Minnesota Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

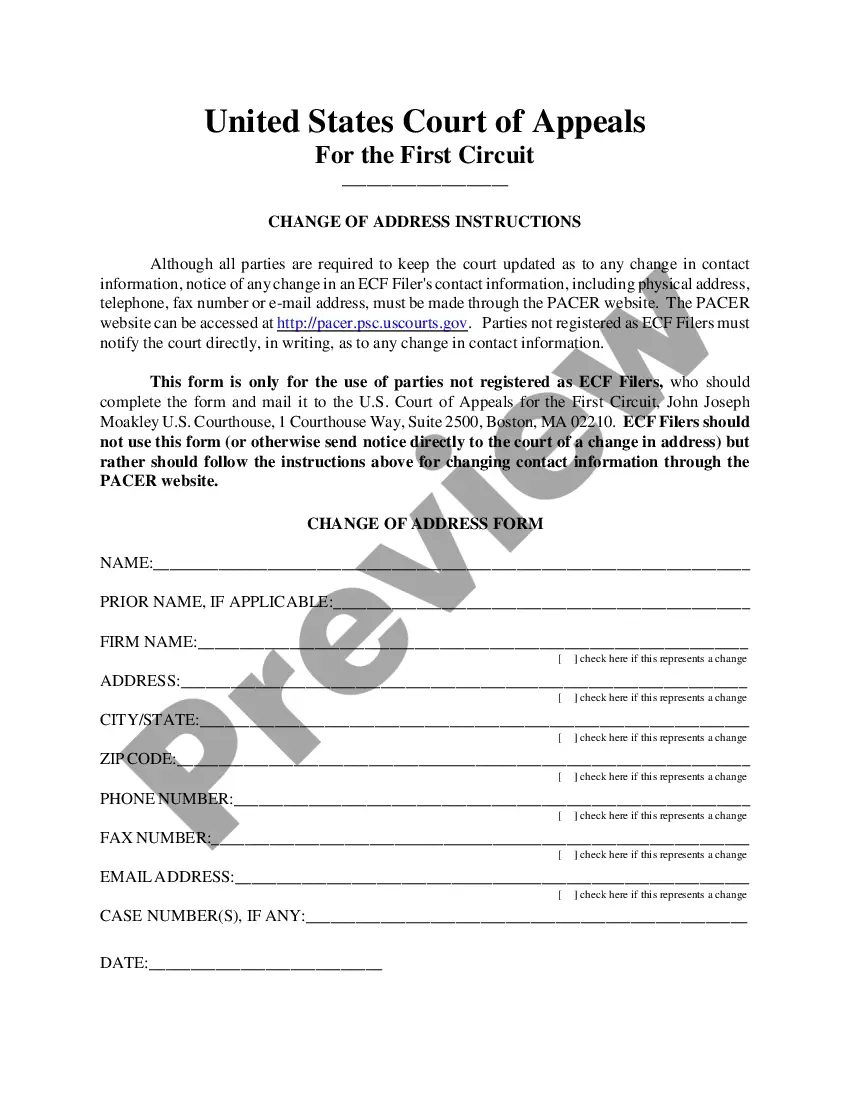

You are able to invest hours online trying to find the authorized document design that fits the state and federal specifications you require. US Legal Forms supplies thousands of authorized forms which are analyzed by pros. It is possible to download or produce the Minnesota Term Sheet - Series A Preferred Stock Financing of a Company from your service.

If you already possess a US Legal Forms bank account, you are able to log in and then click the Download switch. After that, you are able to comprehensive, change, produce, or signal the Minnesota Term Sheet - Series A Preferred Stock Financing of a Company. Each authorized document design you purchase is your own permanently. To have an additional copy for any purchased type, go to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site for the first time, adhere to the simple guidelines under:

- Initial, make certain you have selected the correct document design for that region/area of your liking. Read the type explanation to ensure you have picked the appropriate type. If accessible, utilize the Review switch to search through the document design at the same time.

- In order to discover an additional variation of the type, utilize the Look for discipline to get the design that fits your needs and specifications.

- Upon having found the design you would like, click Get now to continue.

- Select the pricing strategy you would like, enter your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal bank account to pay for the authorized type.

- Select the structure of the document and download it for your device.

- Make changes for your document if possible. You are able to comprehensive, change and signal and produce Minnesota Term Sheet - Series A Preferred Stock Financing of a Company.

