Minnesota Farm Hand Services Contract - Self-Employed

Description

How to fill out Farm Hand Services Contract - Self-Employed?

If you desire to total, download, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Leverage the site's straightforward and efficient search to locate the documents you require.

Various templates for commercial and personal purposes are categorized by types and regions, or keywords.

Every legal document template you purchase is yours permanently.

You will have access to every form you saved within your account. Go to the My documents section and select a form to print or download again. Compete and download, and print the Minnesota Farm Hand Services Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the Minnesota Farm Hand Services Contract - Self-Employed in just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click the Acquire button to access the Minnesota Farm Hand Services Contract - Self-Employed.

- You can also access forms you previously saved from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Ensure you have selected the form for your specific area/region.

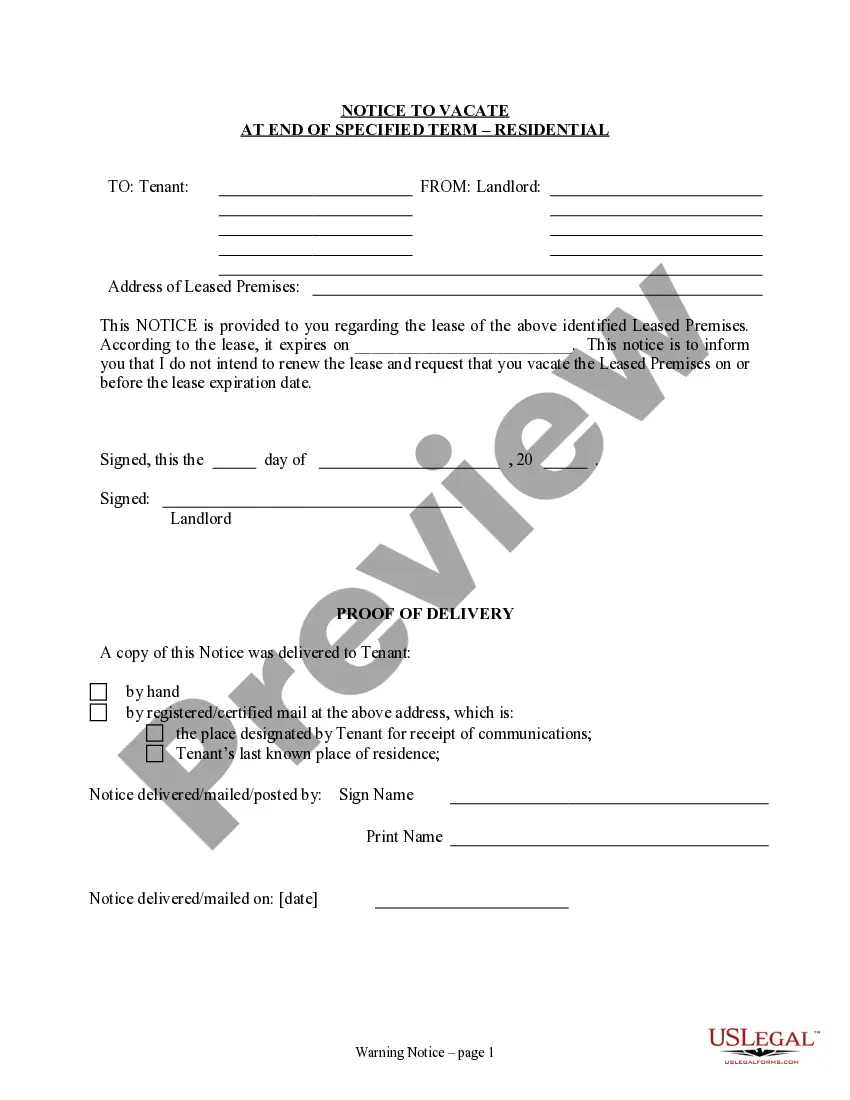

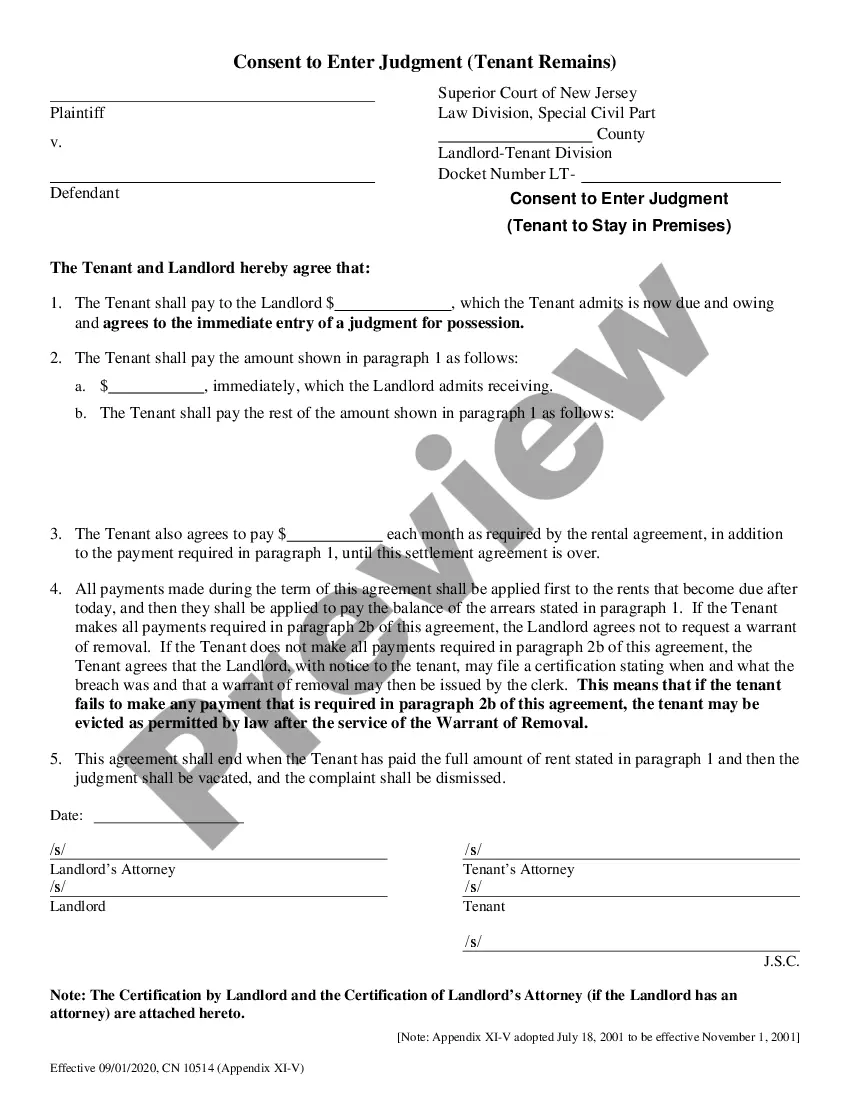

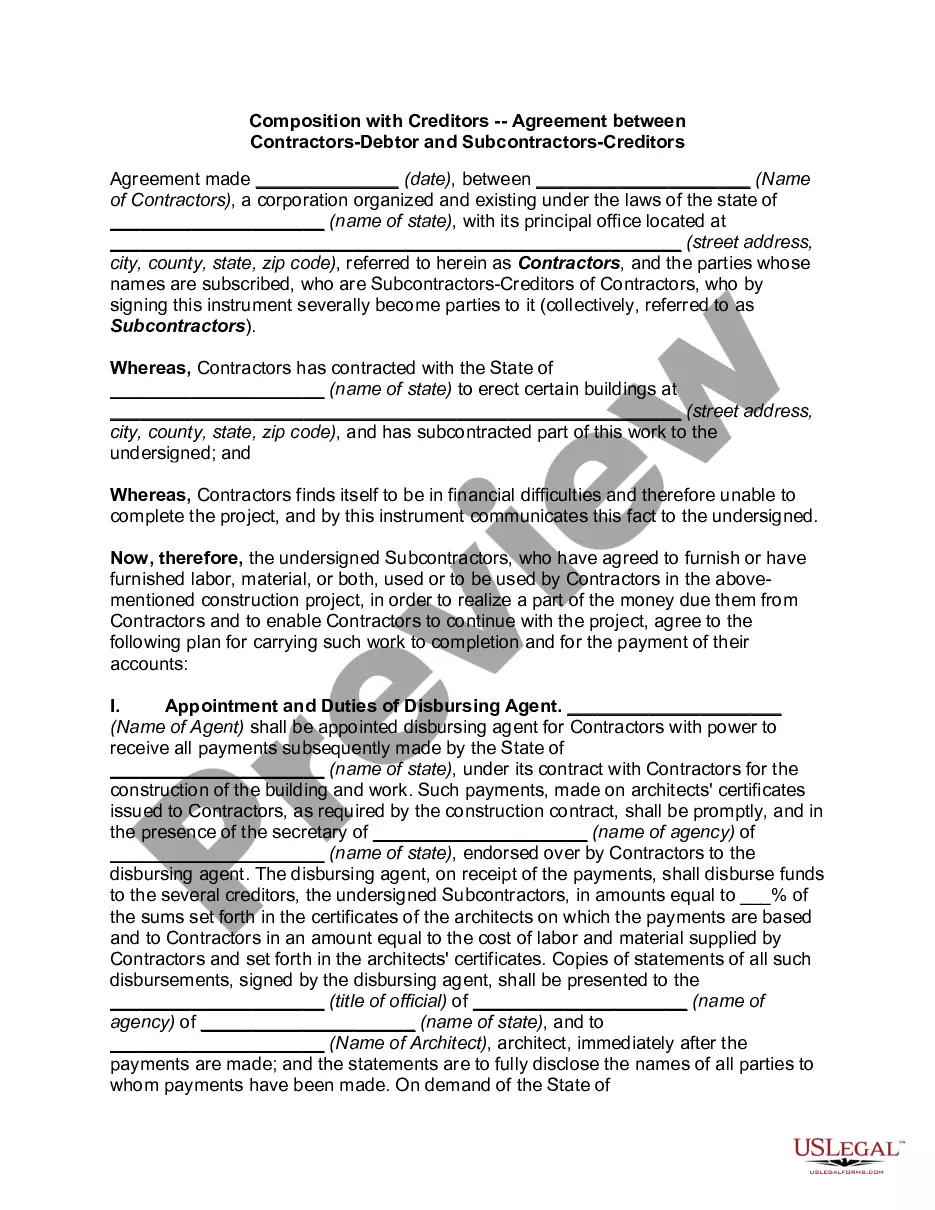

- Take advantage of the Preview option to review the form's content. Remember to read the description.

- If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Choose the format of the legal form and download it to your device.

- Complete, modify, and print or sign the Minnesota Farm Hand Services Contract - Self-Employed.

Form popularity

FAQ

To establish yourself as an independent contractor in Minnesota, start by completing necessary registrations and obtaining licenses if required. Next, consider drafting a Minnesota Farm Hand Services Contract - Self-Employed to outline the terms of your work. Building a strong client base is essential, so networking and showcasing your skills can help attract opportunities. You may also want to explore platforms like uslegalforms to access templates and resources that simplify the contracting process.

An independent contractor in Minnesota is a person who offers their services on a contract basis, rather than as an employee. When you enter into a Minnesota Farm Hand Services Contract - Self-Employed, you typically manage your own business expenses and are responsible for your tax obligations. This status allows for greater flexibility and autonomy, making it ideal for many farm workers. Understanding this classification is essential for compliance with state labor laws.

Yes, Minnesota does impose a self-employment tax. This tax applies to individuals who earn income as independent contractors, including those working under a Minnesota Farm Hand Services Contract - Self-Employed. It's important to track your earnings accurately, as this tax contributes to Social Security and Medicare. To learn more about your tax responsibilities, consider consulting a tax professional familiar with Minnesota's specific regulations.

An independent contractor agreement in Minnesota is a formal document that outlines the working relationship between a contractor and a client. This type of agreement clarifies responsibilities, payment terms, and project expectations. For those seeking to establish a Minnesota Farm Hand Services Contract - Self-Employed, using a legally sound independent contractor agreement can help ensure that both parties understand their rights and obligations, fostering a smooth working relationship.

The 181.13 law in Minnesota serves to ensure fair compensation and treatment of workers in the state. It specifically addresses issues related to unpaid wages and employee classifications, ensuring that independent contractors and employees receive appropriate consideration. When creating a Minnesota Farm Hand Services Contract - Self-Employed, it's important to be aware of this law to ensure compliance and protection for all parties involved.

