Minnesota Jury Instruction - Failure To File Tax Return

Description

How to fill out Jury Instruction - Failure To File Tax Return?

Have you been within a placement the place you need to have documents for both business or person functions just about every working day? There are a variety of authorized file themes available on the Internet, but locating ones you can trust isn`t easy. US Legal Forms delivers a large number of type themes, such as the Minnesota Jury Instruction - Failure To File Tax Return, which can be written in order to meet federal and state demands.

When you are currently informed about US Legal Forms internet site and have your account, basically log in. Following that, you may acquire the Minnesota Jury Instruction - Failure To File Tax Return format.

If you do not offer an account and wish to start using US Legal Forms, adopt these measures:

- Obtain the type you will need and make sure it is for that proper city/county.

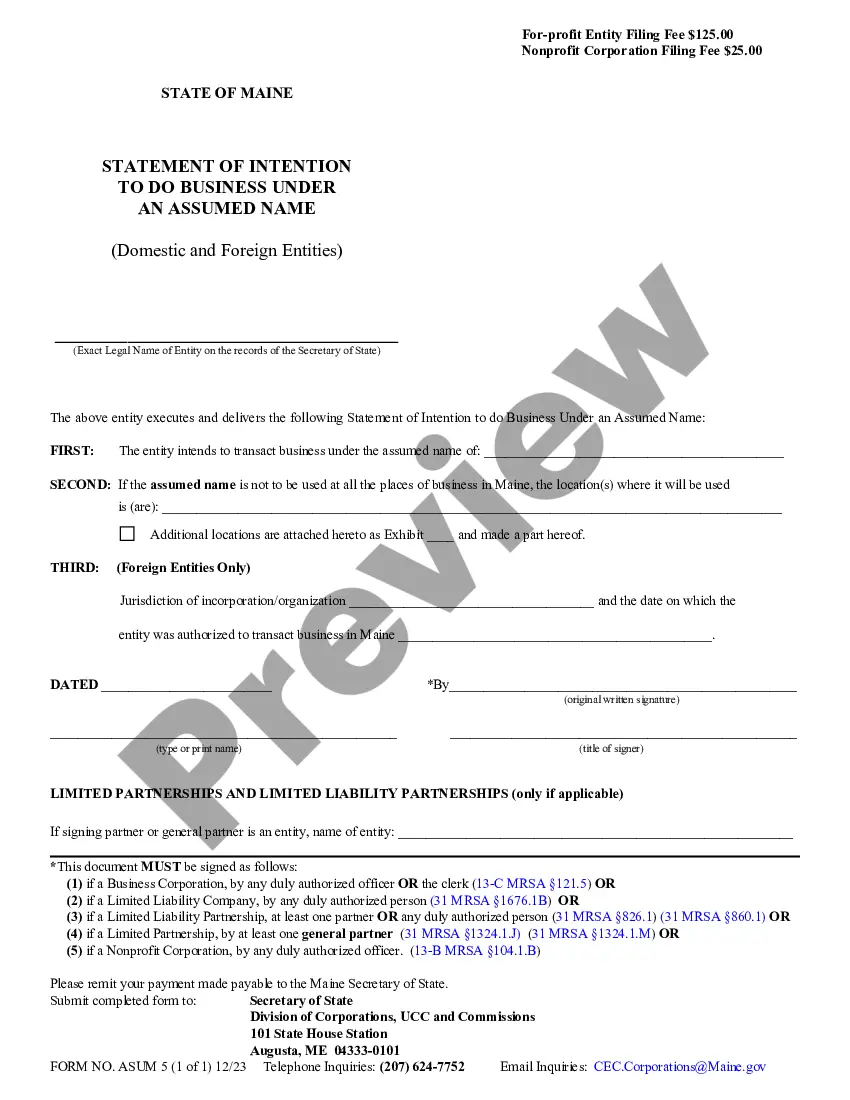

- Make use of the Preview switch to review the form.

- Read the explanation to ensure that you have selected the appropriate type.

- If the type isn`t what you`re looking for, take advantage of the Look for field to obtain the type that suits you and demands.

- Whenever you get the proper type, click on Get now.

- Opt for the rates prepare you desire, fill out the required information to create your account, and pay for an order making use of your PayPal or charge card.

- Pick a hassle-free document structure and acquire your version.

Get every one of the file themes you possess purchased in the My Forms menu. You can get a more version of Minnesota Jury Instruction - Failure To File Tax Return anytime, if necessary. Just click the necessary type to acquire or print out the file format.

Use US Legal Forms, by far the most considerable collection of authorized kinds, to save lots of some time and prevent mistakes. The service delivers professionally manufactured authorized file themes that can be used for a variety of functions. Make your account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

For starters, if you had taxes withheld from your paycheck or paid estimated taxes, you may want to file to obtain a refund. Also, if you're eligible for certain refundable tax credits, you could qualify for thousands of dollars, even if you had very little to no income.

If you are a full-year Minnesota resident, you must file a Minnesota income tax return if your income meets the state's minimum filing requirement. (See the table on this page.) If you are a part-year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement.

TurboTax Tip: If you have had federal taxes withheld from your paycheck, you might want to file a return even when you are not required to, so you can receive your tax refund.

Benefits of Filing a Tax Return For example, if your employer withheld taxes from your paycheck, you may be owed a refund when you file your taxes. Avoid interest and penalties. You may avoid interest and penalties by filing an accurate tax return on time and paying any tax you owe in the right way before the deadline.

There are more reasons you may want to file, even if you don't have to. If you had federal taxes withheld by your employer, you may be eligible for a refund of those taxes. This includes students and part-time workers who may not file because they have too little income to require them to do so.

You must file a Minnesota return if your Minnesota gross income meets the minimum filing requirement ($12,900 in 2022). To determine your Minnesota gross income, go to Calculating Minnesota Gross Income.

If you earn less than $10,000 per year, you don't have to file a tax return. However, you won't receive an Earned-Income Tax Credit refund unless you do file.

Individuals who fall below the minimum may still have to file a tax return under certain circumstances; for instance, if you had $400 in self-employment earnings, you'll have to file and pay self-employment tax. If you have no income, however, you aren't obligated to file.