Minnesota Memorandum Distributing Tangible Personal Property

Description

How to fill out Memorandum Distributing Tangible Personal Property?

If you need to accumulate, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, that are available online.

Take advantage of the site's easy and convenient search to locate the documents you seek.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you desire, click the Buy now button. Select the pricing option you prefer and input your information to register for the account.

- Utilize US Legal Forms to discover the Minnesota Memorandum Distributing Tangible Personal Property with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Minnesota Memorandum Distributing Tangible Personal Property.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you're using US Legal Forms for the first time, refer to the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

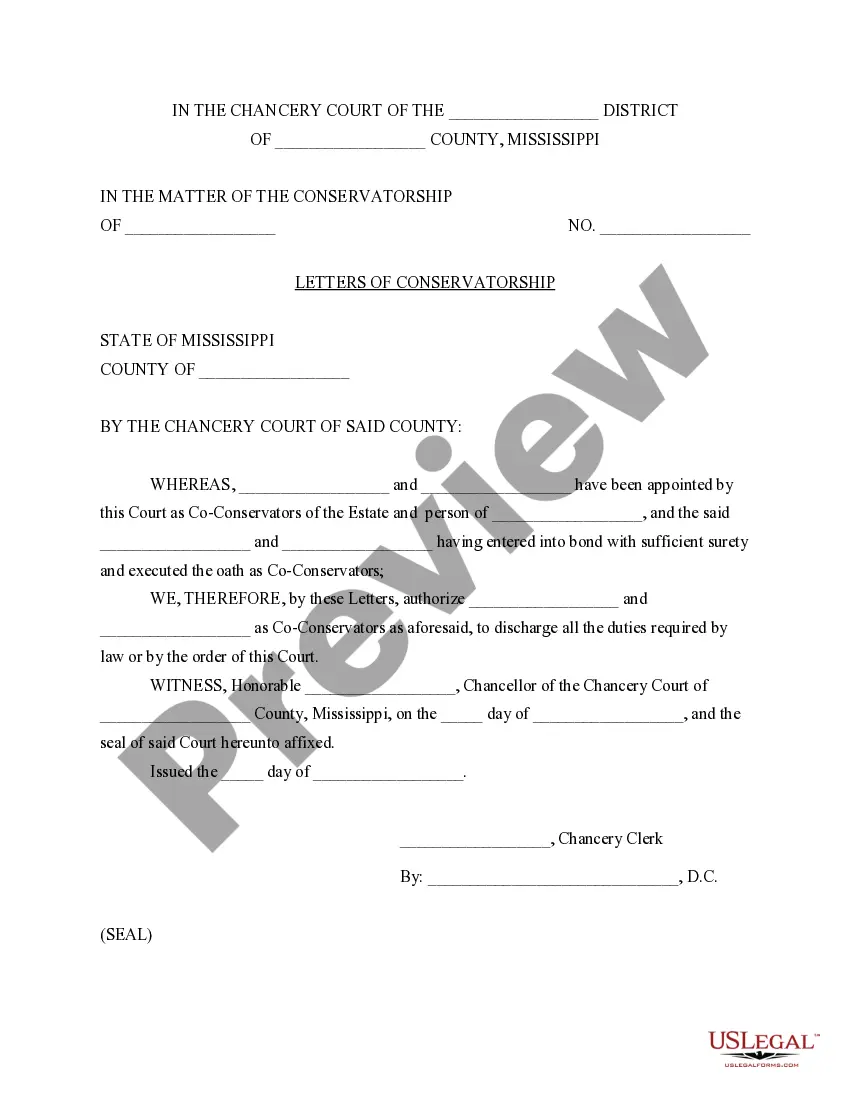

- Step 2. Use the Preview option to review the form's details. Remember to read the description.

Form popularity

FAQ

Selling the Home: The easiest solution when inheriting a house with siblings is generally to sell the house and divide the proceeds from the sale among the siblings according to the percentage shares each sibling had been designated by the will or trust.

How is inheritance split between siblings? When siblings are legally determined to be the surviving kin highest in the order of succession, they will inherit the assets in their deceased sibling's Estate. And they inherit it equally. If there is one surviving sibling, the entire Estate will go to them.

Here are a few methods:Draw lots and take turns picking items.Use colored stickers for each person to indicate what he wants.Get appraisals.Make copies.Use an online service like FairSplit.com to catalog and divide personal property in an estate.More items...?

That said, an equal inheritance makes the most sense when any gifts or financial support you've given your children throughout your life have been minimal or substantially equal, and when there isn't a situation in which one child has provided most of the custodial care for an older parent.

Probate law doesn't stipulate how personal items should be divided among beneficiaries unless they've been specifically named in the Will. Such things are called specific legacies. A mother, for example, might wish her eldest daughter to receive her wedding and engagement rings.

Be Honest. If you choose to leave unequal inheritance for your children, one of the best ways to avoid hurt feelings and resentment among your children is to have an open and honest conversation with them about why you made your decision.

Tangible personal property is generally defined as personal property that can be touched. Household furnishings, books, tools, jewelry, motor vehicles and boats are some of the items which fall into the category of tangible personal property.

Tangible personal property exists physically (i.e., you can touch it) and can be used or consumed. Clothing, vehicles, jewelry, and business equipment are examples of tangible personal property.

Giving adult beneficiaries their inheritances in one lump sum is often the simplest way to go because there are no issues of control or access. It's just a matter of timing. The balance of the estate is distributed directly to the beneficiaries after all the decedent's final bills and taxes are paid.

The term tangible personal property is generally understood to mean items that can be felt or touched. Typical items include clothing, jewelry, art, musical instruments, writings, furnishings and other household goods. Often, these items are of relatively little monetary value, but of great sentimental worth.