Minnesota Charity Subscription Agreement

Description

How to fill out Charity Subscription Agreement?

Finding the right authorized file format might be a have difficulties. Of course, there are a variety of templates available online, but how can you get the authorized kind you want? Utilize the US Legal Forms site. The assistance delivers 1000s of templates, like the Minnesota Charity Subscription Agreement, that can be used for organization and personal demands. All of the kinds are inspected by experts and fulfill state and federal specifications.

Should you be previously listed, log in in your profile and click on the Download button to obtain the Minnesota Charity Subscription Agreement. Make use of profile to check through the authorized kinds you have purchased earlier. Go to the My Forms tab of your profile and get an additional duplicate from the file you want.

Should you be a brand new end user of US Legal Forms, allow me to share basic recommendations so that you can comply with:

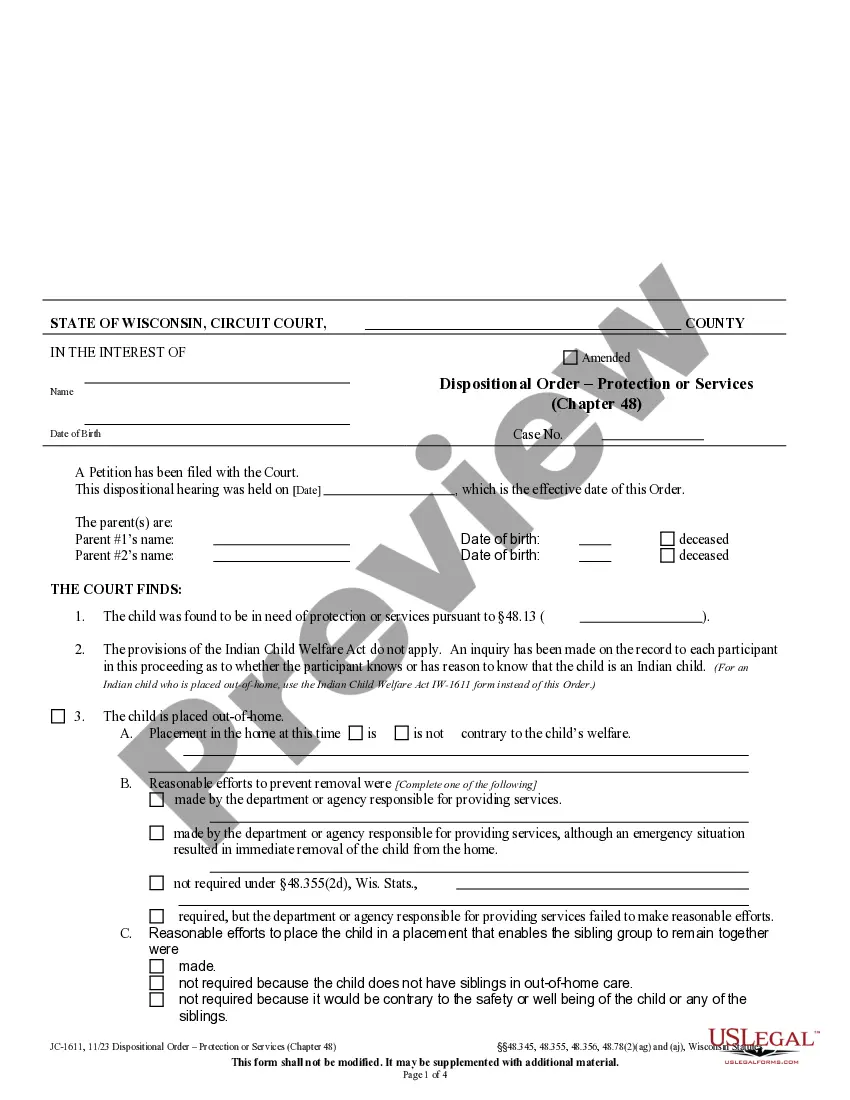

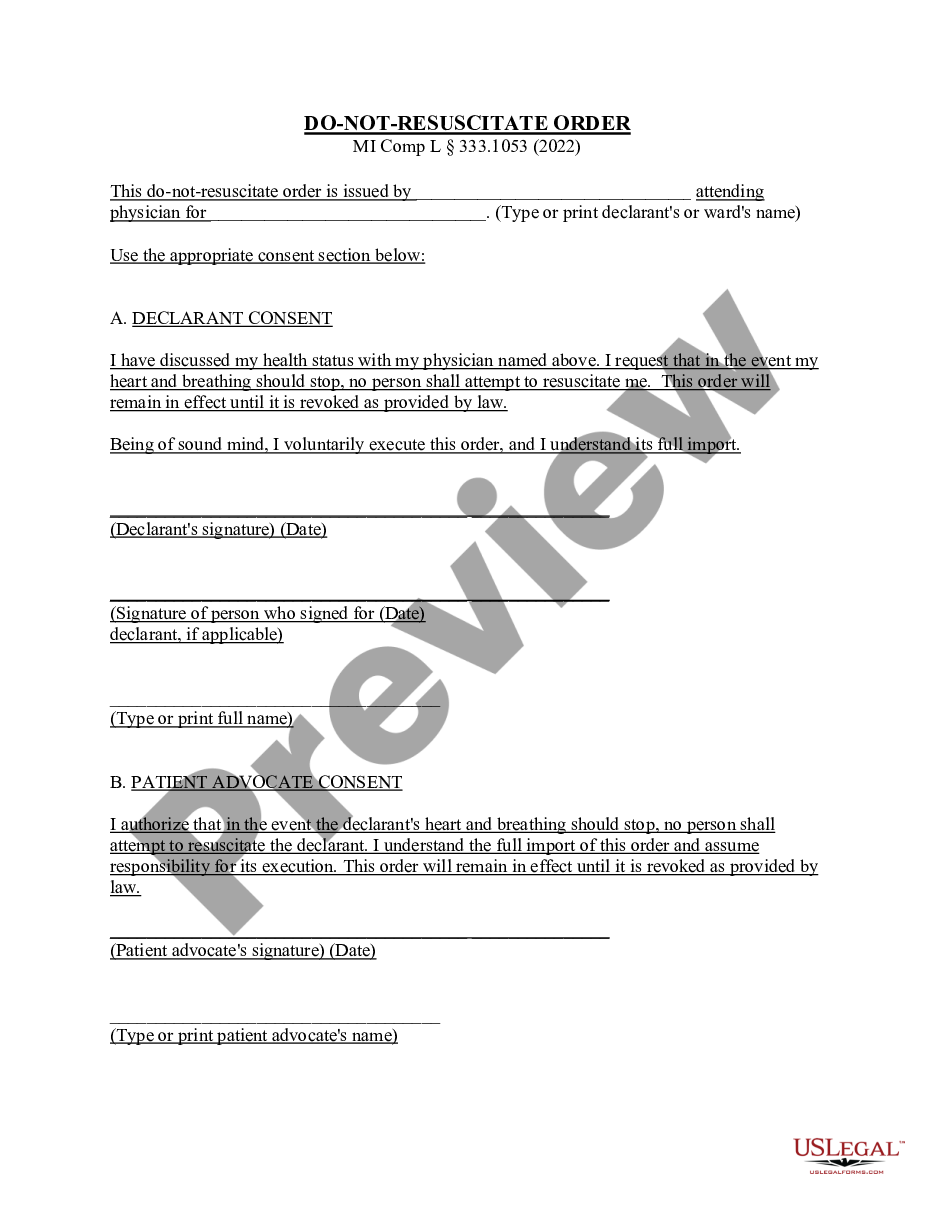

- First, make certain you have chosen the right kind to your metropolis/area. You may examine the shape while using Preview button and read the shape explanation to make certain it will be the right one for you.

- In the event the kind fails to fulfill your requirements, make use of the Seach field to discover the right kind.

- When you are sure that the shape is proper, select the Buy now button to obtain the kind.

- Choose the costs plan you want and enter in the essential info. Build your profile and purchase your order utilizing your PayPal profile or charge card.

- Pick the document structure and obtain the authorized file format in your system.

- Full, change and print and indication the received Minnesota Charity Subscription Agreement.

US Legal Forms may be the greatest catalogue of authorized kinds in which you can discover different file templates. Utilize the company to obtain skillfully-made files that comply with status specifications.

Form popularity

