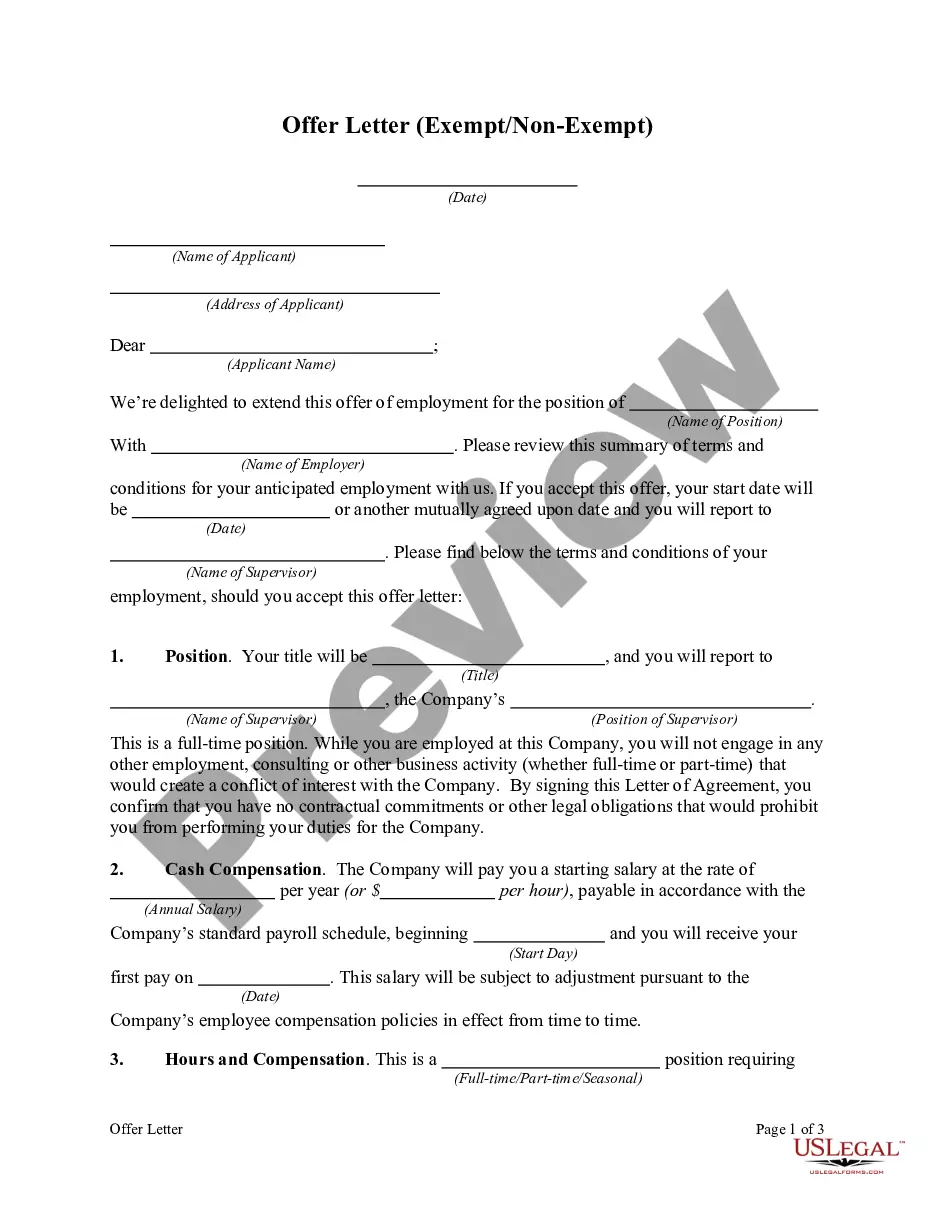

Minnesota Job Offer Letter - Exempt or Nonexempt Position

Description

How to fill out Job Offer Letter - Exempt Or Nonexempt Position?

If you wish to finalize, obtain, or print valid document templates, utilize US Legal Forms, the largest variety of valid forms accessible online.

Take advantage of the site’s straightforward and convenient search feature to locate the documents you need.

Different templates for business and personal uses are organized by categories and titles, or keywords.

Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Minnesota Job Offer Letter - Exempt or Nonexempt Position with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Minnesota Job Offer Letter - Exempt or Nonexempt Position.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If it is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form’s content. Don’t forget to review the explanation.

- Step 3. If you are not satisfied with the form, take advantage of the Search field at the top of the screen to find other versions in the valid form format.

