Minnesota Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

If you wish to total, obtain, or print approved file templates, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Utilize the website's intuitive and convenient search feature to locate the required paperwork.

Various templates for business and personal purposes are categorized by type and state, or by keywords. Use US Legal Forms to discover the Minnesota Approval for Relocation Expenses and Allowances within a few clicks.

Every legal document template you purchase is yours to keep indefinitely. You have access to all forms you have downloaded in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download and print the Minnesota Approval for Relocation Expenses and Allowances with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Minnesota Approval for Relocation Expenses and Allowances.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for your specific area/state.

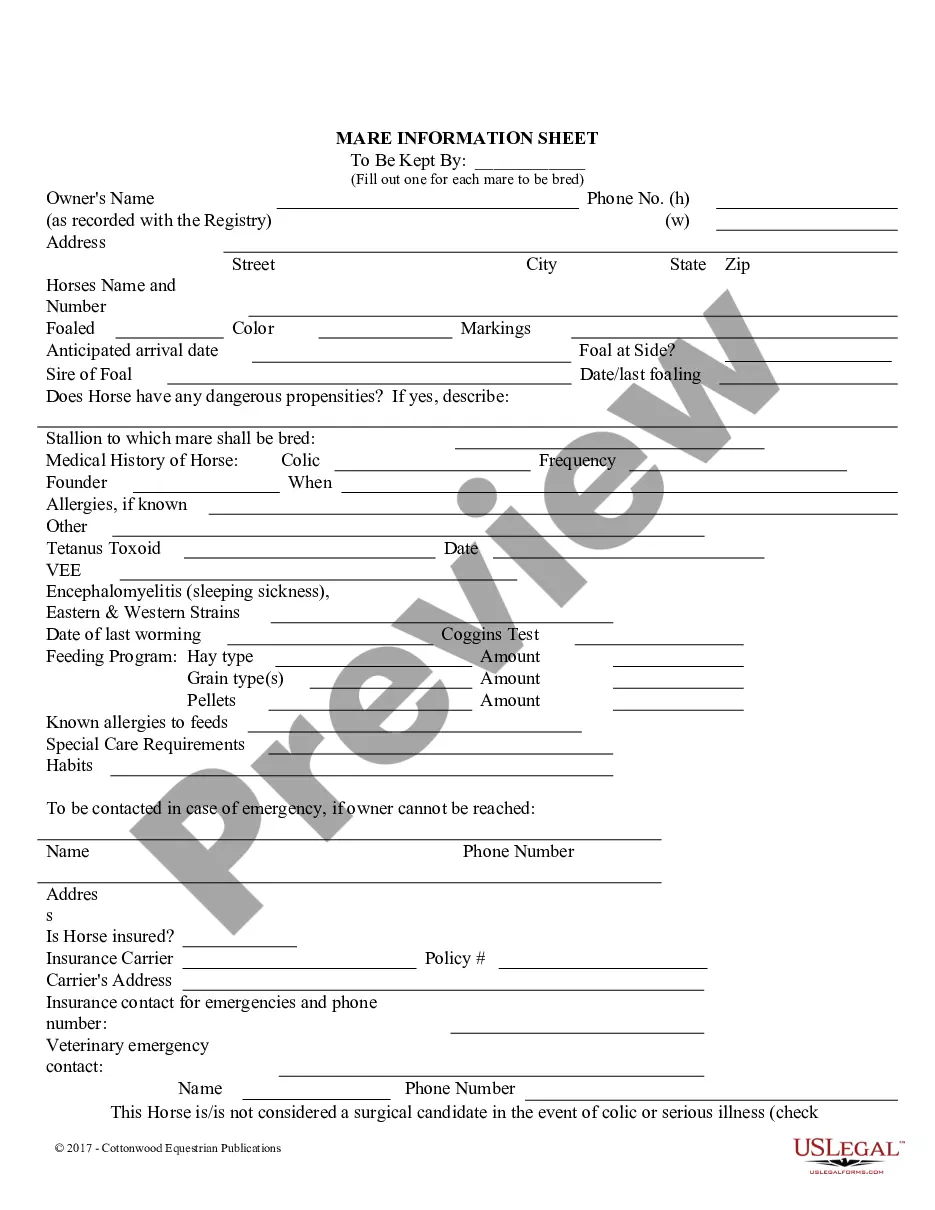

- Step 2. Utilize the Preview option to review the form's details. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your credentials to set up an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Minnesota Approval for Relocation Expenses and Allowances.

Form popularity

FAQ

Eligibility for a relocation allowance generally applies to employees who must move for work-related reasons. Factors such as job position, length of employment, and specific employer policies play a role in determining eligibility. To navigate the complexities of obtaining Minnesota approval for relocation expenses and allowances, consider using US Legal Forms for essential information.

Employees who are asked to relocate for their job often qualify for a relocation bonus. This bonus helps offset the costs and can be a significant incentive for employees. Seeking Minnesota approval for relocation expenses and allowances can clarify your eligibility and provide guidance throughout the process.

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

Put the limit in writing with an offer of relocation reimbursement. The offer details the amount of money you will refund, the types of expenses that qualify, and any other stipulations that you want set on the reimbursement. Make sure you and the job candidate both sign the relocation offer.

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

Relocation assistance may cover many areas , including packing and unpacking services, transportation and moving costs, temporary lodging, disposition of a residence, acquisition of a new residence, mortgage assistance, cultural training and language training.

House-hunting trips domestically, and housing internationally. 10 days of hotel expense reimbursement on either end of the move. Payment of all moving expenses, including the packing up. Storage.

What is a relocation allowance? A relocation allowance is the payment made by an employer or the government agency; to cover transfer expenses and other costs incurred by an employee who is required to take up the employment elsewhere.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

You can deduct certain expenses associated with moving your household goods and personal effects. Examples of these expenses include the cost of packing, crating, hauling a trailer, in-transit storage, and insurance.