Minnesota Cast Member Contract

Description

How to fill out Cast Member Contract?

Have you ever entered a location where you require documents for both business or personal reasons every single day.

There are numerous legitimate document templates available online, but finding ones you can trust is not simple.

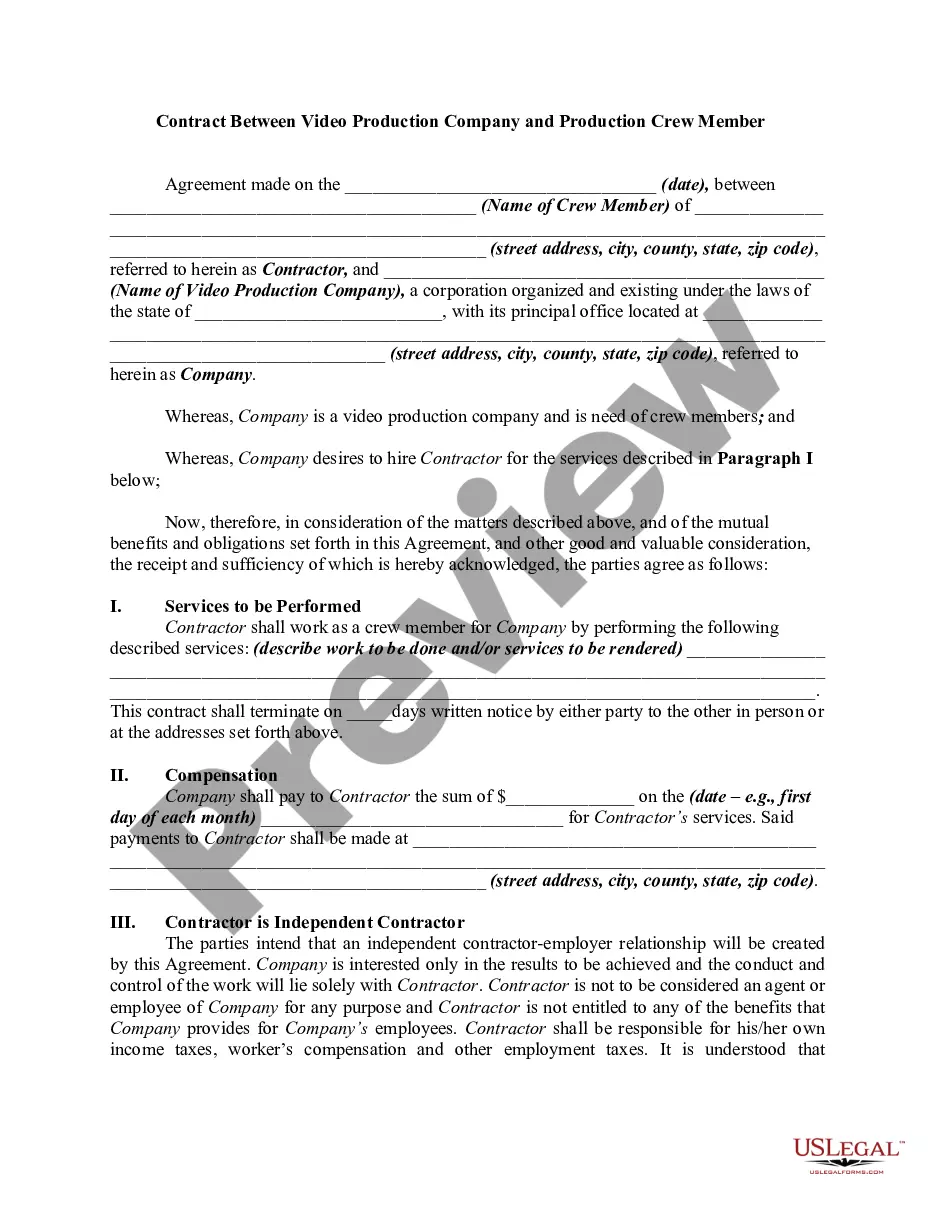

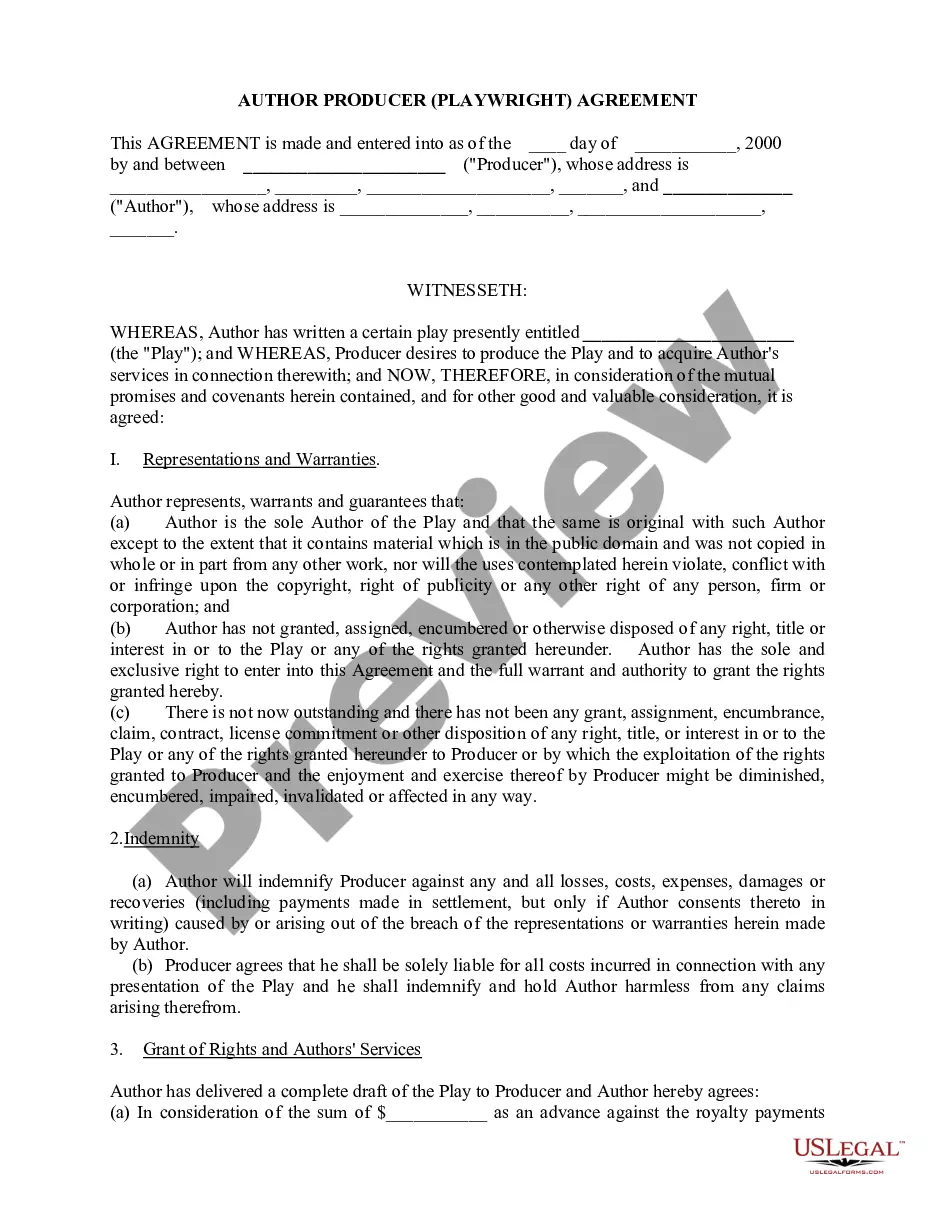

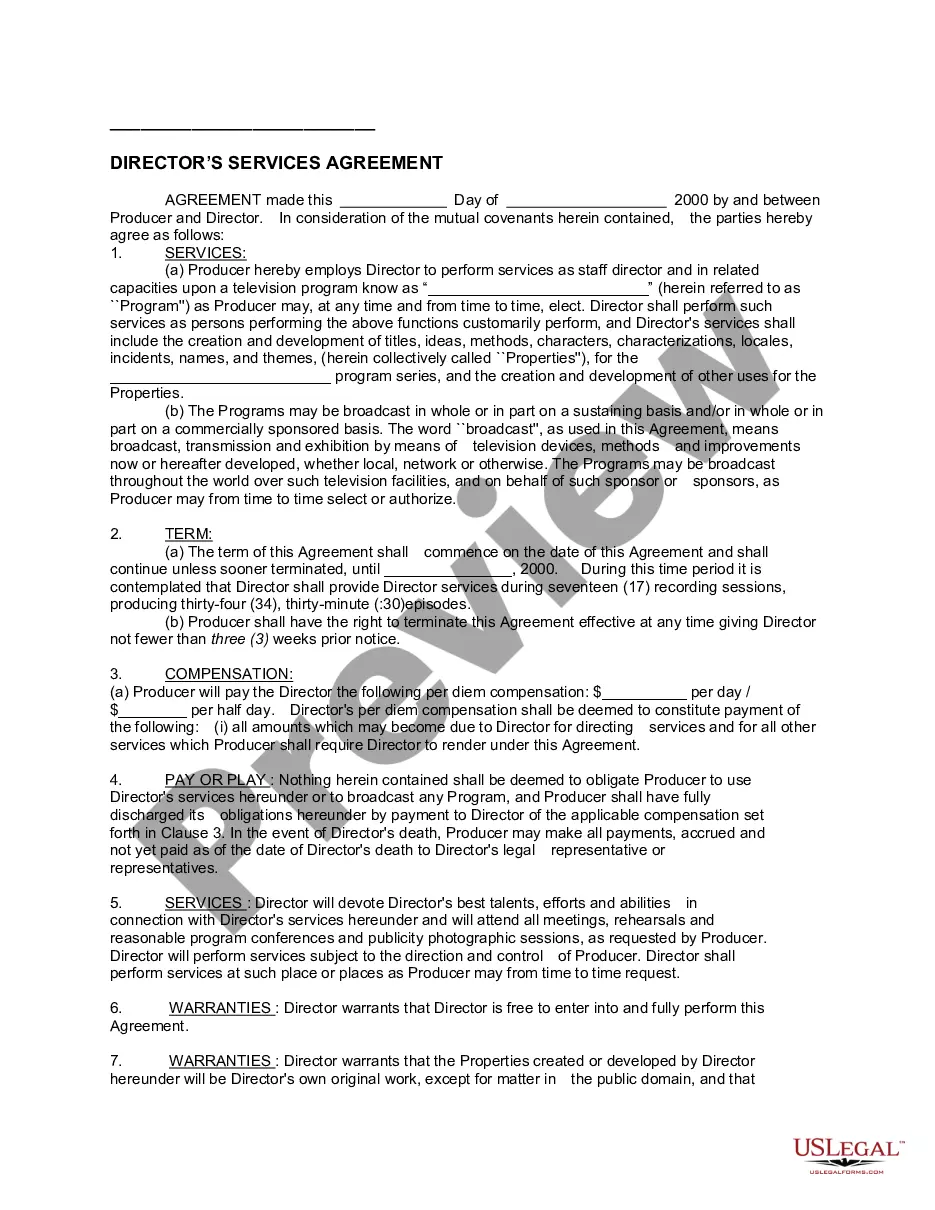

US Legal Forms offers thousands of template documents, such as the Minnesota Cast Member Contract, that are crafted to comply with federal and state regulations.

Once you obtain the right document, click Purchase now.

Choose the payment plan you prefer, fill in the required information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Cast Member Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and confirm it is for your specific city/state.

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct document.

- If the document is not what you need, use the Search area to find the form that fits your needs and specifications.

Form popularity

FAQ

In Minnesota, payroll rules require employers to comply with specific regulations, including minimum wage standards and timely payment of wages. When you enter into a Minnesota Cast Member Contract, it is essential to understand that all employees, including cast members, must receive their wages on a regular schedule. Additionally, employers must provide employees with information regarding deductions and withholdings. For further assistance in navigating these rules, consider using uslegalforms to access templates and resources tailored to Minnesota's legal requirements.