The statute 181.13 in Minnesota defines the legal obligations between employers and employees, particularly concerning wages and working conditions. This statute establishes essential protections for workers, including those engaged in various agricultural activities. Understanding this statute is crucial when drafting a Minnesota Farm Hand Services Contract - Self-Employed, as it outlines the rights and responsibilities of both parties.

Yes, contract work does count as self-employment. When you enter a Minnesota Farm Hand Services Contract - Self-Employed, you are essentially operating your own business. This means you’ll manage your own taxes and business expenses, setting you apart from traditional employment arrangements. Understanding this distinction helps you better navigate your work situation.

Both terms can describe similar work situations, but 'independent contractor' is often more precise in formal contexts. When discussing a Minnesota Farm Hand Services Contract - Self-Employed, using 'independent contractor' can clarify your work arrangement. This term emphasizes the project-based nature of the work, which might appeal to potential clients who prefer clear contractual agreements.

Recent updates for self-employed individuals mostly involve tax reporting and deductions. The IRS has made adjustments that may benefit those operating under a Minnesota Farm Hand Services Contract - Self-Employed. For example, changes to allowable deductions mean you can deduct business expenses more effectively. It's essential to stay updated on these rules to maximize your financial benefits.

The 183 day rule in Minnesota refers to how the state determines residency for tax purposes. If a self-employed person spends 183 days or more in Minnesota during the calendar year, they may be considered a resident. This ruling can affect your financial obligations, especially if you're earning through a Minnesota Farm Hand Services Contract - Self-Employed. Be aware, as this can impact your tax responsibilities.