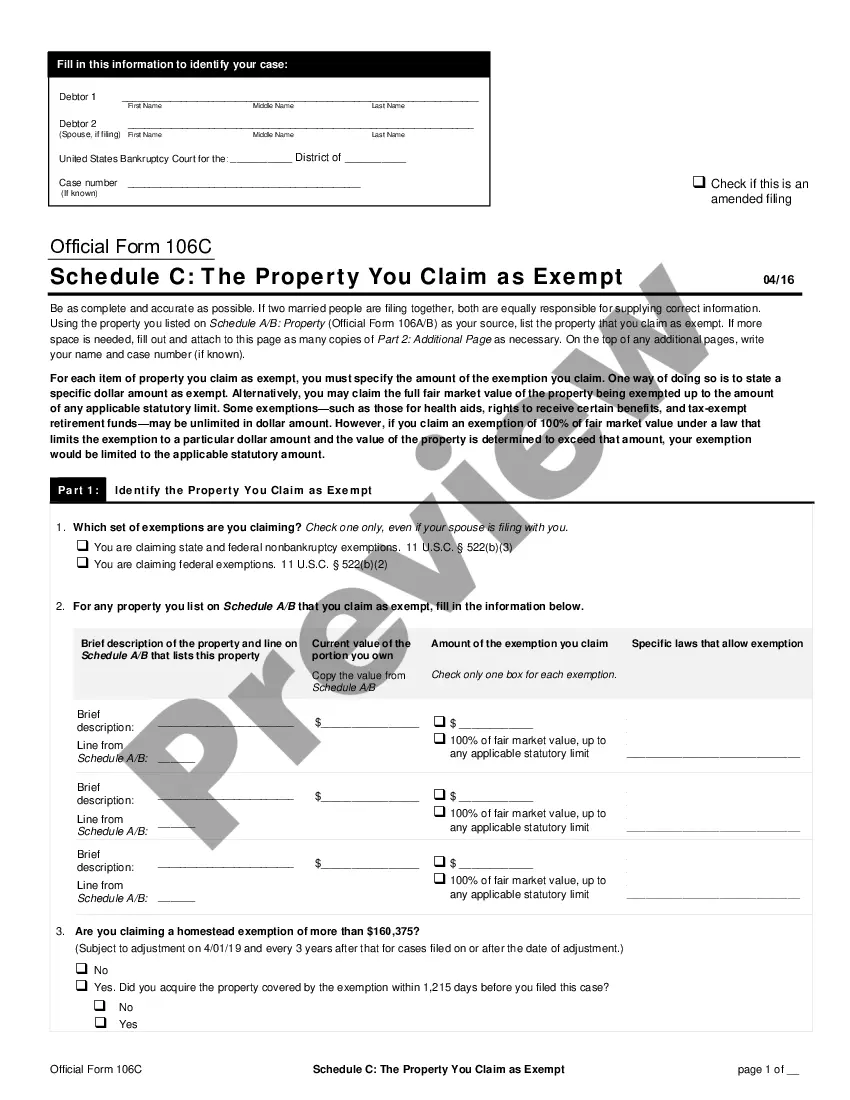

Minnesota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

It is possible to devote hours online looking for the lawful papers design that suits the state and federal demands you need. US Legal Forms provides a large number of lawful varieties that are reviewed by experts. You can easily download or print out the Minnesota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 from your services.

If you currently have a US Legal Forms account, you are able to log in and then click the Download button. After that, you are able to complete, edit, print out, or indication the Minnesota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. Every single lawful papers design you get is yours eternally. To have an additional version of the bought type, check out the My Forms tab and then click the related button.

If you work with the US Legal Forms site the very first time, adhere to the easy guidelines under:

- First, make certain you have chosen the best papers design for your county/town of your choosing. Browse the type explanation to ensure you have selected the right type. If readily available, make use of the Review button to check with the papers design at the same time.

- If you would like discover an additional version in the type, make use of the Research field to obtain the design that suits you and demands.

- After you have located the design you desire, click on Get now to continue.

- Choose the prices strategy you desire, type in your accreditations, and register for a free account on US Legal Forms.

- Total the transaction. You can utilize your charge card or PayPal account to purchase the lawful type.

- Choose the file format in the papers and download it for your gadget.

- Make changes for your papers if necessary. It is possible to complete, edit and indication and print out Minnesota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Download and print out a large number of papers layouts making use of the US Legal Forms site, which provides the largest assortment of lawful varieties. Use professional and status-particular layouts to tackle your business or personal requires.

Form popularity

FAQ

Go to .revenue.state.mn.us to file electronically or download Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. Call 651 ?296?3781 or 1?800?652?9094 to have the form sent to you. Looking for the status of your property tax refund? Minnesota Property Tax Refund revenue.state.mn.us ? sites ? default ? files revenue.state.mn.us ? sites ? default ? files

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss. Schedule C: Instructions for Completing It, Step by Step thebalancemoney.com ? how-to-complete-sc... thebalancemoney.com ? how-to-complete-sc...

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

Can I file my M1PR (Minnesota Property Tax Refund) through TurboTax? Yes, you can file your M1PR when you prepare your Minnesota taxes in TurboTax. We'll make sure you qualify, calculate your Minnesota property tax refund, and fill out an M1PR form. The M1PR can be mailed or e-filed (if qualified). Can I file my M1PR (Minnesota Property Tax Refund) through ... intuit.com ? en-us ? help-article ? tax-forms intuit.com ? en-us ? help-article ? tax-forms

To fill out the Certificate of Rent Paid information in the TaxAct program: From within your TaxAct return (Online or Desktop), click State. Click Minnesota in the expanded State menu. Click Property Tax Refund to expand the category and then click Certificate of rent paid. Minnesota - Certificate of Rent Paid (CRP) - TaxAct taxact.com ? support ? minnesota-certificate... taxact.com ? support ? minnesota-certificate...