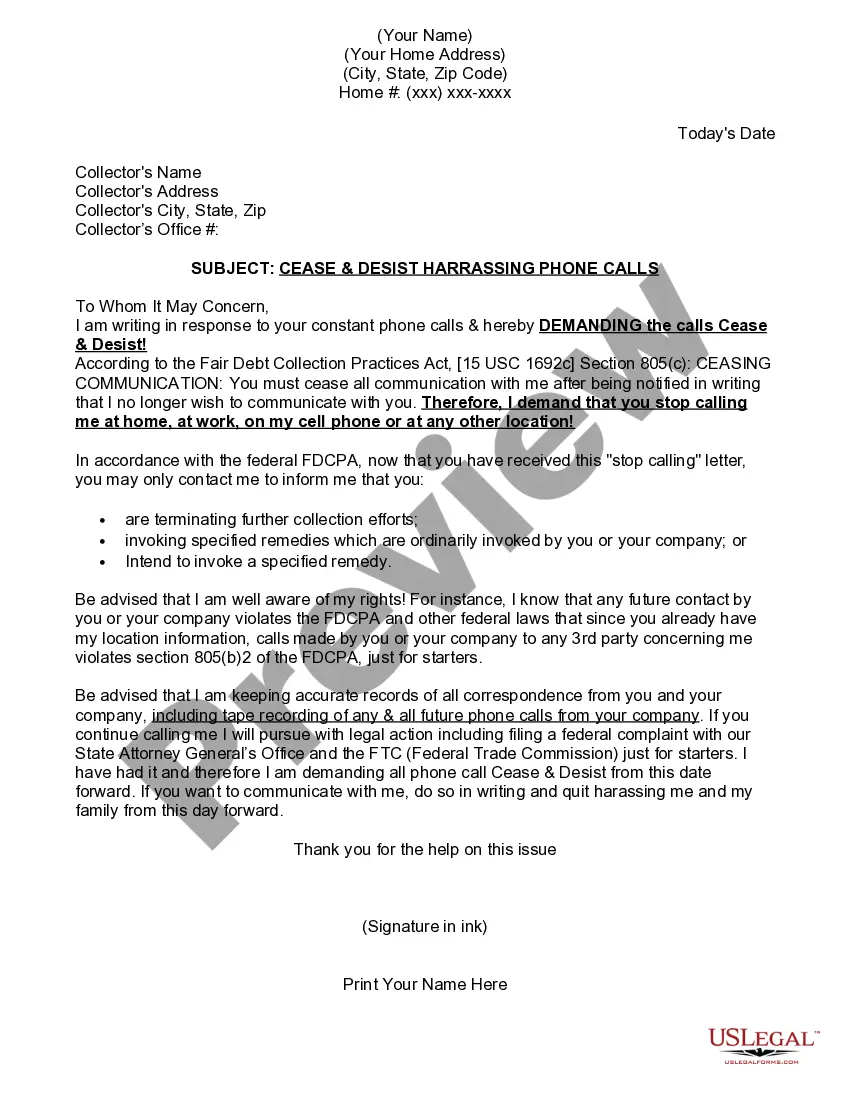

Minnesota Cease and Desist for Debt Collectors

Description

How to fill out Cease And Desist For Debt Collectors?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad selection of legal document formats that you can download or create.

By utilizing the site, you will access thousands of forms for business and personal purposes, organized by categories, claims, or keywords.

You can find the most recent templates like the Minnesota Cease and Desist for Debt Collectors in just a few minutes.

Read the form description to ensure that you have chosen the right template. If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your details to sign up for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Minnesota Cease and Desist for Debt Collectors. Each template you save to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Minnesota Cease and Desist for Debt Collectors with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a vast array of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If you already have a subscription, Log In and download the Minnesota Cease and Desist for Debt Collectors from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms from the My documents tab of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you have selected the correct form for the city/county.

