Minnesota HVAC Service Contract - Self-Employed

Description

How to fill out HVAC Service Contract - Self-Employed?

If you need to obtain, download, or print official document templates, utilize US Legal Forms, the largest repository of official forms available online.

Take advantage of the site’s user-friendly and efficient search to locate the documents you require.

A wide array of templates for business and personal needs are organized by categories and states or by keywords.

Every official form template you obtain is yours permanently. You have access to all forms you downloaded in your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Minnesota HVAC Service Agreement - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to access the Minnesota HVAC Service Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to retrieve the Minnesota HVAC Service Agreement - Self-Employed.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

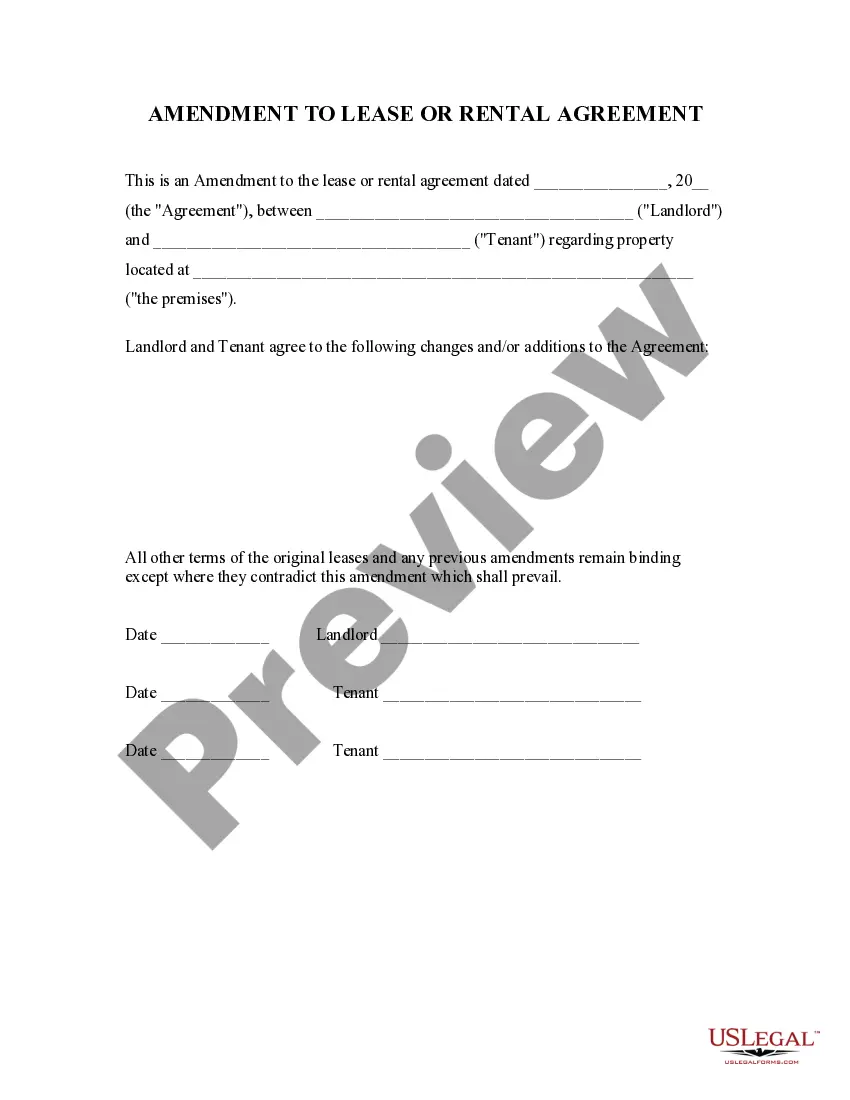

- Step 2. Use the Review option to check the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the official form template.

- Step 4. Once you have found the desired form, click the Purchase now button. Choose your preferred payment plan and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the purchase.

- Step 6. Select the format of the official form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Minnesota HVAC Service Agreement - Self-Employed.

Form popularity

FAQ

Yes, it is possible for someone to be labeled an independent contractor while actually functioning as an employee under the law. This misclassification can occur if a worker's tasks closely align with those of regular employees, involving significant oversight and control from the employer. In situations involving a Minnesota HVAC Service Contract - Self-Employed, it’s essential to analyze the specific working relationship to avoid potential legal complications. Utilizing resources like USLegalForms can help clarify these classifications and ensure compliance.

In Minnesota, the main difference between an employee and an independent contractor lies in the relationship and control dynamics. Employees receive regular wages, benefits, and have taxes withheld by employers, while independent contractors often work on a project basis, invoice for their work, and manage their taxes. This distinction matters significantly for individuals considering a Minnesota HVAC Service Contract - Self-Employed, as it directly impacts tax obligations and worker rights. Understanding these differences helps businesses and workers make informed decisions.

The distinction between an employee and an independent contractor often hinges on control and independence. Employers typically have significant control over employees, dictating how, when, and where they do their work. In contrast, independent contractors, especially those involved in a Minnesota HVAC Service Contract - Self-Employed, maintain more autonomy in how they complete their tasks. It's crucial to evaluate factors such as the method of payment, the nature of work, and the level of direction provided.

Determining whether you are an independent contractor or an employee involves examining the nature of your work relationship. Key indicators include the degree of control a client has over your work, how you are compensated, and whether you provide your own tools. Understanding these distinctions is vital when engaging in a Minnesota HVAC Service Contract - Self-Employed.

To qualify as an independent contractor, you need to establish a business entity, maintain separate financial accounts, and have contracts with clients that outline your services. It is critical to ensure that you are not under the direct control of your clients while performing your tasks. This autonomy is central to sustaining a Minnesota HVAC Service Contract - Self-Employed.

A legally binding contract in Minnesota must meet certain criteria: it must be clear, mutual, and made with the intention of creating a legal obligation. The contract should also involve consideration, meaning both parties provide something of value. When drafting a Minnesota HVAC Service Contract - Self-Employed, it's essential to include these elements to ensure enforceability.

In many contexts, the terms self-employed and independent contractor are used interchangeably; however, there can be slight distinctions. 'Self-employed' generally refers to anyone working for themselves, while 'independent contractor' often implies a specific contractual relationship with clients. In the realm of Minnesota HVAC Service Contracts - Self-Employed, either term emphasizes your business autonomy.

Several factors determine whether you qualify as an independent contractor. These include your level of control over how you perform your work, your business identity, and whether you have a significant investment in your tools or services. Understanding these criteria helps clarify your position in the realm of Minnesota HVAC Service Contracts - Self-Employed.

You can demonstrate that you are an independent contractor by compiling specific records that highlight your work relationships. Collect contracts with clients, receipts for services rendered, and relevant tax forms that report your self-employment earnings. This documentation collectively reinforces your claim under a Minnesota HVAC Service Contract - Self-Employed.

To prove you are an independent contractor in the context of a Minnesota HVAC Service Contract - Self-Employed, you should gather documents that show your business operations. This may include contracts with clients, invoices for services, and proof of business licenses. Additionally, tax documents indicating self-employment income can help substantiate your status.