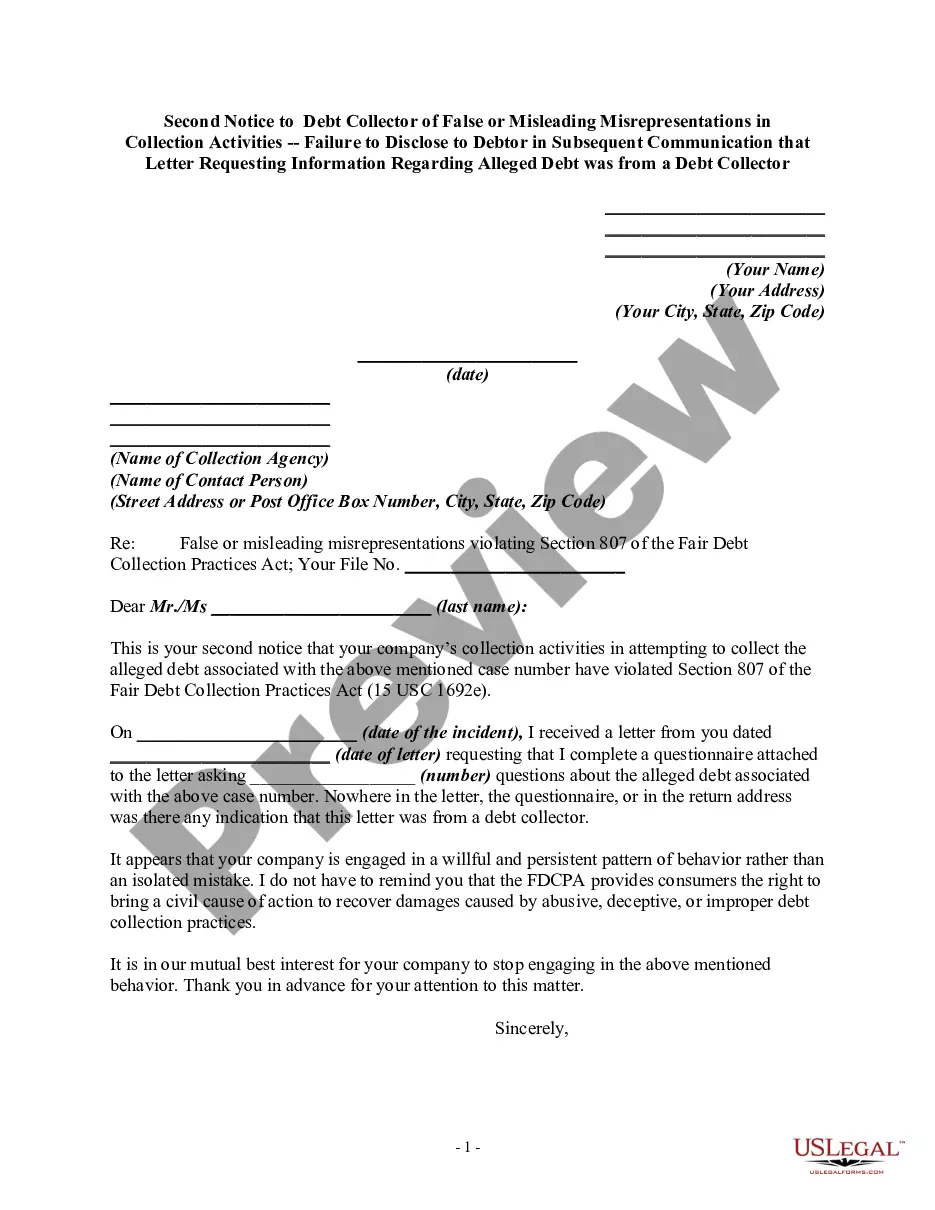

This form is a follow-up letter containing a warning that the debt collector's continued violation of the Fair Debt Collection Practices Act may result in a law suit being filed against the debt collector.

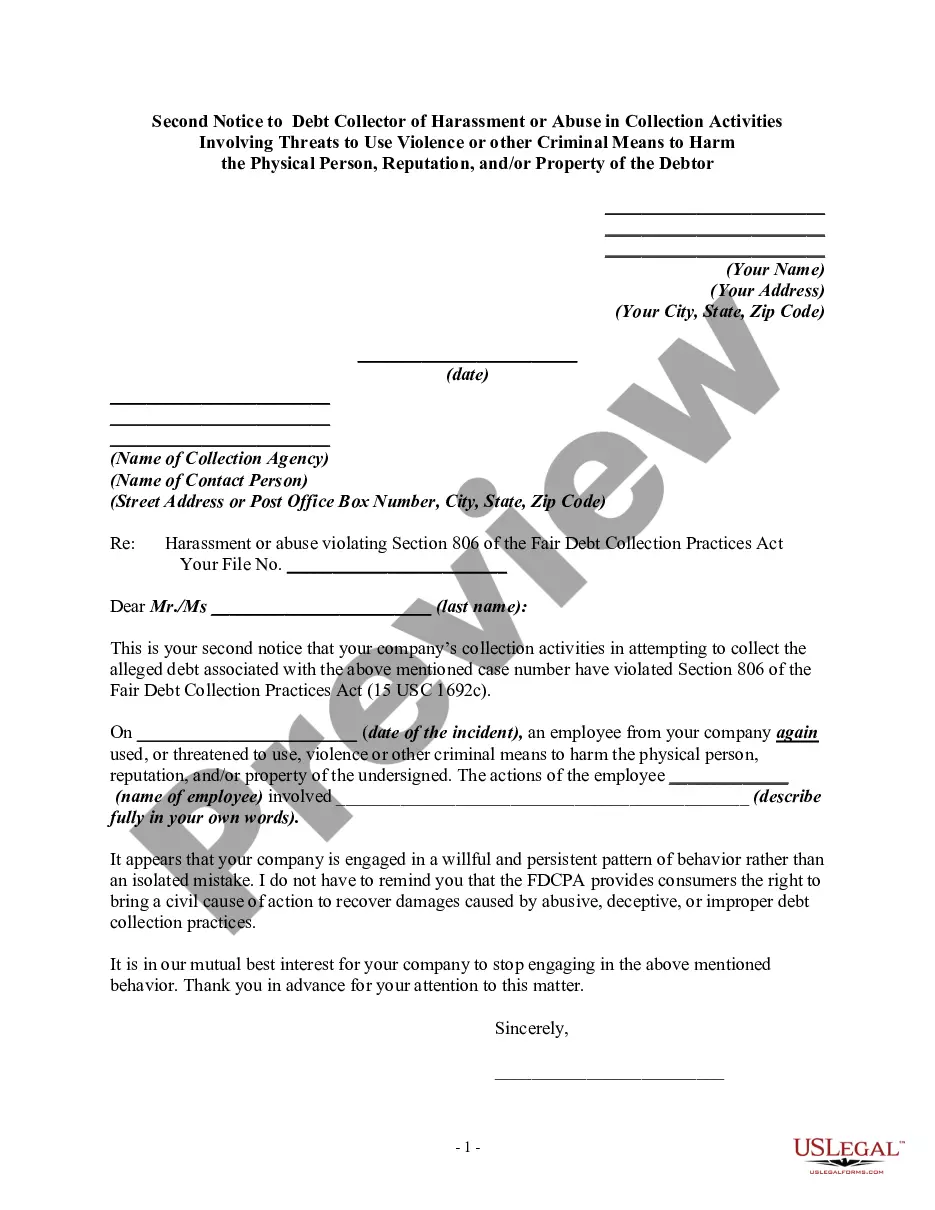

Minnesota Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor

Description

How to fill out Second Notice To Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad assortment of legal document styles that you can download or print. By using the site, you will obtain thousands of documents for business and personal reasons, organized by categories, states, or keywords.

You can quickly find the most recent versions of documents such as the Minnesota Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor.

If you have a subscription, Log In and download the Minnesota Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor from the US Legal Forms repository. The Download button will be visible on every document you view. You can access all previously downloaded documents from the My documents tab of your account.

Process the payment. Use Visa or Mastercard or a PayPal account to finalize the transaction.

Select the format and download the document to your device. Make edits. Fill out, modify, print, and sign the downloaded Minnesota Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor. Each template you store in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the template you desire. Access the Minnesota Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor with US Legal Forms, the largest collection of legal document styles. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If this is your first time using US Legal Forms, follow these simple steps to get started:

- Ensure you have chosen the correct document for your region/area. Click the Preview button to review the document’s content.

- Check the document description to confirm that you have selected the appropriate document.

- If the document doesn’t meet your needs, use the Search box at the top of the screen to find the one that does.

- Once satisfied with the document, confirm your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

Debt Collector Harassment Under the FDCPA, a debt collector cannot threaten to sue you to force faster payment of a debt. More often than not, when a collection agent or lawyer threatens to sue, it is to frighten you into making larger payments or establishing an impractical and financially infeasible payment schedule.

Debt collectors may threaten to sue you to try to collect a debt. In some cases, they can legally make this threat. But in other situations, making this threat is illegal. The Fair Debt Collection Practices Act governs how debt collectors can use threats to collect debts.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.