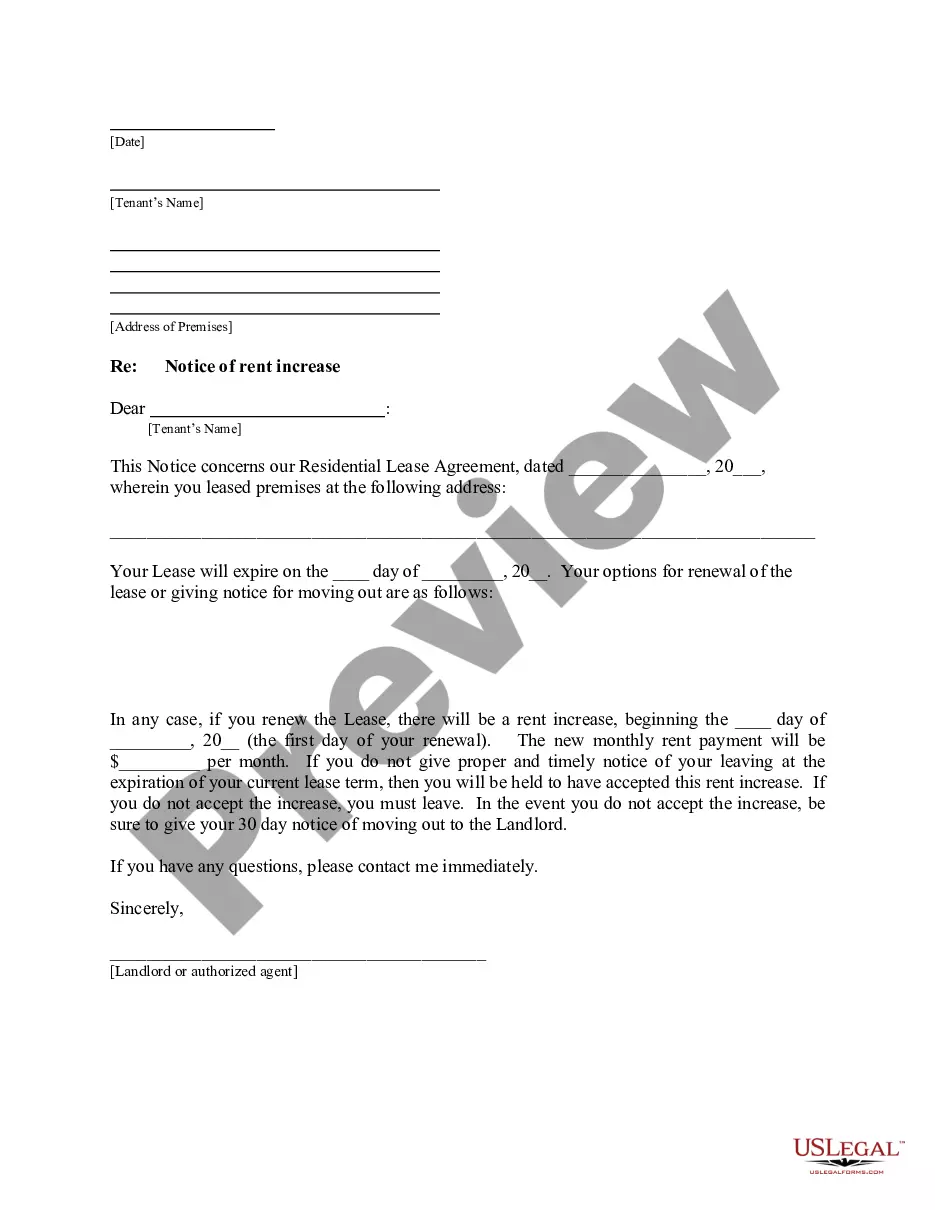

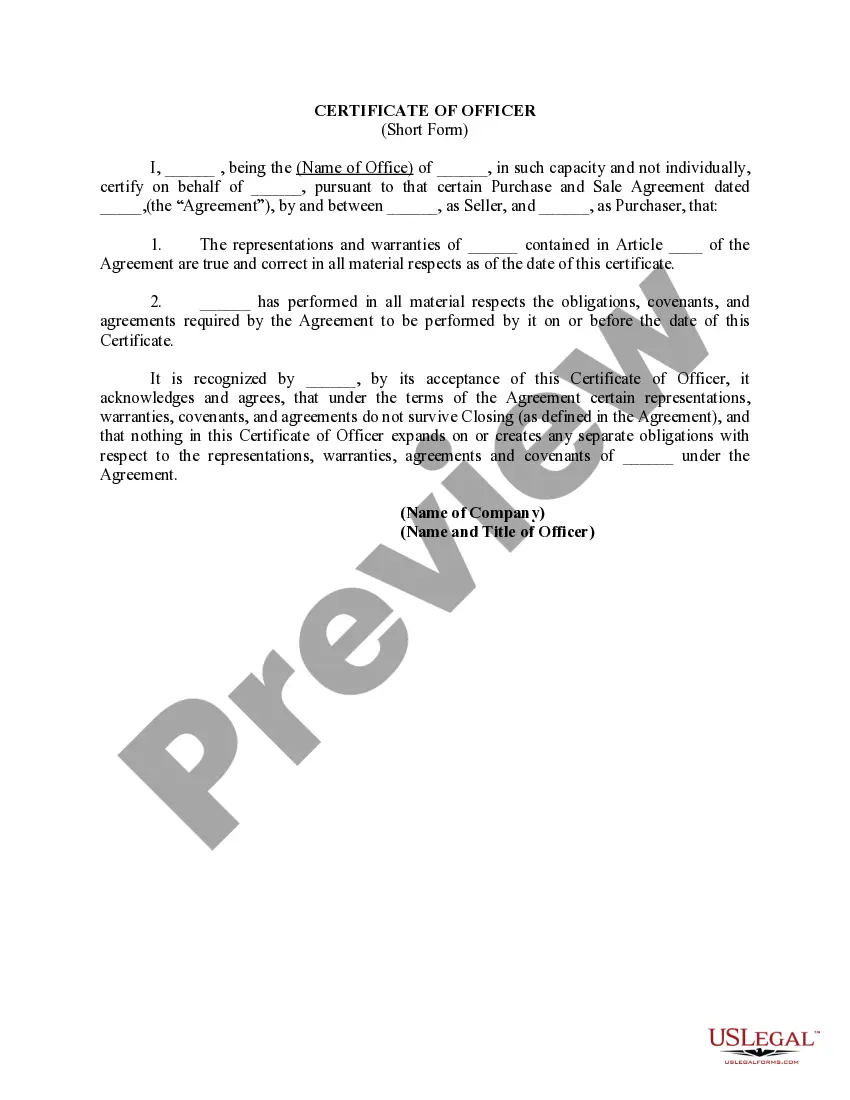

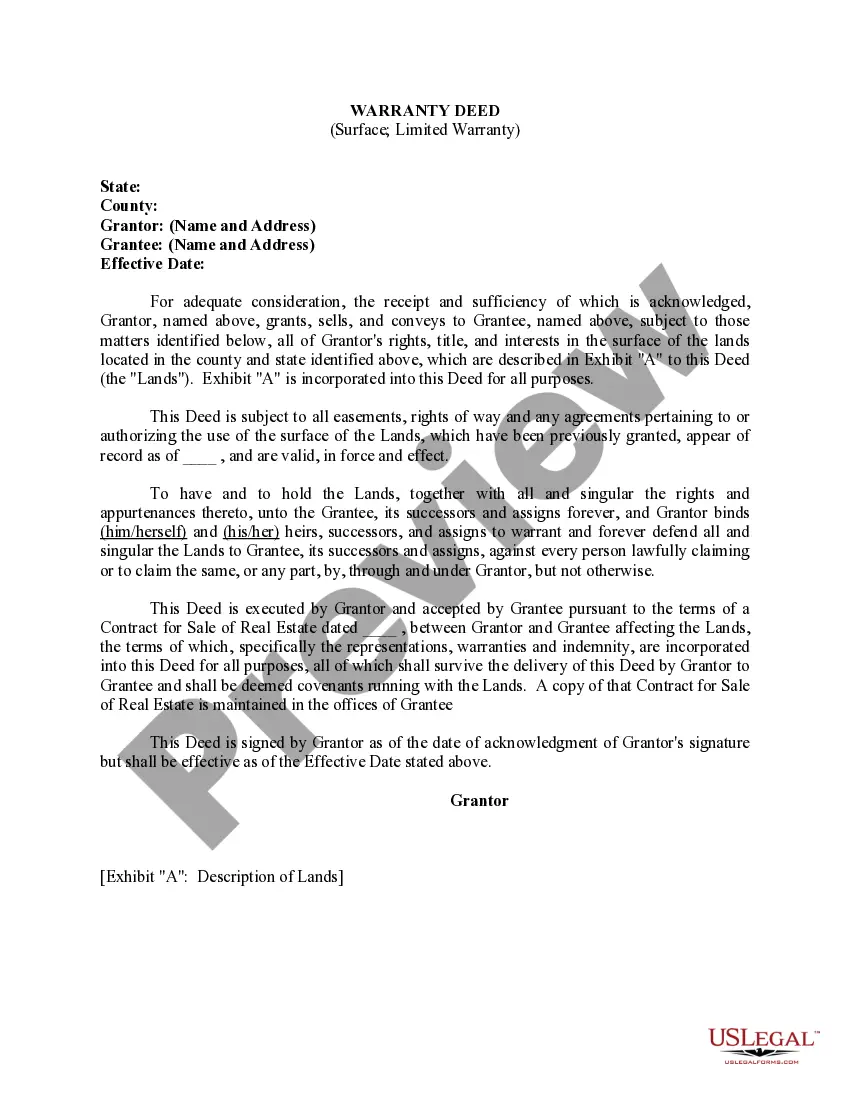

- Click the Preview button to review the contents of the form.

Form popularity

FAQ

The 777 rule for debt collectors refers to the three steps that you can take to address a debt: 1) Validate the debt, 2) Negotiate a payment plan, and 3) Write a cease and desist letter if necessary. Understanding this rule can help you manage your debt more effectively. If you decide to send a Minnesota Cease and Desist for Debt Collectors, it can be a crucial step in stopping unwanted communication. USLegalForms provides valuable resources for navigating these steps.

The 11-word phrase commonly used to stop debt collectors is, 'I do not wish to be contacted about this debt.' This phrase serves as a clear directive and can be included in your Minnesota Cease and Desist for Debt Collectors letter. By using this phrase, you assert your rights and limit harassment from debt collectors. For assistance, you can find templates and guidance on platforms like USLegalForms.