A valid contract must have an offer, acceptance, consideration, legal capacity, and a lawful purpose. Each party must be competent to enter into the agreement, and the contract must not involve illegal activities. These elements are crucial for the effectiveness of a Minnesota Cast Member Contract. By ensuring these requirements are met, you can avoid disputes and create a solid foundation for your agreement.

The three main rules in contract law include offer, acceptance, and consideration. An offer must be clear, and the acceptance must mirror the terms of the offer. Consideration refers to something of value exchanged between the parties. Understanding these rules is essential when drafting a Minnesota Cast Member Contract, ensuring all parties are protected.

To prove you are an independent contractor, maintain clear documentation of your work arrangements. This includes your Minnesota Cast Member Contract, invoices, and any communications regarding your services. Keeping organized records will help when discussing your status with clients or tax authorities. Always stay informed about your rights and responsibilities as an independent contractor.

The rules of contract employment require clarity in terms, including job responsibilities, compensation, and duration. A Minnesota Cast Member Contract outlines these specifics, ensuring both parties understand their obligations. It's important to recognize that independent contractors may not receive the same benefits as employees. Familiarize yourself with these rules to avoid misunderstandings in your work agreements.

To determine if you're an independent contractor, assess your level of control over your work. If you have a Minnesota Cast Member Contract and can manage your schedule and methods, you are likely an independent contractor. Additionally, review the terms of your agreement and how you are compensated. This clarity will help you understand your rights and responsibilities.

You qualify as an independent contractor if you have control over how you perform your work and are not subject to the employer's direction. Typically, if you sign a Minnesota Cast Member Contract, you are considered an independent contractor. This means you set your own hours and decide how to complete tasks. Understanding this distinction is essential for tax purposes and benefits eligibility.

If you receive a 1099 form for your earnings as an independent contractor, you typically do not send it directly to the state of Minnesota. However, you should keep it for your records and use it when filing your state and federal taxes. This form is crucial for reporting your income accurately. Always consult with a tax professional for specific guidance related to your Minnesota Cast Member Contract.

To show proof of income as an independent contractor, you can provide documents like invoices, bank statements, or contracts. If you work under a Minnesota Cast Member Contract, you can use this contract as evidence of your earnings. Keep records of all payments received to support your income claims. This documentation will help you when filing taxes or applying for loans.

Bargaining unit 220 in Minnesota is another classification that includes various public employees who come together to negotiate their working conditions. This unit plays a vital role in advocating for employee rights and benefits. Like unit 216, understanding the implications of bargaining unit 220 can be essential for anyone entering into a Minnesota Cast Member Contract, as it affects employment terms and conditions.