Download and produce thousands of document themes utilizing the US Legal Forms web site, which provides the most important collection of authorized forms. Use skilled and state-particular themes to handle your organization or individual requires.

Form popularity

FAQ

More recent examples of startups that raised Series A funding include Nearby, aifora, and CoLearn. The first major round of external funding, Series A funding can help a startup to grow. It can be preceded by seed or even pre-seed funding and be followed by several rounds of funding.

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

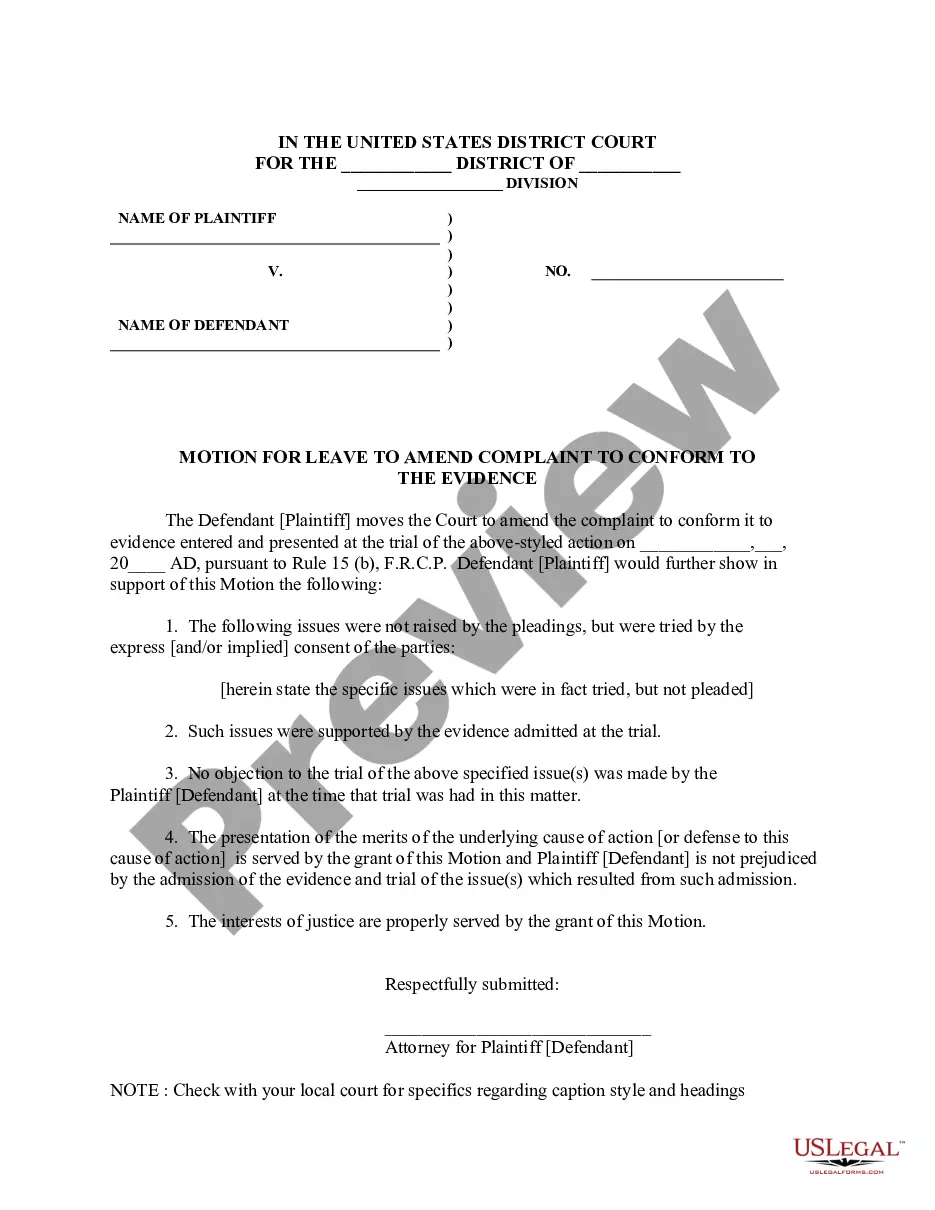

A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

Key Takeaways. Preferred stock is a different type of equity that represents ownership of a company and the right to claim income from the company's operations. Preferred stockholders have a higher claim on distributions (e.g. dividends) than common stockholders.