You can indeed tell a debt collector to cease and desist communication. By sending a Minnesota Cease and Desist for Debt Collectors, you formally instruct them to stop contacting you. Once they receive this letter, they are legally obligated to comply unless they take further legal action. This process empowers you to regain control over your financial situation.

Yes, you can send a cease and desist letter to a debt collector in Minnesota. This letter formally requests that they stop all communication with you regarding the debt. It is your right as a consumer to limit or end contact with debt collectors, and a Minnesota Cease and Desist for Debt Collectors serves this purpose effectively. If you need assistance drafting this letter, consider using resources from USLegalForms.

In Minnesota, debt collectors must follow specific rules designed to protect consumers. They cannot harass you or use deceptive practices while collecting debts. Additionally, they must provide you with clear information about your debt and validate it upon request. Understanding these rules can empower you to take action, such as issuing a Minnesota Cease and Desist for Debt Collectors.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

Include your contact information and send this letter via certified mail with a return receipt requested so that you know if and when the creditor receives your letter. Once the debt collector receives a cease and desist letter, it must stop all further contact unless the law permits otherwise.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .

Dear debt collector: Pursuant to my rights under the state and federal fair debt collection laws, I hereby request that you immediately cease all calls to your phone number in relation to the account of wrong person's full name. This is the wrong number to contact that person.