Form popularity

FAQ

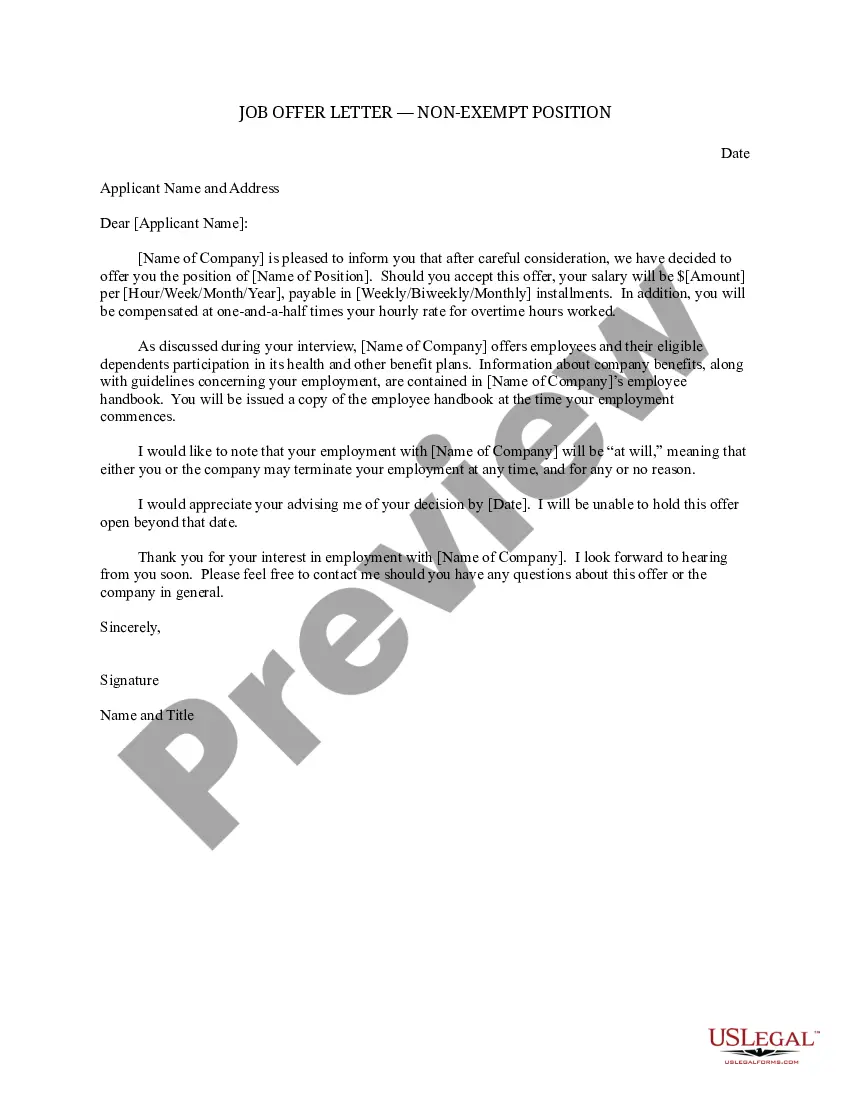

An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

The offer was sent from a personal email The biggest giveaway is the email address that the job offer has been sent from. If it's been sent from a free e-mail account like 'google.com or hotmail.com' then you should know that it's fake. Authentic job offers are sent from company registered e-mails.

With that, every job offer letter should include the following terms:A job title and description.Important dates.Compensation, benefits, and terms.Company policies and culture.A statement of at-will employment.An employee confidentiality agreement and noncompete clause.A list of contingencies.

Exempt employees are mostly paid on a salary basis and not per hour. Unlike non-exempt employees, employers may decide whether to pay exempt employees for any extra work outside the official 40 working hours per week. As a business owner, this allows you flexibility in your payment and employee benefits policies.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Exempt/Nonexempt Classification. Offer letters to nonexempt employees should state that they must record their hours worked and they will be paid overtime (as pre-approved by their supervisor), and describe available meal and rest periods.

The Minnesota Fair Labor Standards Act contains exemptions for more than 20 types of workers, including: nonprofit volunteers; elected officials; police and firefighters; seasonal fair, carnival and ski facility workers (overtime exempt only);

Some important details about an offer letter are: It is NOT a legally binding contract. It does NOT include promises of future employment or wages. It includes an employment at-will statement.

The federal exempt salary amount was increased to $684 a week Jan. 1, 2020. Additionally, while federal law allows some additional partial-day salary deductions for missed work hours due to FMLA leave, illness or disability, Minnesota law does not allow these same salary deductions.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.