Minnesota Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer)

Description

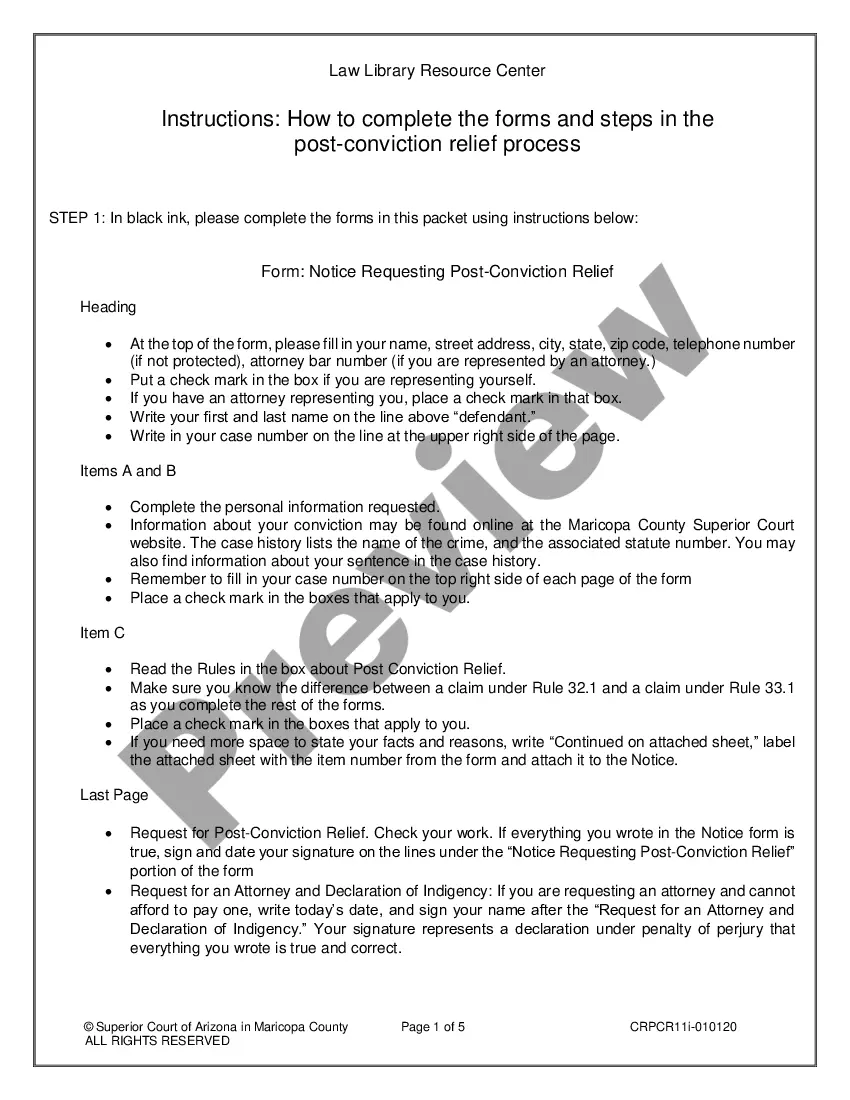

How to fill out Sample Asset Purchase Agreement Between Third Tier Subsidiary Of Corporation (Seller) And Second Tier Subsidiary Of Unrelated Corporation (Buyer)?

US Legal Forms - one of several largest libraries of authorized types in the United States - provides a wide array of authorized record themes you may download or produce. Using the website, you can find 1000s of types for business and specific uses, sorted by categories, suggests, or search phrases.You can get the most recent types of types much like the Minnesota Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer) in seconds.

If you already have a registration, log in and download Minnesota Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer) in the US Legal Forms library. The Acquire key will show up on each type you view. You have access to all in the past delivered electronically types within the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, allow me to share easy recommendations to obtain started off:

- Be sure you have picked out the correct type for your area/county. Go through the Review key to analyze the form`s information. Browse the type outline to ensure that you have chosen the proper type.

- When the type does not suit your specifications, utilize the Search field towards the top of the screen to obtain the one which does.

- When you are satisfied with the shape, verify your selection by clicking on the Buy now key. Then, opt for the prices prepare you prefer and offer your references to sign up for the accounts.

- Method the financial transaction. Make use of Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Find the formatting and download the shape on your own gadget.

- Make modifications. Fill up, edit and produce and signal the delivered electronically Minnesota Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer).

