Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

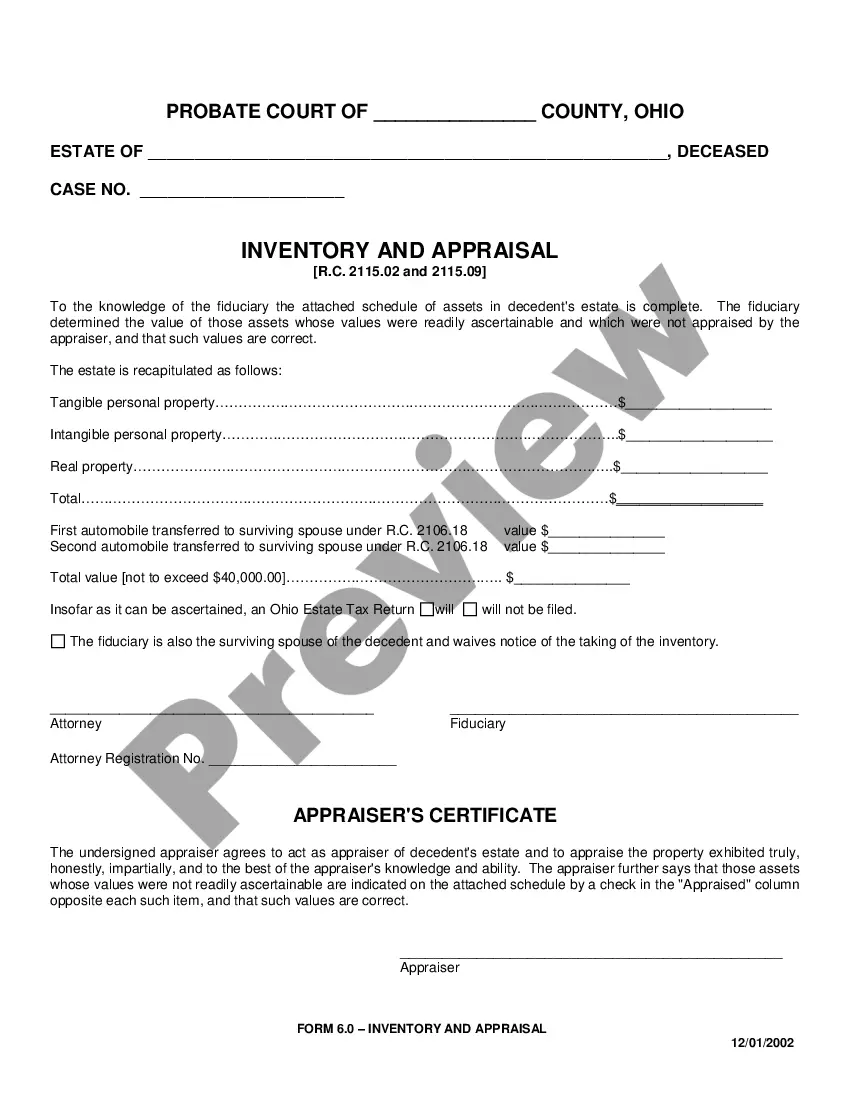

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Are you in the location where you require documents for either business or specific functions daily.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, designed to meet federal and state requirements.

Once you locate the correct form, click Get now.

Choose the payment plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct area/region.

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the appropriate form.

- If the form isn’t what you’re seeking, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To write a Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, start by clearly stating your current financial situation. Explain the specific circumstances that led to your difficulties, such as job loss or medical expenses. It is important to express your commitment to resolving the issue and suggest possible solutions, like a repayment plan. Finally, ensure that your letter is clear, sincere, and provides necessary documentation to support your claims.

When writing a hardship letter, avoid placing blame or making excuses. Do not include unnecessary emotional appeals that may detract from your main message. Focus on facts and your willingness to resolve the situation. Remember, a well-crafted Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should communicate clearly and professionally, providing a solid case for your request.

To write a hardship letter aimed at stopping foreclosure, clearly explain your situation while being truthful. Include specific examples of challenges you have faced and express your willingness to find a solution. Utilizing a Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template can streamline the process and ensure that you include all necessary details.

For financial hardship, you typically need to provide documentation such as income statements, medical bills, or proof of job loss. These documents help illustrate your situation to the lender. When writing a Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure, it's beneficial to include these proofs to strengthen your request for assistance.

Writing a proof of hardship letter involves detailing the circumstances that led to your financial difficulties. Present your situation with clarity, including relevant facts and supporting documents. A clear Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can serve as a strong foundation for your case, making it easier for the lender to understand your needs.

To write a foreclosure hardship letter, begin by clearly stating your financial situation. Include specific details such as loss of income, medical issues, or unexpected expenses. Be honest about your hardship and express your desire to work with the lender. Using the Minnesota Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can guide you in structuring your letter effectively.

To fill out a financial hardship form, begin by gathering all necessary financial information, including income, expenses, and any outstanding debts. Then, clearly state your current financial hardships, making sure to stick to the facts. You can reference the Minnesota hardship letter to mortgagor or lender to prevent foreclosure for guidance on structure and content. Providing thorough and accurate information increases your chances of receiving the assistance you need during this difficult time.