Minnesota Fireplace Contractor Agreement - Self-Employed

Description

How to fill out Fireplace Contractor Agreement - Self-Employed?

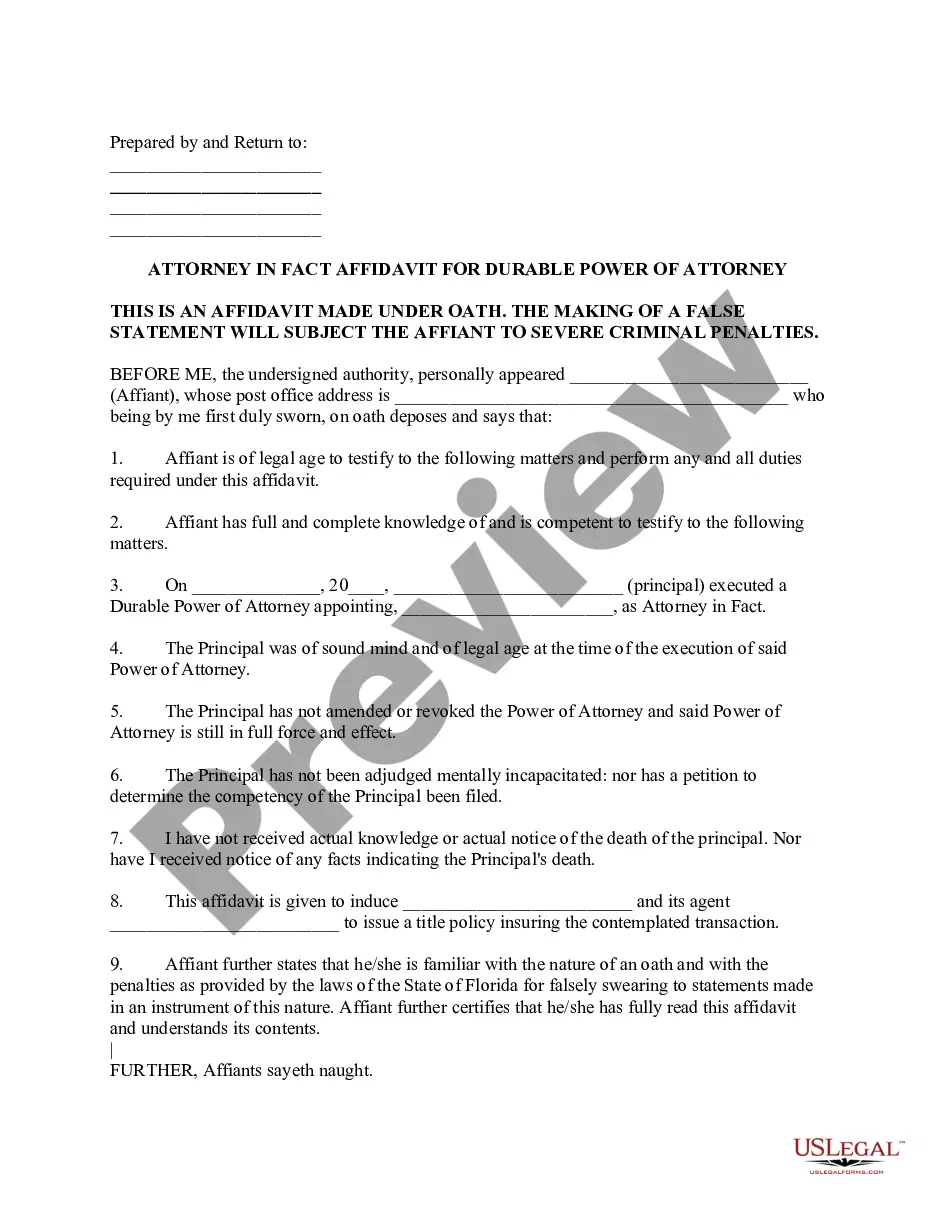

Have you ever found yourself in a scenario where you need documents for either business or personal reasons on a daily basis? There are numerous legal document templates accessible online, but finding ones you can rely on can be challenging. US Legal Forms offers a vast array of form templates, including the Minnesota Fireplace Contractor Agreement - Self-Employed, designed to comply with state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Minnesota Fireplace Contractor Agreement - Self-Employed template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Find the form you need and ensure it is for the correct city/region. Utilize the Preview option to review the form. Check the description to confirm that you have selected the correct template. If the form is not what you are looking for, use the Search field to find the template that meets your needs. Once you find the right form, click Acquire now. Choose the payment plan you prefer, fill in the required details to create your account, and pay for your order using PayPal or a credit card. Select a convenient file format and download your copy.

- Locate all the document templates you have purchased in the My documents section. You can download a duplicate of the Minnesota Fireplace Contractor Agreement - Self-Employed at any time if necessary. Simply click on the desired form to download or print the template.

- Utilize US Legal Forms, the most extensive selection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be used for various purposes.

- Create your account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Proving your status as an independent contractor typically involves demonstrating that you work independently and are not subject to the control of another entity. Gathering invoices, contracts, and documentation of your work history can support your claim. It's important to maintain clear records, especially when establishing your Minnesota Fireplace Contractor Agreement - Self-Employed to ensure compliance and protection.

A basic independent contractor agreement outlines the terms between you and the contracting party, detailing the scope of work, payment terms, and project timelines. It serves as a legal foundation for your services and helps prevent disputes. By using a trustworthy service like USLegalForms, you can easily craft a reliable Minnesota Fireplace Contractor Agreement - Self-Employed tailored to your needs.

