Minnesota Joint Venture Agreement - Purchase and Operation of Apartment Building

Description

How to fill out Joint Venture Agreement - Purchase And Operation Of Apartment Building?

Have you found yourself in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating trustworthy ones is not simple.

US Legal Forms offers thousands of form templates, including the Minnesota Joint Venture Agreement - Purchase and Operation of Apartment Building, designed to comply with federal and state regulations.

If you locate the appropriate form, click Buy now.

Choose the pricing plan you prefer, enter the necessary information to create your account, and pay for the order using PayPal or a credit card. Select a preferred document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Minnesota Joint Venture Agreement - Purchase and Operation of Apartment Building template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

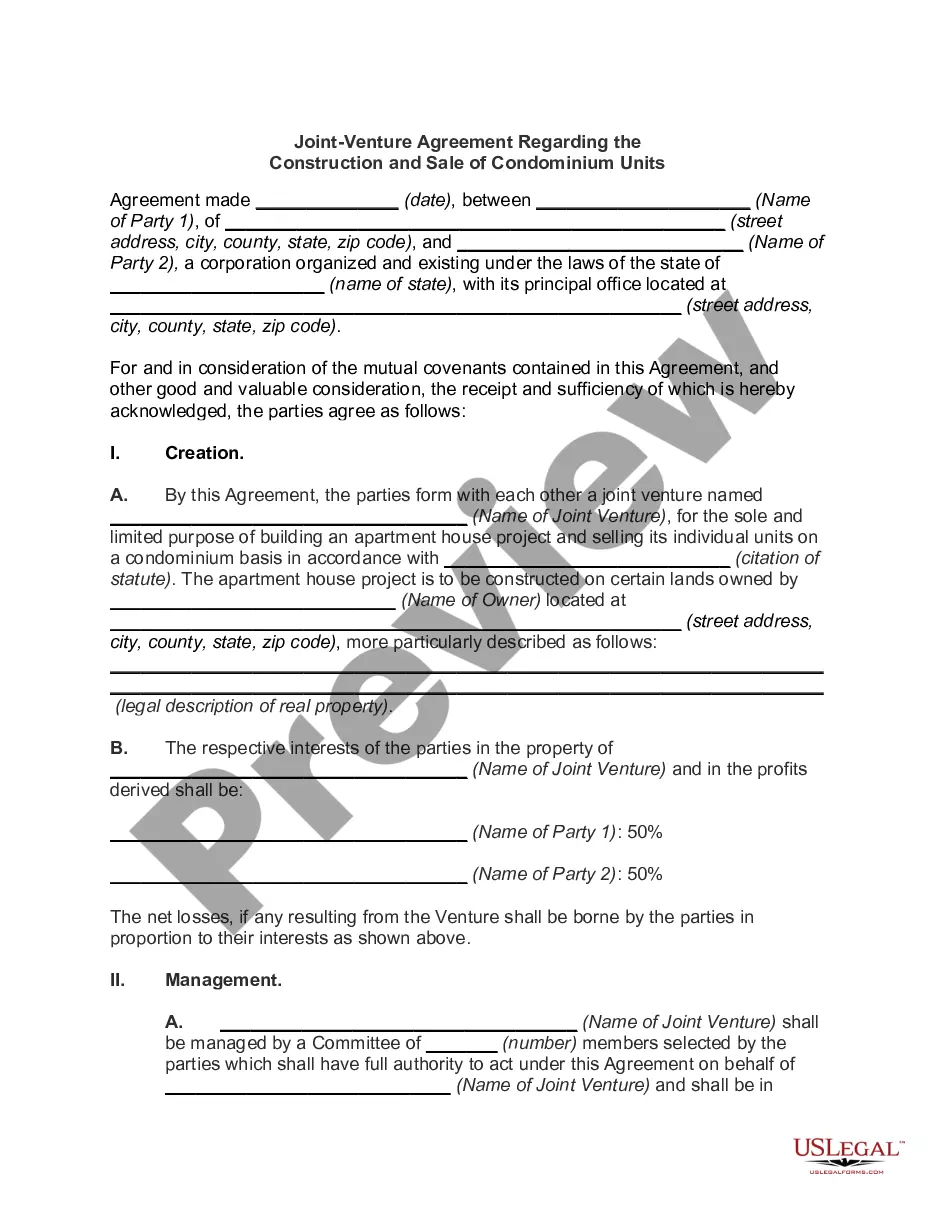

- Utilize the Preview button to review the form.

- Check the summary to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

A joint venture in building construction typically involves two or more parties collaborating on a specific project, sharing resources, profits, and risks. When forming a Minnesota Joint Venture Agreement for the purchase and operation of an apartment building, this structure allows partners to leverage specialized skills and financial capabilities. Such arrangements can optimize project execution and improve overall outcomes in property development.

It is challenging to determine the exact number of joint ventures globally, as new arrangements continuously emerge across different industries. In the real estate sector, specifically regarding Minnesota Joint Venture Agreements for the purchase and operation of apartment buildings, the number is growing due to the increasing interest in collaborative investment. This trend reflects a broader shift toward strategic partnerships in various markets.

The four primary objectives of joint ventures include sharing risks and costs, accessing new markets, combining expertise and resources, and achieving greater financial return. With a Minnesota Joint Venture Agreement for the purchase and operation of an apartment building, these objectives become crucial in establishing a foundation for successful collaboration. Partners can work together strategically to fulfill mutual aims and drive positive results.

The most popular joint venture often involves equity joint ventures, where parties contribute capital and resources to share risks and rewards equally. In the context of a Minnesota Joint Venture Agreement for the purchase and operation of an apartment building, this model can enhance property management and operational efficiency. Such arrangements enable partners to leverage each other’s strengths and reach shared goals effectively.

The four types of joint venture entry strategies include equity joint ventures, contractual joint ventures, cooperative joint ventures, and strategic alliances. When considering a Minnesota Joint Venture Agreement for the purchase and operation of an apartment building, these strategies provide flexible options for partners. Each strategy has its own benefits, like shared risk and pooled resources, ultimately facilitating successful project outcomes.

Structuring a real estate JVThe 'investor' will typically be structured as a limited partnership managed by a general partner or other tax efficient vehicle. The investor vehicle will contract with the asset managerowned by the operator investment vehicleto form the JV entity.

Sections of a Joint Venture ContractThe formation of the venture.The business name of the venture.The purpose of the joint venture.All parties contributions.The profit distribution.The management set up.Parties responsibilities.No-exclusivity clause.More items...

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance.

The Joint Operating Agreements (JOA) is a contractual agreement between two or more parties with shared interests in a tract or leasehold that outlines coordinated exploration, development and production activities in a designated contract area.

What is included in a Joint Venture Agreement?Business location.The type of joint venture.Venture details, such as its name, address, purpose, etc.Start and end date of the joint venture.Venture members and their capital contributions.Member duties and obligations.Meeting and voting details.More items...