Minnesota Subordination by Lessee of Right to Use All or Part of Surface Estate

Description

How to fill out Subordination By Lessee Of Right To Use All Or Part Of Surface Estate?

Finding the right legitimate file web template could be a battle. Naturally, there are plenty of themes available online, but how can you discover the legitimate kind you want? Use the US Legal Forms website. The service delivers a huge number of themes, such as the Minnesota Subordination by Lessee of Right to Use All or Part of Surface Estate, that can be used for organization and personal demands. All the forms are inspected by pros and meet state and federal needs.

When you are currently signed up, log in to your bank account and click on the Download switch to obtain the Minnesota Subordination by Lessee of Right to Use All or Part of Surface Estate. Make use of bank account to look throughout the legitimate forms you have purchased previously. Proceed to the My Forms tab of your respective bank account and get yet another duplicate of your file you want.

When you are a new customer of US Legal Forms, listed below are easy directions so that you can adhere to:

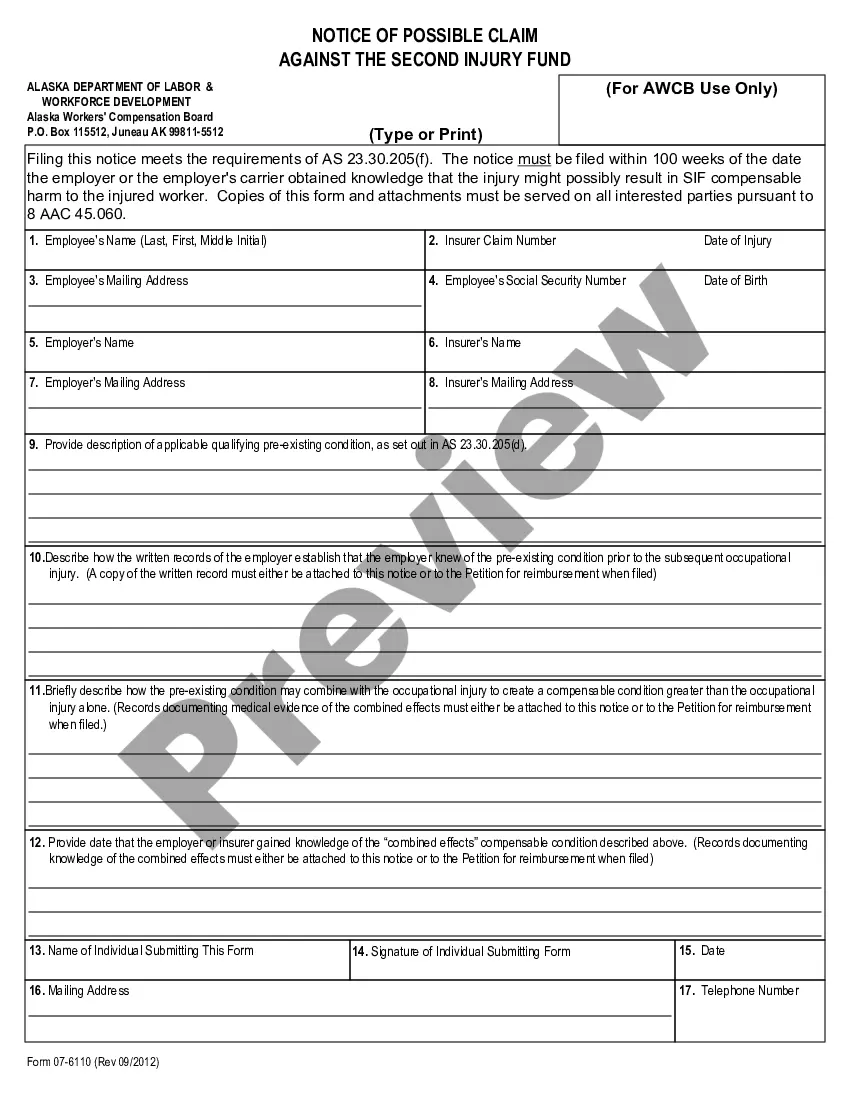

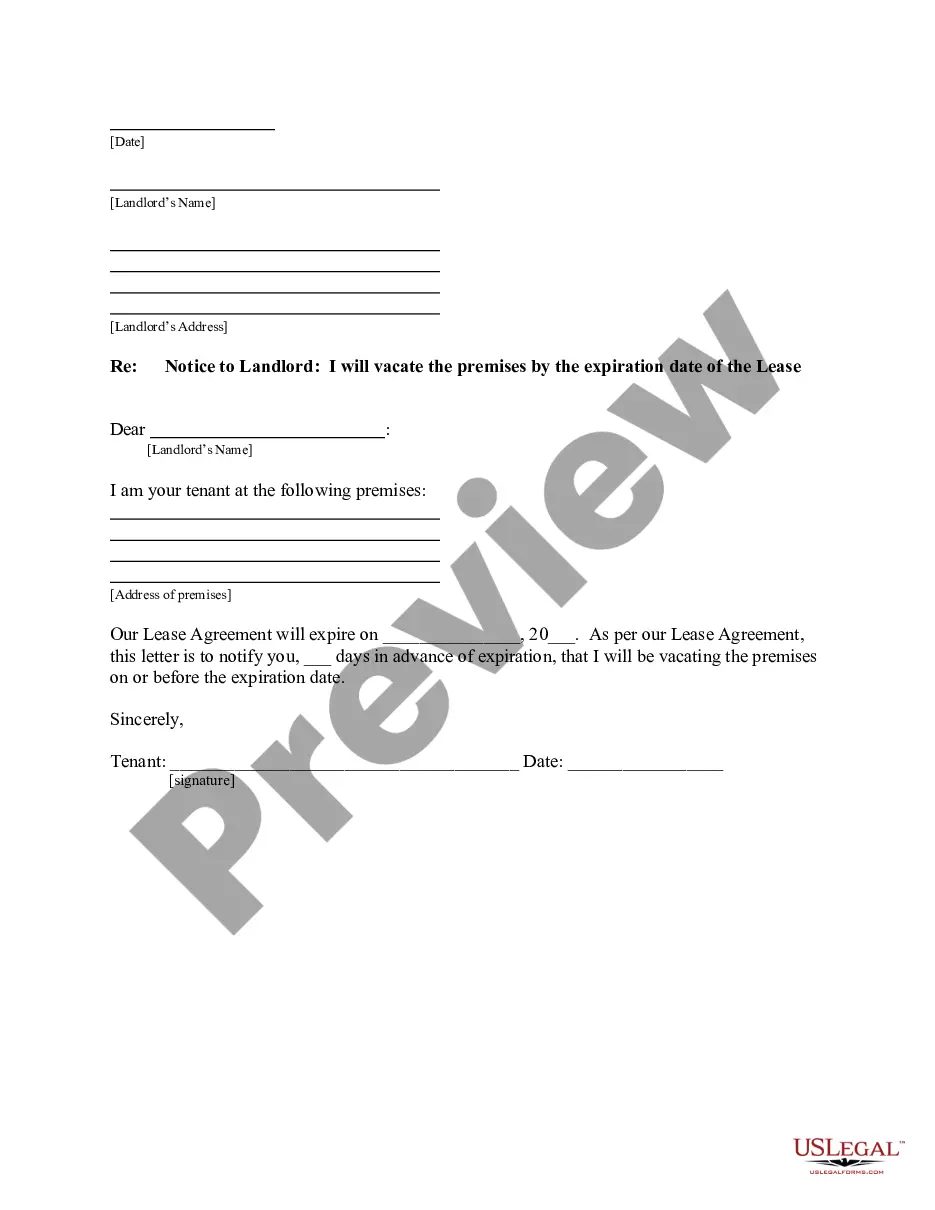

- Initially, ensure you have selected the right kind for your personal city/state. You can look through the form utilizing the Review switch and study the form outline to guarantee this is the right one for you.

- When the kind is not going to meet your expectations, make use of the Seach discipline to discover the proper kind.

- When you are sure that the form would work, go through the Purchase now switch to obtain the kind.

- Opt for the rates program you want and enter in the required information. Make your bank account and pay for the transaction utilizing your PayPal bank account or charge card.