To be classified as an independent contractor, you must typically demonstrate control over your work, your own setup, and how you provide services. You should invoice for your services, manage your taxes, and often carry your own liability insurance. This classification holds significance in the context of your Minnesota Fireplace Contractor Agreement - Self-Employed, as it delineates your responsibilities and rights.

The new federal rule on independent contractors clarifies the criteria for classification in relation to the employment status. This rule aims to ensure transparency and fairness in how workers are categorized. If you are navigating the world of self-employment, understanding this rule is essential, especially when drafting your Minnesota Fireplace Contractor Agreement - Self-Employed.

Legal requirements for independent contractors vary by state and situation. Generally, independent contractors, including those working under a Minnesota Fireplace Contractor Agreement - Self-Employed, must comply with tax regulations, obtain necessary licenses, and ensure proper insurance coverage. It’s advisable to consult legal resources or platforms like UsLegalForms to ensure compliance and proper documentation.

employed contract should contain several key elements to protect both you and your client. Include the project description, deliverables, payment terms, and timelines in a Minnesota Fireplace Contractor Agreement SelfEmployed. Additionally, terms regarding termination and dispute resolution can help prevent conflicts and ensure clarity.

Filling out an independent contractor agreement involves several steps to ensure all necessary details are included. Start by identifying the parties involved, then outline the scope of work and payment terms within a Minnesota Fireplace Contractor Agreement - Self-Employed. Be specific about deadlines, responsibilities, and any other pertinent terms to avoid misunderstandings in the future.

As you prepare to hire a contractor, ensure you have essential documents ready. A Minnesota Fireplace Contractor Agreement - Self-Employed provides a clear understanding of the expectations and responsibilities of each party. You may also require W-9 forms, invoices, and proof of insurance to protect both parties during the project.

An independent contractor needs to fill out several documents to ensure a smooth working relationship. Besides the W-9 form, a Minnesota Fireplace Contractor Agreement - Self-Employed is vital as it outlines the terms and conditions of your work. Additionally, you may need to complete invoices for your services and keep relevant records for tax reporting.

Independent contractors typically fill out Form W-9 to provide their taxpayer identification information. This information is essential for clients who need to prepare a 1099 form reporting payments. When engaged in a Minnesota Fireplace Contractor Agreement - Self-Employed, having a W-9 ensures you maintain clear communication with your clients regarding tax obligations.