Minnesota Self-Employed Animal Exercise Services Contract

Description

How to fill out Self-Employed Animal Exercise Services Contract?

Have you ever found yourself in a situation where you require documents for both business or personal reasons almost daily.

There is a multitude of legal document templates accessible online, yet discovering ones you can rely on is challenging.

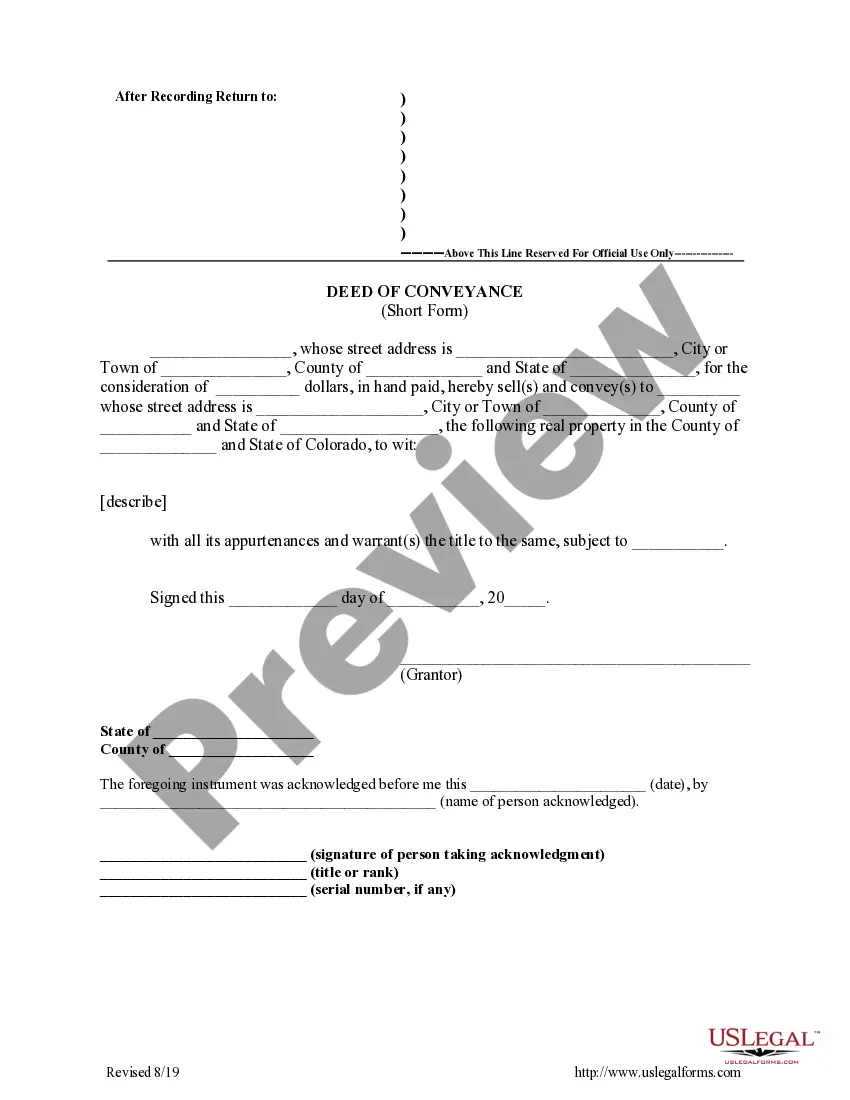

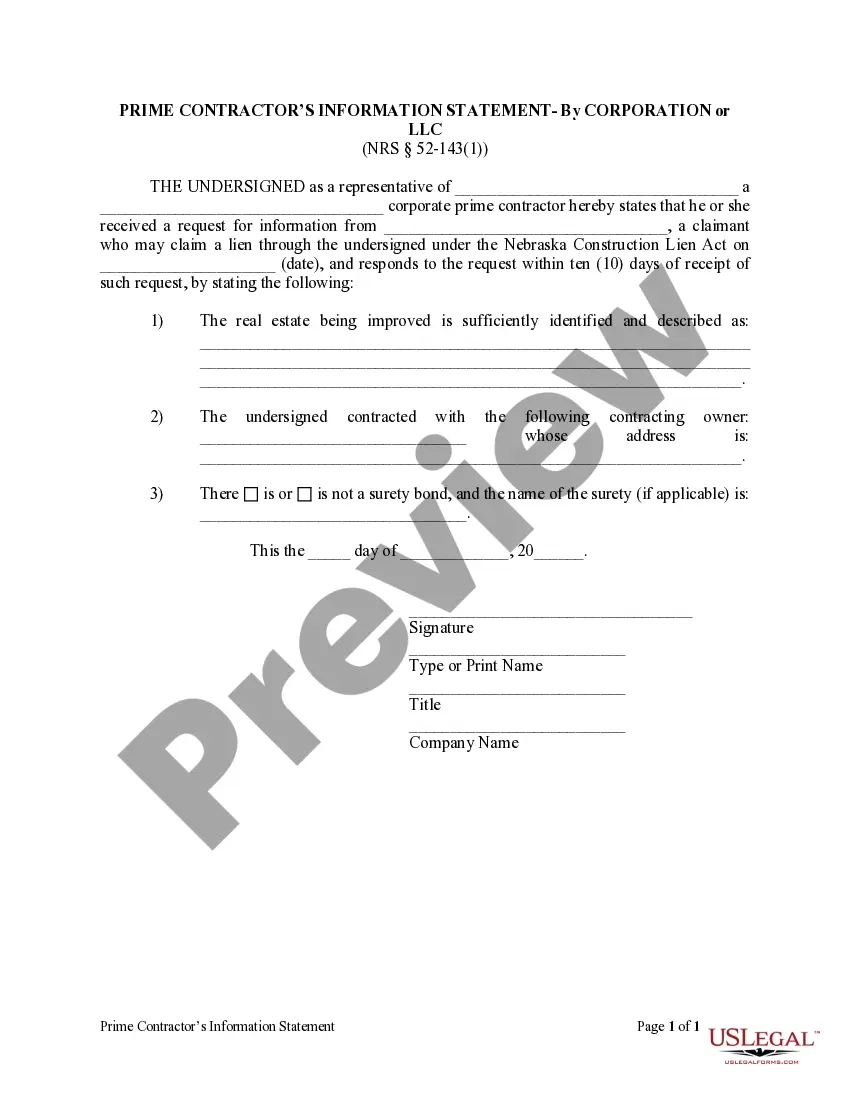

US Legal Forms offers numerous template options, including the Minnesota Self-Employed Animal Exercise Services Contract, which are designed to meet federal and state requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill out the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Minnesota Self-Employed Animal Exercise Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct area/county.

- Utilize the Review button to examine the form.

- Read the details to confirm that you have selected the appropriate document.

- If the form is not what you are looking for, use the Search field to find the document that meets your requirements.

Form popularity

FAQ

The choice between saying self-employed or independent contractor often depends on context. Both terms are widely understood, but 'independent contractor' may be more specific in legal and business documents. When drafting a Minnesota Self-Employed Animal Exercise Services Contract, using the term that best fits your situation can help clarify your role.

An independent contractor should not be classified as an employee due to the nature of their working relationship. Employees typically work under the direction of an employer, while independent contractors maintain control over how they perform their tasks. This distinction is crucial for agreements like a Minnesota Self-Employed Animal Exercise Services Contract.

Yes, an independent contractor is generally the same as being self-employed. Both terms describe individuals who operate their own businesses and provide services to clients without being considered employees. A Minnesota Self-Employed Animal Exercise Services Contract will clarify this relationship and outline the terms of service.

Yes, a 1099 employee is considered self-employed. This designation applies to individuals who receive a Form 1099 from clients instead of a W-2 from an employer. If you are working under a Minnesota Self-Employed Animal Exercise Services Contract, you are likely classified as self-employed and responsible for your own taxes.