FAQ

Any nonprofit group or organization, unless exempt, located in Minnesota must register with the Minnesota Attorney General. Any non-exempt nonprofit, in any state, intending to solicit in Minnesota must also register, along with anyone intending to solicit in Minnesota on behalf of a nonprofit.

Minnesota law exempts certain nonprofit organizations from paying Sales and Use Tax. To get this exemption, an organization must apply to the Minnesota Department of Revenue for authorization, known as Nonprofit Exempt Status.

The Charitable Solicitation Act, Minnesota Statutes sections 309.50-. 61, governs the activities of charitable organizations that solicit cash and non-cash donations in Minnesota.

General requirements. No person shall act as a professional fundraiser unless registered with the attorney general. The registration statement must be in writing, under oath, in the form prescribed by the attorney general and must be accompanied by a registration fee of $200.

How To Start A Nonprofit In Minnesota Choose your MN nonprofit filing option. File the MN nonprofit articles of incorporation. Get a Federal EIN from the IRS. Adopt your MN nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for any required state licenses. Open a bank account for your MN nonprofit.

A limited liability company is a nonprofit limited liability company if it is organized under or governed by this chapter and its articles of organization state that it is a nonprofit limited liability company governed by this section.

Prepare and File Articles of Incorporation Agency:Minnesota Secretary of StateForm:Articles of Incorporation ? Original FilingFiling Method:Mail, in-person, or onlineAgency Fee:$70 by mail. $90 online or expedited in-person.Turnaround:~5-7 business days by mail. ~24hrs online.2 more rows

The Form 990 is the most detailed and most misunderstood filing for nonprofits. It is the most complete documentation of an organization's financial history and is often used to hold the organization accountable for its past actions and future decisions.