Every single design you included in your money does not have an expiration particular date and it is your own eternally. So, if you want to download or produce one more duplicate, just check out the My Forms segment and click in the type you will need.

Obtain access to the Minnesota Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer) with US Legal Forms, by far the most comprehensive library of authorized record themes. Use 1000s of specialist and status-certain themes that meet up with your business or specific needs and specifications.

Form popularity

FAQ

If purchasing a business entity, you are purchasing all the corporation's shares or if a limited liability company, its membership interest. In contrast, if purchasing the business' assets, you are buying all the assets, contracts, debts, and anything else registered under the business' name.

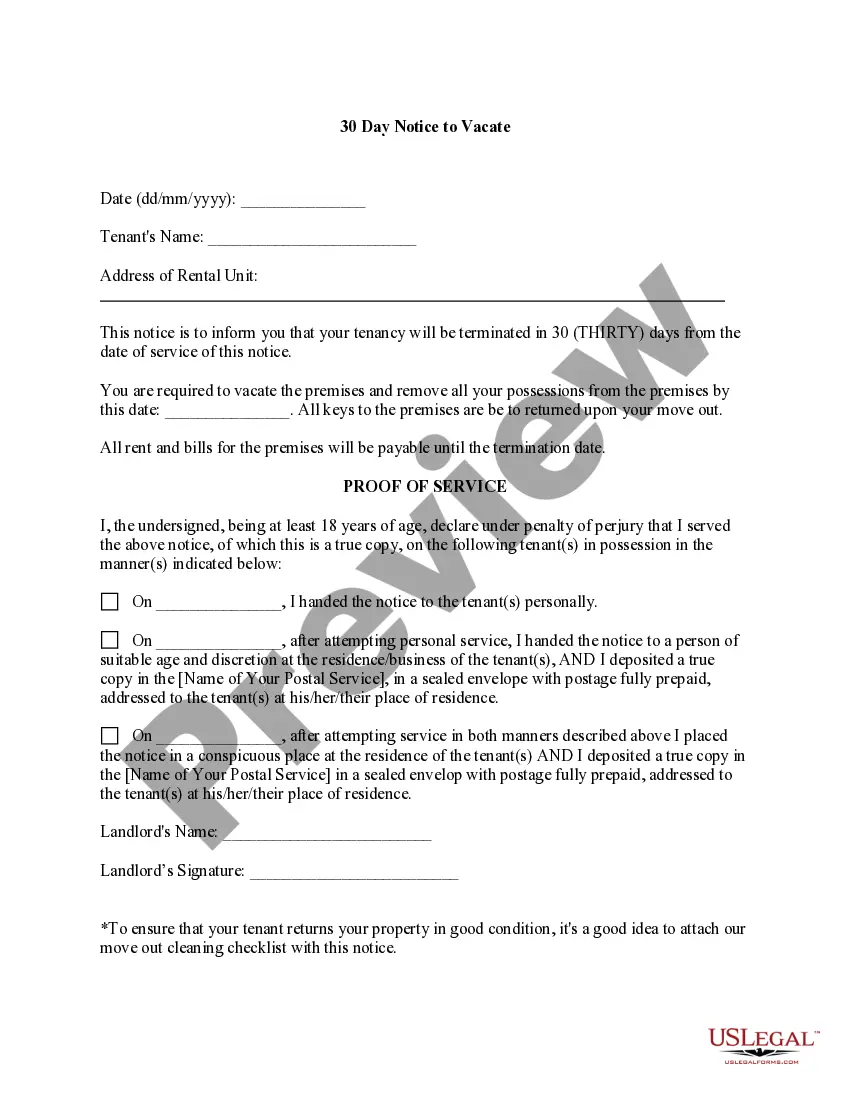

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

There are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

What Must You Include in an Asset Purchase Agreement? Party information. Include the full legal names of the business, buyer, and seller in the opening paragraph. Definitions. ... Purchase price. ... Purchased assets. ... Representations and warranties. ... Dispute Resolution. ... Indemnification. ... Closing conditions.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Buying assets of a business entails purchasing items such as property, fixtures, equipment, and customer and client goodwill.

In an acquisition of a business, transaction costs are expensed on, or prior to, the acquisition date. In an asset acquisition, transaction costs are a cost of acquiring the assets, and therefore initially capitalized and then subsequently depreciated.

What's the Difference? Generally speaking, an asset purchase is when an individual, either with an existing entity or by forming a new entity (LLC or Corporation), buys the assets of a business without buying the business itself. Asset Purchases entail buying everything that the business owns (the Assets).