Minnesota Amendments to certificate of incorporation

Description

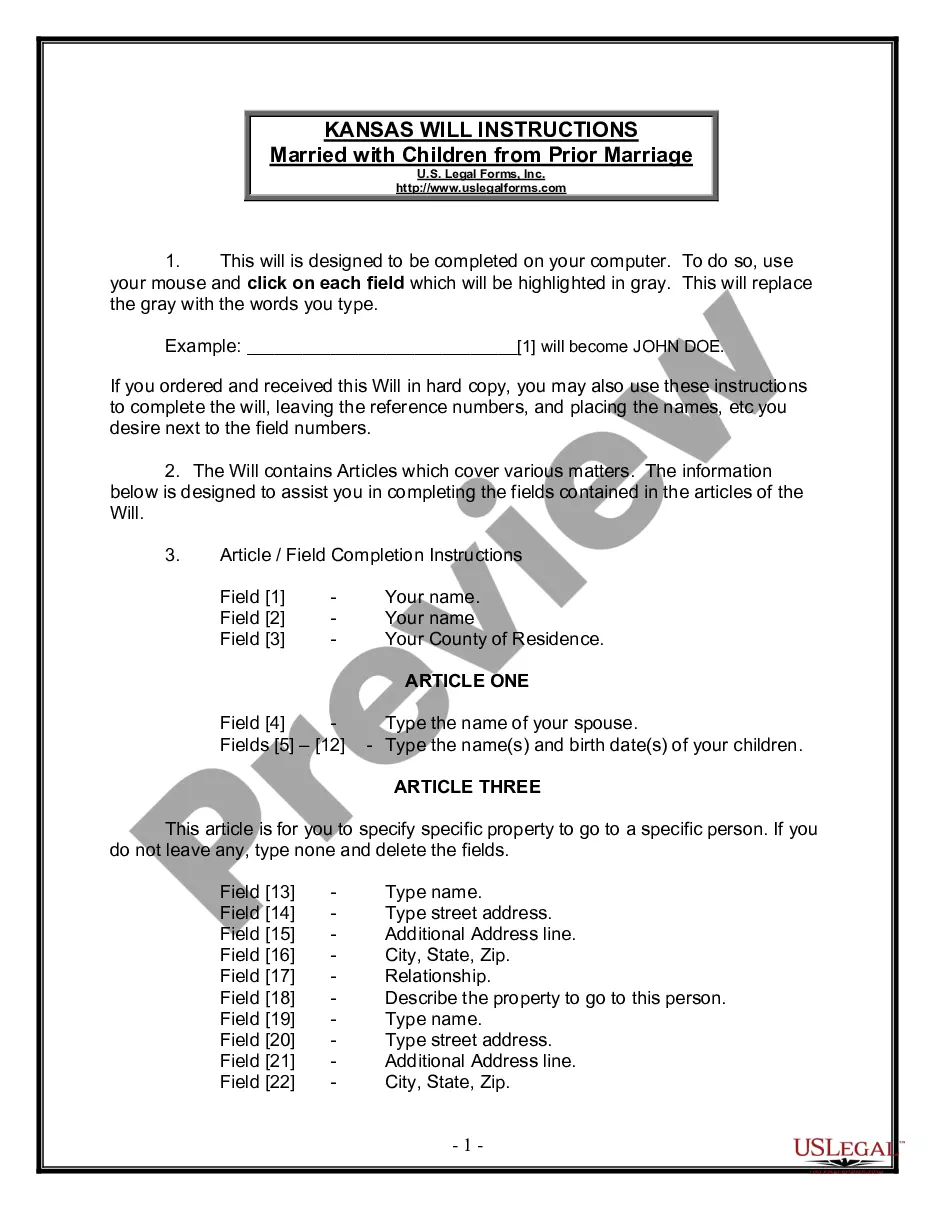

How to fill out Amendments To Certificate Of Incorporation?

Finding the right authorized papers design can be quite a battle. Obviously, there are a variety of themes available online, but how do you get the authorized form you will need? Make use of the US Legal Forms website. The support provides thousands of themes, including the Minnesota Amendments to certificate of incorporation, that you can use for organization and personal requires. All the types are examined by specialists and fulfill state and federal specifications.

In case you are already listed, log in to the bank account and then click the Obtain button to have the Minnesota Amendments to certificate of incorporation. Use your bank account to appear throughout the authorized types you have bought previously. Proceed to the My Forms tab of your bank account and acquire one more version from the papers you will need.

In case you are a whole new user of US Legal Forms, allow me to share simple instructions that you should comply with:

- Very first, ensure you have selected the correct form for the town/county. It is possible to check out the form while using Preview button and read the form outline to make certain it is the best for you.

- In the event the form does not fulfill your needs, use the Seach area to discover the proper form.

- Once you are sure that the form is acceptable, select the Acquire now button to have the form.

- Opt for the pricing strategy you want and enter the necessary information and facts. Build your bank account and pay money for an order making use of your PayPal bank account or credit card.

- Select the submit formatting and down load the authorized papers design to the product.

- Total, modify and print and indication the obtained Minnesota Amendments to certificate of incorporation.

US Legal Forms may be the most significant collection of authorized types that you can find various papers themes. Make use of the company to down load appropriately-manufactured documents that comply with state specifications.

Form popularity

FAQ

All Minnesota LLCs must file an annual renewal, also known as an annual report. The reports must be sent by December 31st each year to the Secretary of State's Business Services office. This process is vital for keeping your LLC in good standing.

There is no fee for filing the annual renewal if the entity is active and in good standing. An entity that has been dissolved by our office for failure to file an annual renewal, may retroactively reinstate its existence by filing the current year's renewal and pay the applicable fee.

How do you dissolve a Minnesota Corporation? Corporations which have issued shares: To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A.

If you are a Minnesota-organized business entity, file the applicable business name change form and filing fee with the Secretary of State. 3.) If you are a foreign business entity, file the applicable form and filing fee with the Minnesota Secretary of State: Foreign corporation -- Name Change Amendment Form.

Minnesota LLC members must pay federal income tax at the 15.3% self-employment rate plus state income tax at a graduated rate. Minnesota collects a state sales tax of 6.875%, and most municipalities also levy a local sales tax.

Minnesota Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.

Minnesota Annual Renewal: $0 Minnesota LLCs must file an annual report called the Minnesota Annual Renewal. There is no fee to file your Annual Renewal as long as you file by the due date, which is December 31st each year, starting the year after you form your LLC.

To file in person or by mail, submit the Amendment of Articles of Incorporation to the Minnesota SOS. The form you need to amend your articles of incorporation is in your online account when you sign up for registered agent service with Northwest. Keep the original copy and submit a legible photocopy to the SOS.