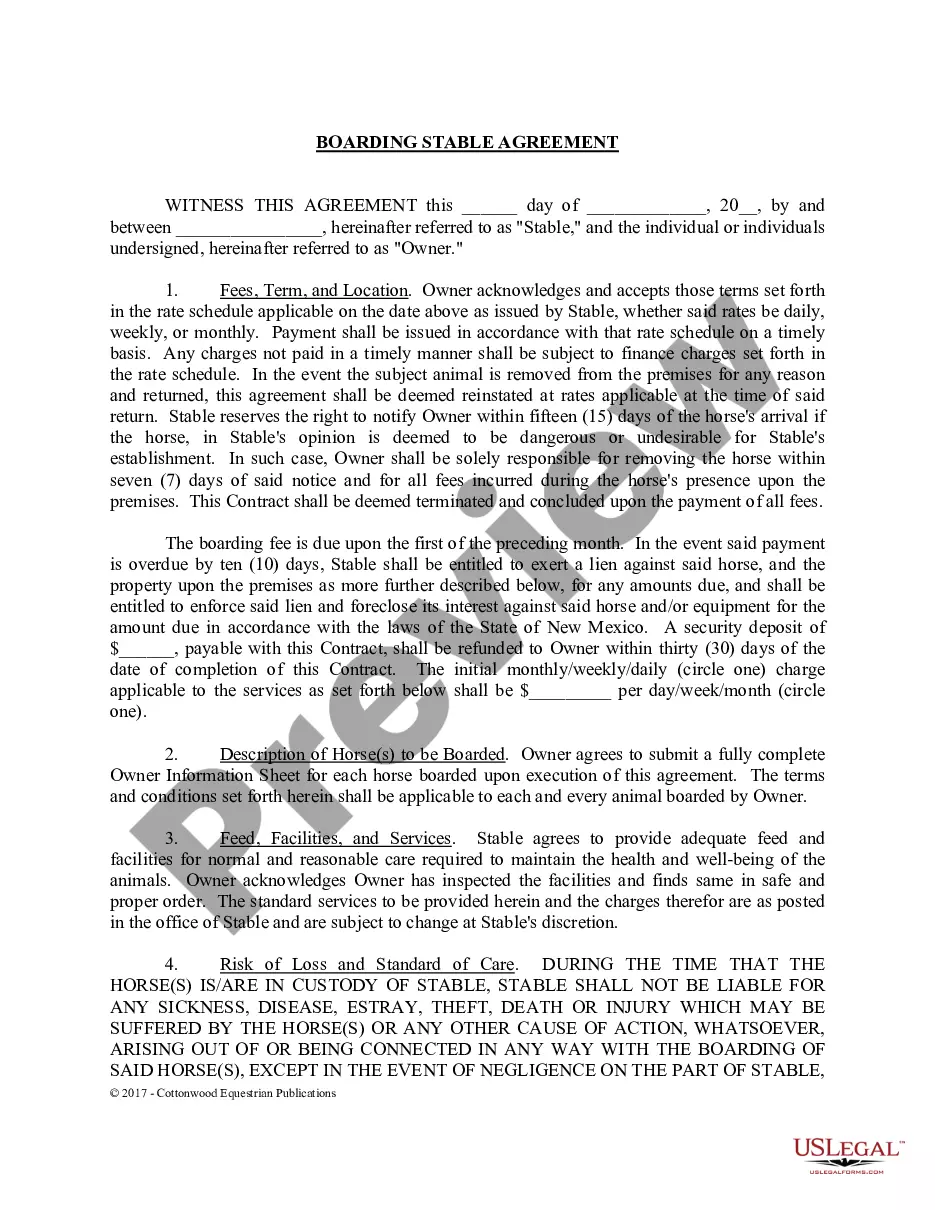

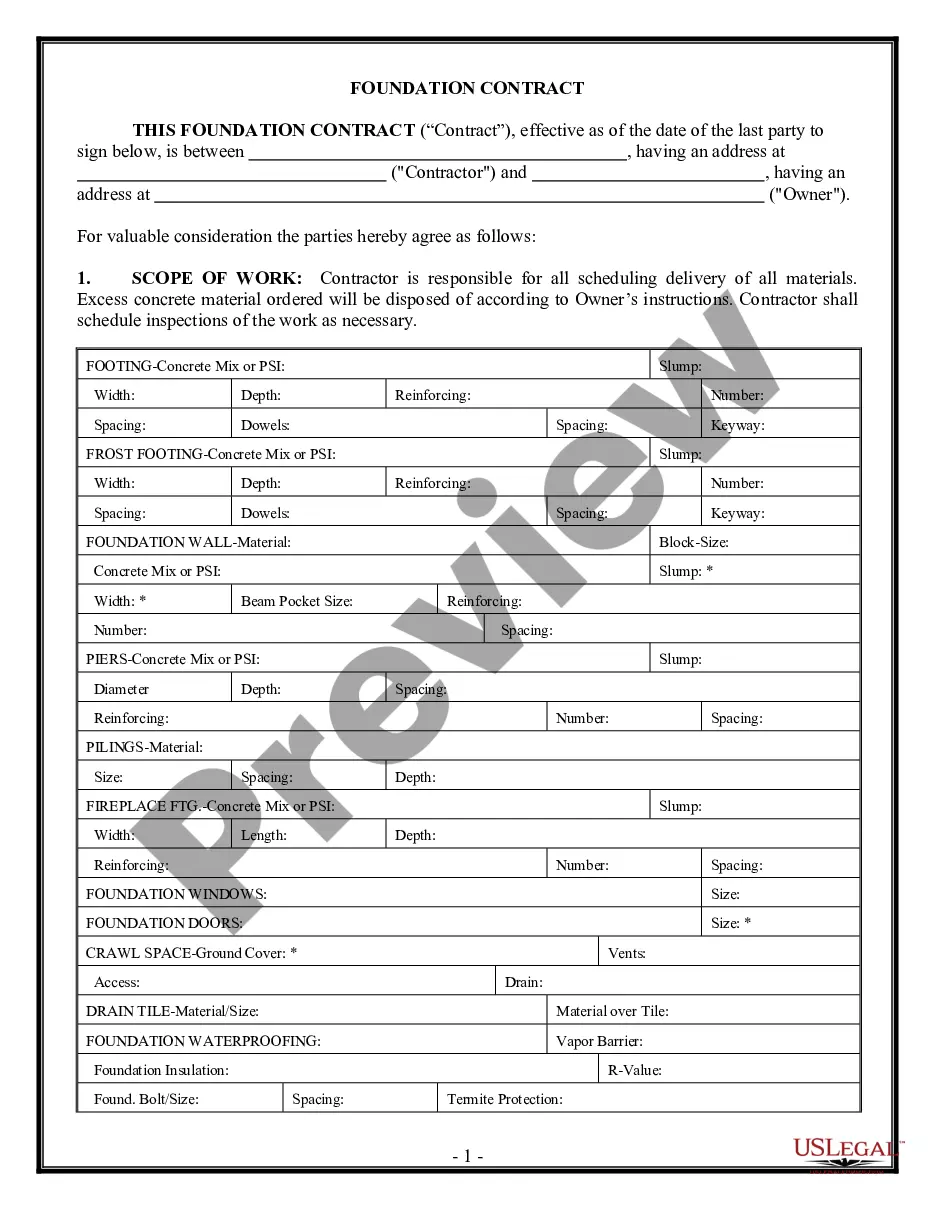

Minnesota Agreement to Reimburse for Insurance Premium

Description

How to fill out Agreement To Reimburse For Insurance Premium?

Are you presently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers a vast selection of form templates, including the Minnesota Agreement to Reimburse for Insurance Premium, designed to meet federal and state requirements.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you want, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Minnesota Agreement to Reimburse for Insurance Premium template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Preview button to view the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search area to find the form that meets your needs and requirements.

Form popularity

FAQ

A premium refund is a clause in some insurance policies that grants the beneficiaries a refund to the total amount of premiums paid to date. Depending on the contract and type of insurance, it will grant a refund of the premiums you paid if you die before that term runs out or if you voluntarily end your coverage.

A hospital indemnity policy pays an amount per day for hospitalization directly to the insured regardless of the insured's other health insurance.

In insurance terminology, a rebate is a discount offered to the policyholder upon their insurance premium. A higher sum assured could get you a rebate, as the cost of servicing the policy reduces for the insurer.

The insurer is subject to refund the unearned premium if the insured decides to terminate the policy before the policy period ends. The unearned premium is to be returned when the insured item is lost, and the coverage for the item is no longer required or when the insurer cancels the coverage.

When a provider does not have an agreement with the insurer for payment, they will be reimbursed a usual, customary, and reasonable fee.

A waiting period is the amount of time an insured must wait before some or all of their coverage comes into effect. The insured may not receive benefits for claims filed during the waiting period. Waiting periods may also be known as elimination periods and qualifying periods.

13. Who is responsible for making payment for healthcare claims on behalf of the company? Rationale: Third party administrator is responsible for making payment for health claims.

First dollar coverage is a type of insurance policy with no deductible where the insurer assumes payment once an insurable event occurs. While there is no deductible, the amount the insurer will pay out is often lower than on similar plans that have a deductible, or premiums for the first dollar plan will be higher.

Often companies offer a discount on the premium rate payable on the basis of sum assured (SA) and the mode of payment of premium. In insurance jargon these discounts are called rebates.

Mode rebate is the rebate given on the premium amount if you pay the premium yearly or half yearly. The logic behind this rebate is to encourage the customer to pay in yearly mode as LIC prints only one receipt in a year and there are less administrative expenses.