Minnesota Warranty Agreement as to Web Site Software

Description

How to fill out Warranty Agreement As To Web Site Software?

US Legal Forms - one of the foremost collections of legal documents in the United States - provides a selection of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can discover the most recent forms such as the Minnesota Warranty Agreement related to Web Site Software in a matter of minutes.

If you already possess a membership, Log In and retrieve the Minnesota Warranty Agreement related to Web Site Software from the US Legal Forms collection. The Download option will appear on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Utilize your credit card or PayPal account to finalize the purchase.

Choose the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded Minnesota Warranty Agreement related to Web Site Software. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Minnesota Warranty Agreement related to Web Site Software with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you would like to use US Legal Forms for the first time, here are simple instructions to assist you in getting started.

- Make sure you have selected the correct form for your city/region.

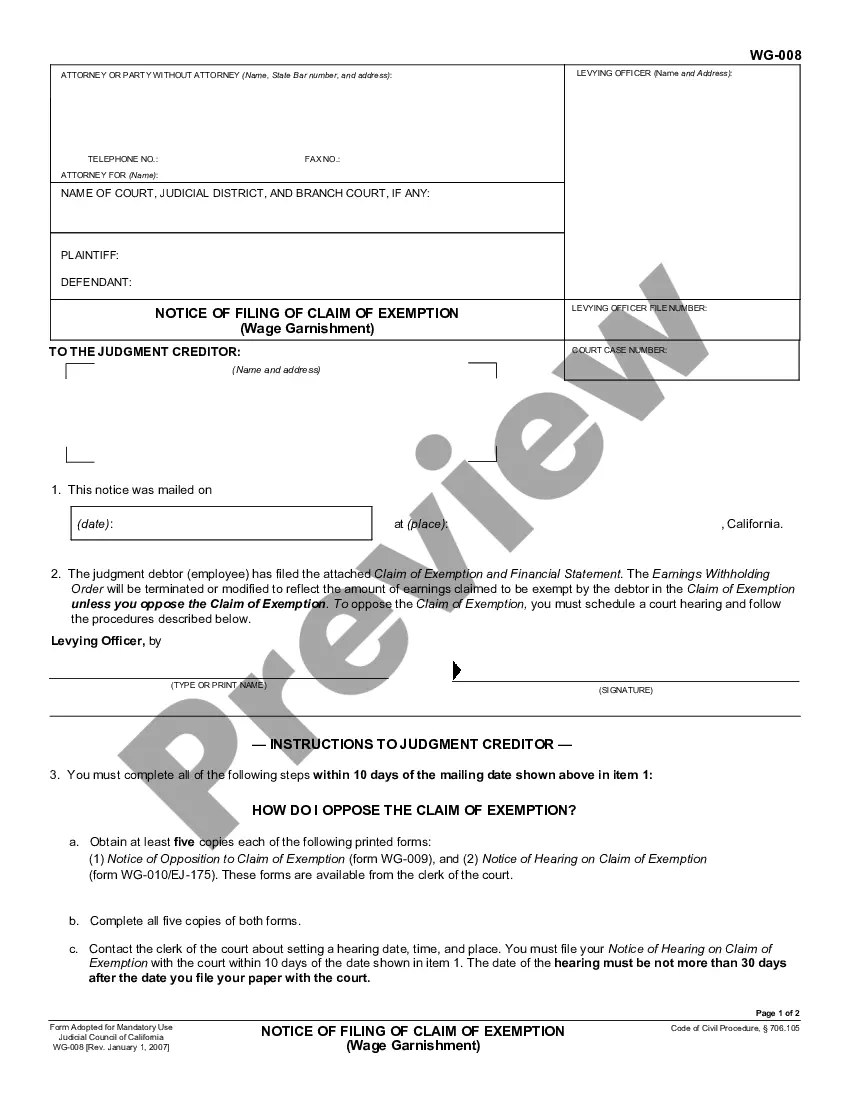

- Click the Preview option to review the form's details.

- Check the form description to verify that you have selected the appropriate form.

- If the form does not fulfill your criteria, use the Search feature at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now option.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Charges for maintenance or upgrades to online hosting software are not taxable, even if separately stated. Digital products are products provided to a customer electronically.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.) (Source: California BOE Publication 109 Non Taxable Sales).

You are responsible for collecting and remitting sales tax on taxable sales made through your website and other sources. When the marketplace is not required to collect Minnesota sales tax on your behalf, you must also collect and remit Minnesota sales tax on those taxable sales.

A multiple-use license for prewritten computer software is taxable. A custom computer software program is not taxable. A custom program is one that is prepared to the special or- der of the customer. It generally requires consultation and an analysis of the customer's requirements.

If the web design is delivered electronically, meaning there is no tangible property transfer, no sales tax will be charged. However, if the finished site is transferred to a zip drive, disk or a paper copy of the site design is provided, there is a tangible property transfer, and sales tax must be charged.

Digital goods, which are nontangible versions of tangible goods, such as e-books, streaming music, and online video games, are not taxable unless specifically included. Intangible personal property, such as stocks and bonds, are not subject to the sales tax.

Charges for maintenance or upgrades to online hosting software are not taxable, even if separately stated. Digital products are products provided to a customer electronically.

Common examples include:Clothing for general use, see Clothing.Food (grocery items), see Food and Food Ingredients.Prescription and over-the-counter drugs for humans, see Drugs.

Materials used or consumed in the industrial production of a retail product, including digital products, are exempt from Minnesota Sales Tax. To buy these materials exempt from tax, the purchaser must provide a completed Form ST3, Certificate of Ex- emption.