Minnesota Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

Choosing the right lawful document design might be a battle. Naturally, there are a variety of layouts accessible on the Internet, but how would you obtain the lawful form you will need? Take advantage of the US Legal Forms web site. The support delivers a large number of layouts, like the Minnesota Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent, that you can use for organization and personal demands. Each of the types are checked by professionals and fulfill state and federal needs.

When you are currently listed, log in to your account and click on the Download option to get the Minnesota Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent. Make use of your account to appear with the lawful types you possess purchased formerly. Proceed to the My Forms tab of your respective account and have one more duplicate of your document you will need.

When you are a brand new end user of US Legal Forms, listed here are easy recommendations that you should stick to:

- Initial, make sure you have selected the appropriate form for the area/region. You can look over the shape while using Review option and look at the shape description to make sure this is basically the right one for you.

- When the form is not going to fulfill your preferences, take advantage of the Seach area to get the correct form.

- Once you are certain the shape is acceptable, click on the Get now option to get the form.

- Select the prices prepare you desire and type in the essential details. Make your account and buy your order with your PayPal account or bank card.

- Select the document formatting and obtain the lawful document design to your system.

- Comprehensive, change and print out and sign the received Minnesota Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

US Legal Forms will be the most significant collection of lawful types that you will find different document layouts. Take advantage of the company to obtain skillfully-made documents that stick to state needs.

Form popularity

FAQ

What are the risks of stock lending? Your potential tax liability. One major consideration lies with your tax liability. ... Your loss of voting rights. Owning stock in a company sometimes grants you voting rights for certain decisions that will affect the company's future. ... Loss of insurance coverage.

From the lender's point of view, the benefits of securities lending include the ability to earn additional income through the fee charged to the borrower to borrow the security. It could also be viewed as a form of diversification. From the borrower's point of view, it allows them to take positions like short selling.

The main risks are that the borrower becomes insolvent and/or that the value of the collateral provided falls below the cost of replacing the securities that have been lent. If both of these were to occur, the lender would suffer a financial loss equal to the difference between the two.

The main benefit of stock lending is its income potential. If your shares are loaned out?which may or may not happen based on market demand?you'll earn interest daily, including weekends and holidays, which you'll typically split with your broker.

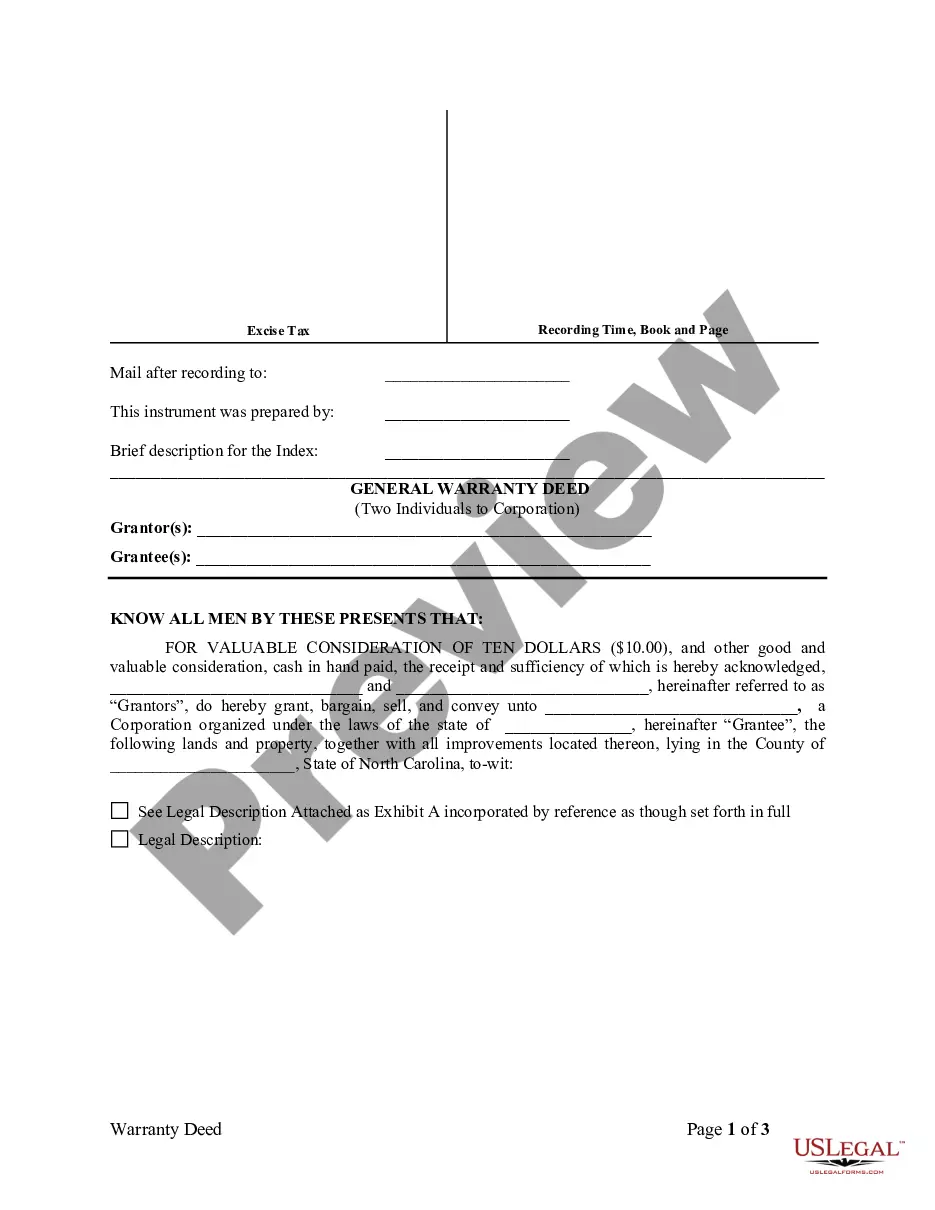

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan.

The omnibus loan agreement involves a well-defined contract between the debtor and the creditor, which outlines the necessary conditions and terms of accommodation of credit regardless of the type of loan product.

There is a risk that Robinhood Securities could default on its obligations to you under the Stock Lending program and fail to return the securities it has borrowed. If Robinhood Securities defaults and is unable to return loaned securities, you will not be able to trade such securities as usual.