Minnesota Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

How to fill out Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

Choosing the right authorized papers template can be quite a have difficulties. Of course, there are tons of web templates available online, but how can you discover the authorized type you want? Utilize the US Legal Forms site. The services gives thousands of web templates, such as the Minnesota Security Agreement regarding borrowing of funds and granting of security interest in assets, that you can use for company and private demands. Each of the kinds are examined by professionals and meet state and federal needs.

If you are already signed up, log in for your bank account and click on the Download option to obtain the Minnesota Security Agreement regarding borrowing of funds and granting of security interest in assets. Make use of bank account to search with the authorized kinds you may have purchased formerly. Check out the My Forms tab of your respective bank account and get yet another version of the papers you want.

If you are a whole new consumer of US Legal Forms, listed below are simple instructions for you to follow:

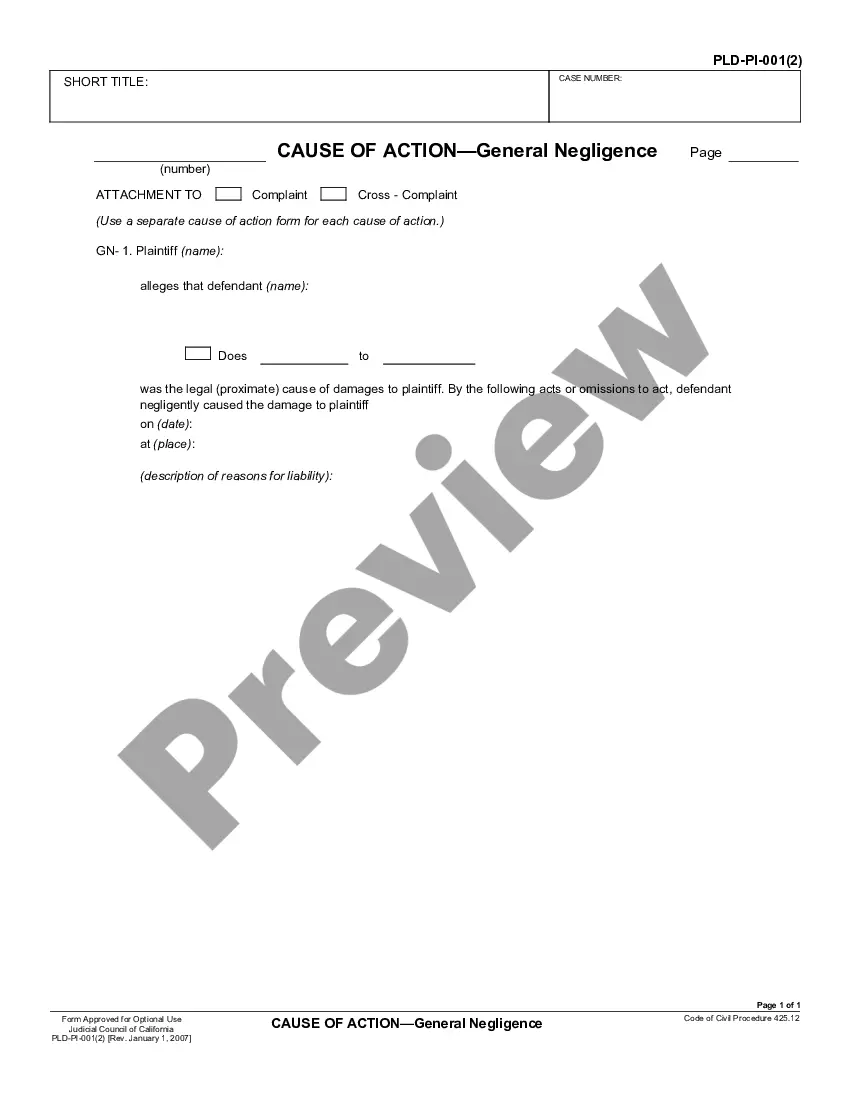

- Initially, ensure you have chosen the correct type for the city/county. You can look through the form using the Preview option and read the form information to guarantee this is basically the right one for you.

- When the type does not meet your expectations, utilize the Seach field to get the proper type.

- When you are sure that the form is acceptable, click the Purchase now option to obtain the type.

- Opt for the costs plan you need and enter in the necessary info. Build your bank account and buy the order with your PayPal bank account or bank card.

- Pick the file structure and acquire the authorized papers template for your device.

- Complete, revise and print out and indicator the received Minnesota Security Agreement regarding borrowing of funds and granting of security interest in assets.

US Legal Forms will be the largest collection of authorized kinds for which you can find different papers web templates. Utilize the service to acquire expertly-manufactured files that follow express needs.

Form popularity

FAQ

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

To create a valid security interest in equipment, inventory, receivables and shares in companies (as well as the other categories of collateral governed by the UCC, (i) a security provider (the grantor) must execute or authenticate a written or electronic security agreement that provides an adequate description of the ...

If the debtor defaults, the lender can gain all rights to the property, as laid under the security agreement. Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

A ?SECURITY AGREEMENT? is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation.

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust."