Minnesota Plan of Liquidation

Description

How to fill out Plan Of Liquidation?

Finding the right legal file template can be quite a have difficulties. Of course, there are a variety of themes accessible on the Internet, but how can you obtain the legal kind you want? Take advantage of the US Legal Forms web site. The service provides 1000s of themes, such as the Minnesota Plan of Liquidation, which can be used for business and personal requirements. Every one of the types are inspected by professionals and meet state and federal needs.

When you are currently listed, log in in your profile and click on the Down load key to get the Minnesota Plan of Liquidation. Utilize your profile to search throughout the legal types you might have purchased formerly. Visit the My Forms tab of your own profile and have yet another version of the file you want.

When you are a new consumer of US Legal Forms, listed here are easy directions so that you can comply with:

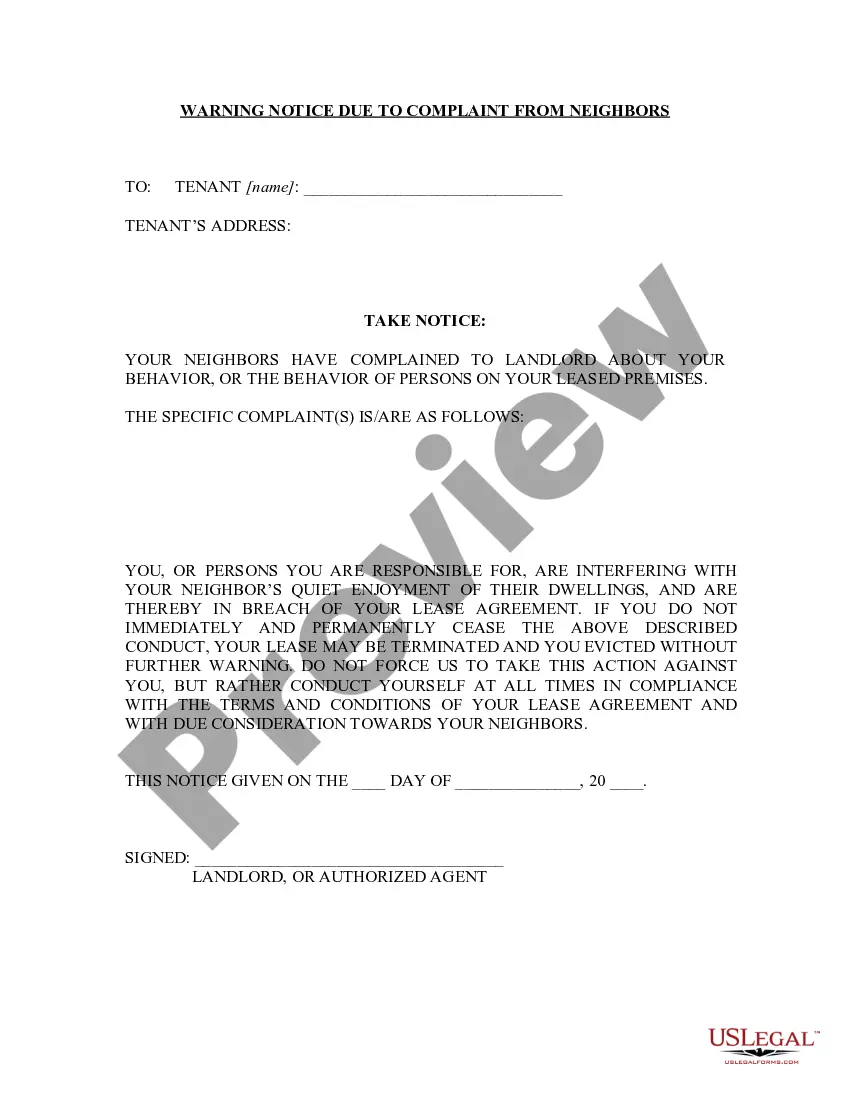

- First, ensure you have chosen the appropriate kind for your personal town/region. You are able to examine the shape making use of the Review key and read the shape information to make sure this is basically the right one for you.

- If the kind will not meet your needs, utilize the Seach discipline to get the proper kind.

- Once you are sure that the shape would work, select the Buy now key to get the kind.

- Choose the costs prepare you want and enter the required info. Make your profile and purchase an order using your PayPal profile or bank card.

- Opt for the document formatting and download the legal file template in your product.

- Complete, revise and printing and signal the attained Minnesota Plan of Liquidation.

US Legal Forms will be the biggest library of legal types in which you can see a variety of file themes. Take advantage of the company to download appropriately-created papers that comply with status needs.

Form popularity

FAQ

How do you dissolve a Minnesota Corporation? Corporations which have issued shares: To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A.

Administrative dissolution is an action that the Minnesota Secretary of State takes when a Minnesota business does not take certain actions required by law. When a business is administratively dissolved, it ceases to exist in Minnesota.

How do I close a business? To close your business and all of your tax accounts through e-Services, you must be an e-Services Master for the business. You can also email business.registration@state.mn.us, or call 651-282-5225 or 1-800-657-3605 (toll-free). Note: If your business closed more than a year ago, contact us.

Things you need to do before you Dissolve a Minnesota LLC. Hold a Members meeting and record a resolution to Dissolve the Minnesota LLC. File a Notice of Dissolution with the MN Secretary of State. File all required Annual Business Renewals with the Minnesota Secretary of State. Clear up any business debt.

To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A. 7291 or 302A. 727.

Nonprofit Articles of Dissolution under Minnesota Statutes, section 317A. 721 can only be used to dissolve a nonprofit corporation that HAS named its first Board of Directors.

How do I close a business? To close your business and all of your tax accounts through e-Services, you must be an e-Services Master for the business. You can also email business.registration@state.mn.us, or call 651-282-5225 or 1-800-657-3605 (toll-free). Note: If your business closed more than a year ago, contact us.

317A. A nonprofit corporation's purpose and activities must serve the organization's mission to benefit the public, and may not be operated to profit other persons or entities.