Minnesota Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

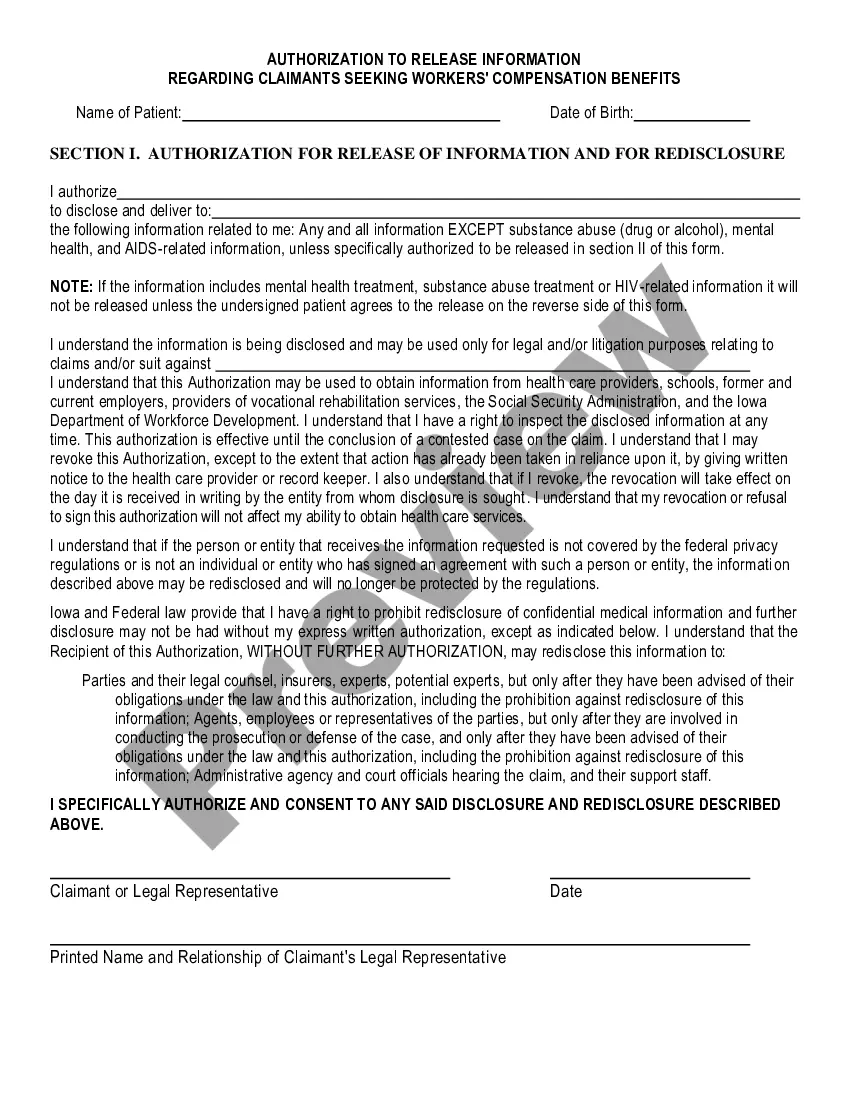

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Have you ever been in a situation where you need to have documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable versions is not easy.

US Legal Forms offers thousands of form templates, such as the Minnesota Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, which are designed to meet state and federal requirements.

Select the pricing plan you want, fill out the necessary information to create your account, and pay for your order using your PayPal or Visa/Mastercard.

Choose a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/county.

- Use the Review button to evaluate the form.

- Check the summary to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, click Get now.

Form popularity

FAQ

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

Minnesota law exempts certain nonprofit organizations from paying Sales and Use Tax. To get this exemption, an organization must apply to the Minnesota Department of Revenue for authorization, known as Nonprofit Exempt Status.

To apply for sales tax exemption, organizations must complete and submit Form ST16 Application for Certificate of Exempt Status to the Minnesota Department of Revenue. For sales and use tax, the Minnesota Department of Revenue Sales and Use Tax Division makes the initial exemption decision.

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

For the purposes of PSLF, eligible not-for-profit organizations include a organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code (IRC), or other not-for-profit organizations that provide a qualifying service.

To apply for sales tax exemption, organizations must complete and submit Form ST16 Application for Certificate of Exempt Status to the Minnesota Department of Revenue. For sales and use tax, the Minnesota Department of Revenue Sales and Use Tax Division makes the initial exemption decision.

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

File Form 1023 with the IRS. Most nonprofit corporations apply for tax-exempt status under Sec. 501(c)(3).