Minnesota Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

If you need to thoroughly, obtain, or print approved document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's simple and user-friendly search feature to locate the documents you require.

Various templates for business and personal use are categorized by type and state, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal document template.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to find the Minnesota Unrestricted Charitable Donation of Cash in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to acquire the Minnesota Unrestricted Charitable Donation of Cash.

- You can also access documents you have previously downloaded in the My documents section of your account.

- For first-time users of US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the appropriate form for the correct city/state.

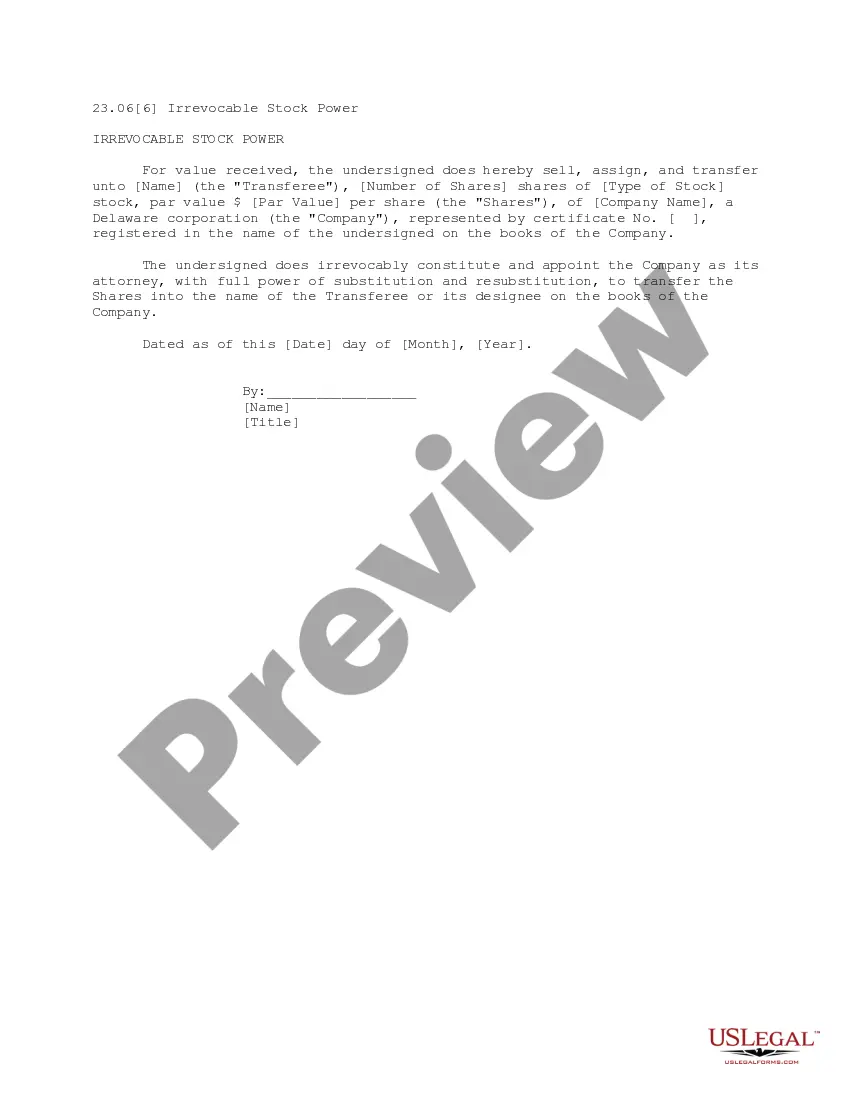

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the description.

Form popularity

FAQ

To classify charitable contributions accurately, you first need to identify the type of donation you are making. A Minnesota Unrestricted Charitable Contribution of Cash falls under cash gifts made to qualifying charitable organizations without specific restrictions on usage. This classification allows organizations greater flexibility in utilizing your contribution for their needs. Always keep detailed records of your contributions for tax purposes and consult with a tax advisor for specific guidance.

Yes, you can deduct charitable contributions in Minnesota, including Minnesota unrestricted charitable contributions of cash made to qualified organizations. Remember to keep detailed records of your donations to substantiate your claims. Utilizing platforms like UsLegalForms can provide you with the necessary documentation to simplify this process.

Yes, Minnesota allows itemized deductions, which can include a range of expenses, such as mortgage interest, medical expenses, and Minnesota unrestricted charitable contributions of cash. Opting to itemize may benefit you if your total deductions exceed the standard deduction. Always evaluate your situation each tax year to maximize your benefits.

To effectively reduce your Minnesota income tax, consider making Minnesota unrestricted charitable contributions of cash. These contributions can lower your taxable income while supporting nonprofits in your community. Additionally, take advantage of available credits and deductions, such as those for educational expenses or property taxes.

You should report your charitable contributions on Schedule A if you are itemizing deductions on your federal tax return. In Minnesota, you can also include those deductions when filing your state tax return. Precise reporting of your Minnesota unrestricted charitable contributions of cash ensures you receive the tax credits available to you.

In Minnesota, while you cannot deduct contributions to a 529 plan from your federal taxes, you can receive a state tax deduction for contributions up to a certain limit. This deduction is separate from the benefits of Minnesota unrestricted charitable contributions of cash. Thus, it's beneficial to explore both options to enhance your tax savings.

When it comes to Minnesota unrestricted charitable contributions of cash, individuals generally can deduct contributions up to 60% of their adjusted gross income. For specific contributions, the limits may be lower, so it's crucial to keep records of your donations. Understanding these limits helps you maximize your tax benefits while supporting your favorite causes.

To claim the Minnesota Unrestricted Charitable Contribution of Cash, you must keep detailed records of your donations. Start by gathering receipts or bank statements that show your contributions. When filing your taxes, you will need to itemize your deductions and provide the necessary documentation. Utilizing resources like US Legal Forms can streamline this process and help ensure that you capture all eligible contributions accurately.