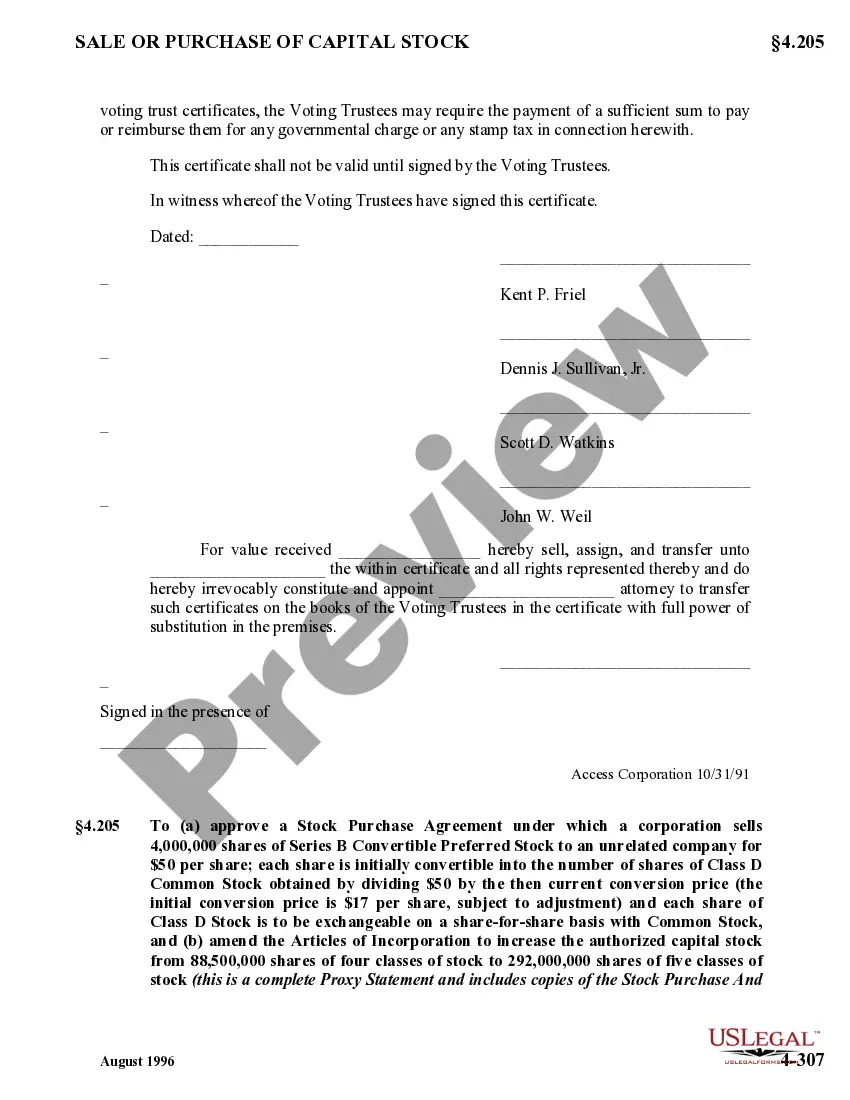

Minnesota Voting Trust Certificate

Description

How to fill out Voting Trust Certificate?

If you wish to comprehensive, down load, or printing legal record themes, use US Legal Forms, the largest variety of legal varieties, that can be found online. Take advantage of the site`s simple and practical lookup to get the files you need. A variety of themes for organization and specific reasons are sorted by groups and suggests, or search phrases. Use US Legal Forms to get the Minnesota Voting Trust Certificate with a handful of clicks.

If you are previously a US Legal Forms buyer, log in for your profile and then click the Obtain button to have the Minnesota Voting Trust Certificate. You may also access varieties you previously downloaded within the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for that right metropolis/country.

- Step 2. Utilize the Review option to check out the form`s articles. Don`t overlook to see the description.

- Step 3. If you are not satisfied using the develop, take advantage of the Lookup discipline at the top of the display screen to locate other variations of your legal develop format.

- Step 4. Upon having located the shape you need, click on the Acquire now button. Opt for the costs prepare you choose and put your references to register for an profile.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Select the structure of your legal develop and down load it on your gadget.

- Step 7. Comprehensive, revise and printing or indication the Minnesota Voting Trust Certificate.

Every single legal record format you acquire is your own property for a long time. You have acces to every single develop you downloaded inside your acccount. Select the My Forms section and choose a develop to printing or down load once more.

Be competitive and down load, and printing the Minnesota Voting Trust Certificate with US Legal Forms. There are many specialist and state-distinct varieties you can utilize for the organization or specific demands.

Form popularity

FAQ

The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. This might include managing rental properties, investing funds, or paying income to the beneficiary. Trusts differ in how a trustee can distribute trust income. Living Trusts - Probate and Planning Minnesota Attorney General ? consumer ? handbooks Minnesota Attorney General ? consumer ? handbooks

The statutory language says an interested person "includes heirs, devisees, children, spouses, creditors, beneficiaries and any others having a property right in or claim against the estate of a decedent, ward or protected person which may be affected by the proceeding.

Beneficiaries of trust generally fall into two categories. One type of beneficiary is ultimately entitled to take ownership and control of trust capital and the income it generates as outlined in the trust agreement. Beneficiary of Trust: Definition and Role in Estate Planning investopedia.com ? terms ? beneficiary-of-tr... investopedia.com ? terms ? beneficiary-of-tr...

(A) A security given or delivered with, or as a bonus on account of, any purchase of securities or any other thing is considered to constitute part of the subject of the purchase and to have been offered and sold for value. (B) A gift of assessable stock is considered to involve an offer and sale.

A Certificate of Trust may need to be recorded in the county that any real property is in. That said, if there's no real property owned by the Trust, there may not be any need to record it.

A Beneficiary Controlled Trust refers to a trust where the beneficiary may also be the controlling trustee. The beneficiary can be provided virtually the same control as he or she would have with outright ownership. For example, the beneficiary, as the controlling trustee, could make all investment decisions. What a Beneficiary Controlled Trust Can Do to Protect Your Legacy ... kiplinger.com ? retirement ? estate-planning kiplinger.com ? retirement ? estate-planning

An estate or trust with $600 or more of gross income assignable to Minnesota must file Form M2, Income Tax Return for Estates and Trusts. Filing is required even if the trust is considered a resident trust. Filing Requirements for Estates and Trusts | Minnesota Department of ... revenue.state.mn.us ? filing-requirements-est... revenue.state.mn.us ? filing-requirements-est...

I. As a beneficiary of a trust in Minnesota, you have the right to information about the trust and its administration. This includes, but is not limited to: A complete copy of the trust document. Updates on the trust's assets and liabilities.