To write an independent contractor agreement, begin by identifying the parties involved and detailing the services to be provided. Include payment terms, timelines, and any necessary clauses regarding confidentiality or liability. Utilizing a Minnesota Self-Employed Animal Exercise Services Contract template can streamline this process and ensure all essential elements are covered.

employed person is often referred to as an independent contractor or freelancer. This individual operates their own business and offers services directly to clients, such as the ones detailed in a Minnesota SelfEmployed Animal Exercise Services Contract. Being selfemployed allows for greater flexibility and control over one's work schedule and business operations.

ESA certification can be beneficial, particularly if you want legal recognition for your animal's role in your mental well-being. Having certification may give you access to housing and travel accommodations that might otherwise be restricted. Additionally, it establishes a formal connection between you and your emotional support animal. With our assistance, you can create a Minnesota Self-Employed Animal Exercise Services Contract that enhances your experience and ensures compliance with relevant laws.

Obtaining ESA certification can be straightforward if you have the proper documentation from a licensed mental health professional. This documentation typically outlines your need for an emotional support animal and can simplify the process. While some online services offer quick certification, ensure you choose a legitimate provider to avoid scams. Our platform can guide you through the necessary steps to establish a Minnesota Self-Employed Animal Exercise Services Contract that meets your needs.

The Emotional Support Animal (ESA) law in Minnesota provides individuals with mental health challenges the right to have emotional support animals in certain situations. This law allows you to live with your ESA and take them to specific public places. It is essential to understand that an ESA is not the same as a service animal, which has different legal protections. If you need assistance drafting a Minnesota Self-Employed Animal Exercise Services Contract, our platform can help you create a tailored agreement.

While most veterinary services in Minnesota are not taxed, there are specific situations where certain products or services may incur tax. For example, if a vet sells pet supplies, those items might be taxable. Understanding the tax landscape is vital for those operating under a Minnesota Self-Employed Animal Exercise Services Contract, as it helps in setting prices and maintaining compliance.