- Select the submit file format and down load the legitimate file web template to your system.

- Full, edit and print out and indicator the obtained Minnesota Subordination by Lessee of Right to Use All or Part of Surface Estate.

US Legal Forms is definitely the greatest collection of legitimate forms that you can find various file themes. Use the service to down load skillfully-created documents that adhere to express needs.

Form popularity

FAQ

A subordination real estate mortgage clause gives the loan it's in reference to first lien position. It states that any other loans or liens on the property take a second lien position. Most first mortgage lenders won't fund a loan unless there is a subordination clause giving them first lien position.

A subordination agreement is one where the lending party agrees to assign the pre-existing lien a lower priority to a subsequent oil and gas lease. As a result, it is as if the lease had been executed and recorded prior to the lien.

What is Subordination? Subordination is putting something in a lower position or rank. Therefore, a subordination agreement puts the lease below the mortgage loan in priority. Mortgage lenders want the leases to be subordinate to the mortgage. That way, the mortgage loan is paid first if there is a foreclosure.

The party that primarily benefits from a subordination clause in real estate is the lender. However, if you decide to pursue a second mortgage, then the subordination clause prioritizes the first lender's repayment and contract rights. The most common application of subordination clauses is when refinancing a property.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

The Subordination Clause. A subordination clause is a lease provision whereby the tenant subordinates its possessory interest in the leased premises to a third-party lender, usually a bank (the rights of the tenant are thus subject to the rights of the lender).