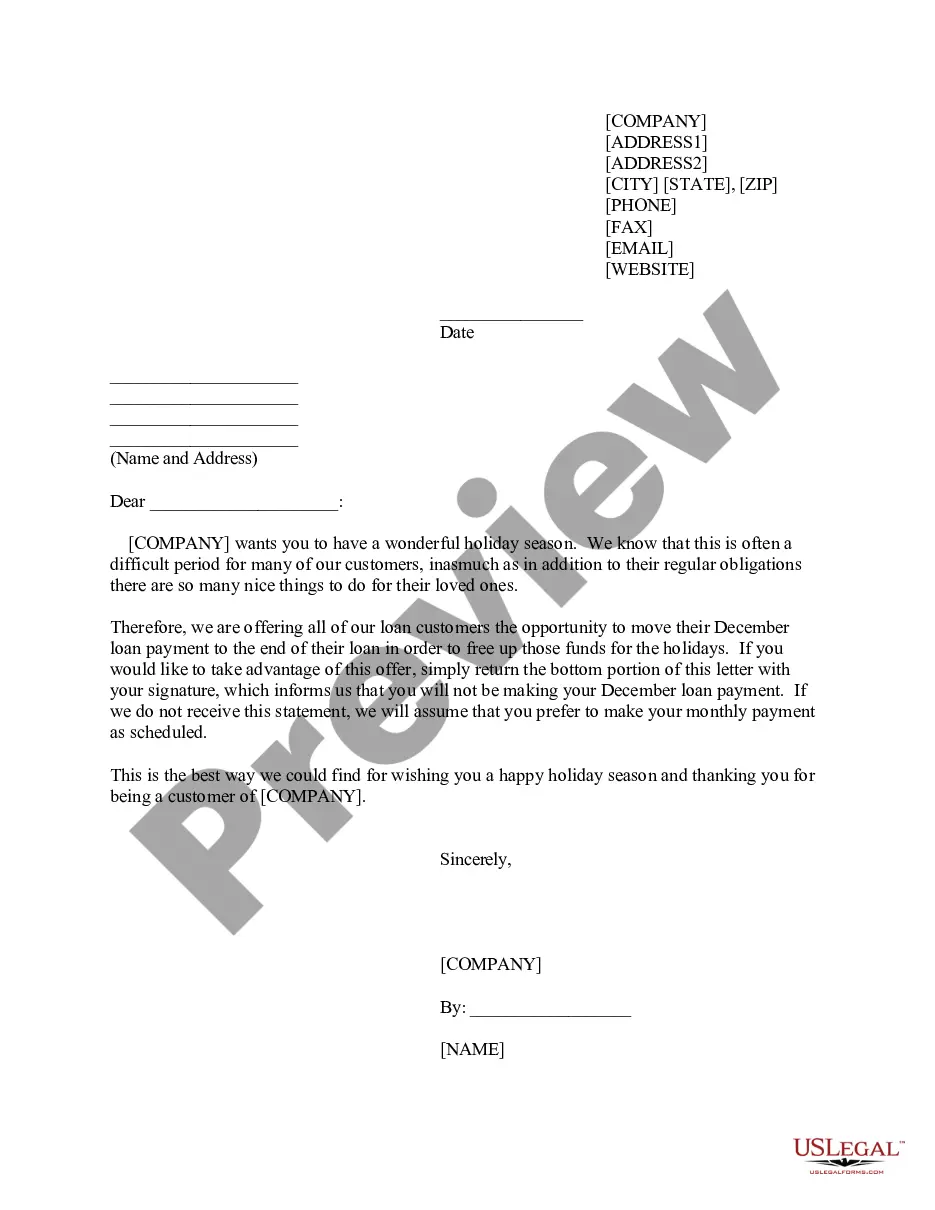

Minnesota Affiliate Letter in Rule 145 Transaction

Description

How to fill out Affiliate Letter In Rule 145 Transaction?

Selecting the appropriate legal document template can be quite a challenge. Of course, there are numerous templates accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Minnesota Affiliate Letter in Rule 145 Transaction, which is suitable for both business and personal use.

All forms are reviewed by experts and comply with state and federal regulations.

If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained Minnesota Affiliate Letter in Rule 145 Transaction. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize the service to access professionally crafted paperwork that adheres to state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the Minnesota Affiliate Letter in Rule 145 Transaction.

- Use your account to search through the legal forms you have purchased previously.

- Navigate to the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your city/state.

- You can review the form using the Preview button and read the form description to confirm it is the correct one for you.

Form popularity

FAQ

Rule 144(a)(3) identifies what sales produce restricted securities. Control securities are those held by an affiliate of the issuing company. An affiliate is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 145 is an SEC rule that allows companies to sell certain securities without first having to register the securities with the SEC. This specifically refers to stocks that an investor has received because of a merger, acquisition, or reclassification.

Rule 147, as amended, has the following requirements: the company must be organized in the state where it offers and sells securities. the company must have its principal place of business in-state and satisfy at least one doing business requirement that demonstrates the in-state nature of the company's business.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

The Commission raised the Form 144 filing thresholds so that affiliates must file Form 144 if their proposed sales in reliance on Rule 144 within a three-month period exceed 5,000 shares or $50,000. Non-affiliates no longer need to file Form 144.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.