Generally, after the trustor passes away, the trustee notifies the trust's beneficiaries, enacts the trust's conditions and the beneficiaries receive the assets. In addition, the grantor's death makes the trust irrevocable.

If an estate asset is held jointly with a spouse or has a designated beneficiary (such as an RRSP or TFSA that has a named beneficiary) in many cases, the asset can be transferred without requiring probate.

Key Takeaways. Irrevocable trusts cannot be modified, amended, or terminated without permission from the grantor's beneficiaries or by court order. The grantor transfers all ownership of assets into the trust and legally removes all of their ownership rights to the assets and the trust.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Testamentary trusts allow individuals to pass specific assets to beneficiaries without allowing them to gain control of the assets.

Name a Trust Provide the following information on the beneficiary designation: The full name of the trust as it shows on the trust document. The date the trust was created. The name of the trustee, followed by the word ?trustee,? or if you cannot provide a trustee, ETF may accept another contact person.