Minnesota Boiler And Radiator Services Contract - Self-Employed

Description

How to fill out Boiler And Radiator Services Contract - Self-Employed?

Are you presently in a role that requires documents for possibly commercial or particular reasons almost every day.

There are numerous legal document templates accessible online, but finding forms you can trust is not simple.

US Legal Forms provides a wide array of form templates, such as the Minnesota Boiler And Radiator Services Contract - Self-Employed, designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Choose a convenient file format and download your version. Access all of the document templates you have purchased in the My documents section. You can obtain another version of the Minnesota Boiler And Radiator Services Contract - Self-Employed anytime if needed. Simply select the required form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Minnesota Boiler And Radiator Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct area/county.

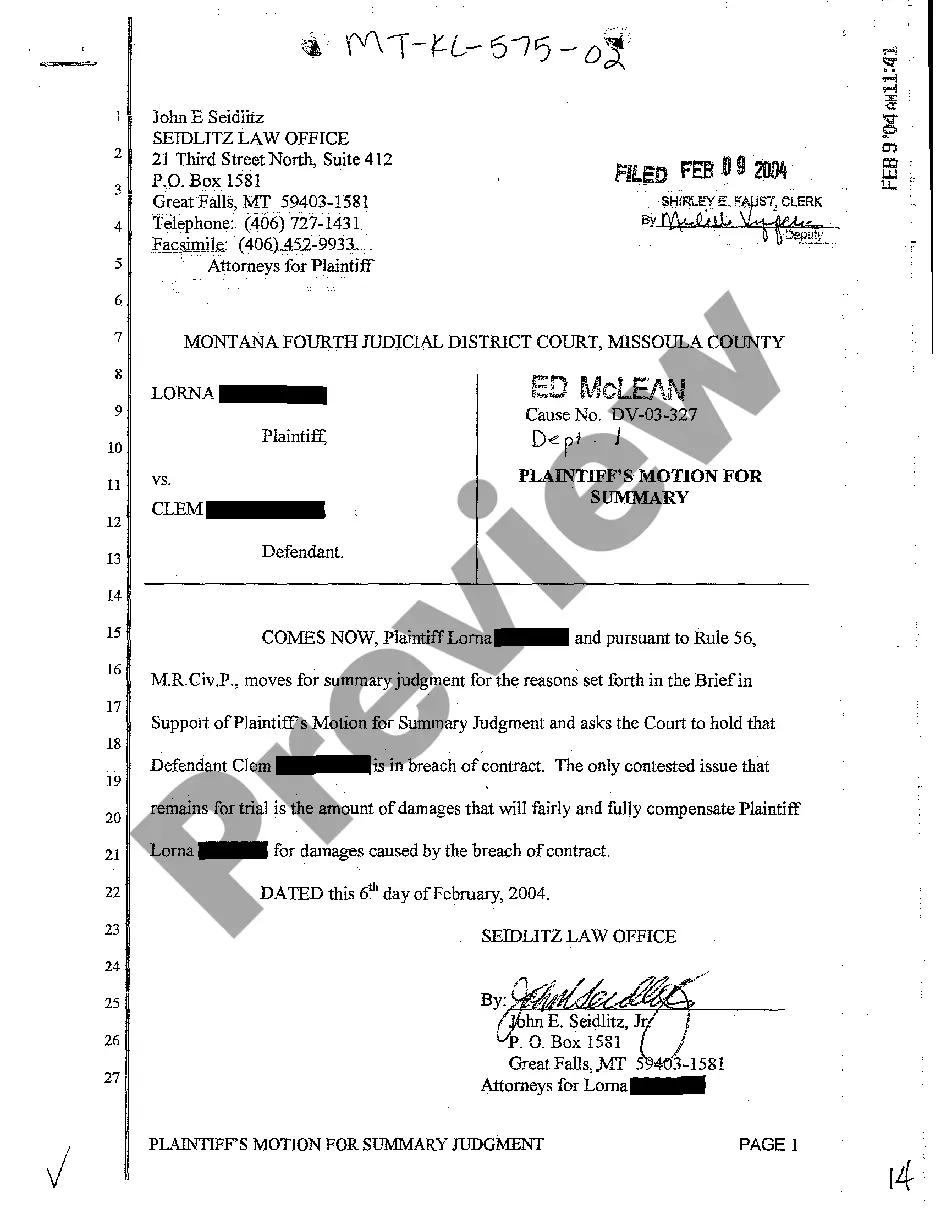

- Use the Review button to evaluate the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

The earnings of boiler operators in Minnesota can range widely based on experience and job responsibilities. Typically, annual salaries average around $50,000, but self-employed individuals under a Minnesota Boiler And Radiator Services Contract can potentially increase their earnings. The ability to negotiate contracts and set personal rates often leads to more favorable financial outcomes.

Yes, homeowners in Minnesota can perform their own plumbing work, but there are specific regulations to follow. It’s important to understand that certain plumbing tasks may require permits and inspections. If you’re contemplating any plumbing decisions, consider how a Minnesota Boiler And Radiator Services Contract - Self-Employed might be beneficial for ensuring compliance with local codes.

The time required to obtain a boiler operator license in Minnesota can vary based on individual circumstances. Typically, it takes several weeks to several months to complete the application process and fulfill the required educational prerequisites. If you're pursuing this under a Minnesota Boiler And Radiator Services Contract - Self-Employed, ensure you have all documentation ready to help expedite the process.

To obtain a boiler license in Minnesota, you must complete the necessary application process through the Minnesota Department of Labor and Industry. This often includes meeting specific education and experience requirements, which may be outlined in your Minnesota Boiler And Radiator Services Contract - Self-Employed. Following the completion of the application, you may need to pass an examination to demonstrate your knowledge and skills.

In Minnesota, boiler operators typically earn a competitive salary, averaging around $50,000 annually. However, self-employed operators working under a Minnesota Boiler And Radiator Services Contract may earn more due to the flexibility and control over their rates. The specific earnings depend heavily on experience, location, and the scale of services provided.

The highest salary for a boiler operator can vary based on experience and location. In Minnesota, those who hold a Minnesota Boiler And Radiator Services Contract - Self-Employed may earn significantly more, especially in industries that require specialized skills. It is essential to consider various factors, such as the sector and the operator's level of expertise, when assessing potential earnings.

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.