Minnesota LLC Operating Agreement for Husband and Wife

Description

How to fill out LLC Operating Agreement For Husband And Wife?

Locating the appropriate legal document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you find the legal document you require.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Minnesota LLC Operating Agreement for Spouses, which you can use for business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All forms are reviewed by experts and meet state and federal standards.

- If you are already registered, Log In to your account and click the Download button to retrieve the Minnesota LLC Operating Agreement for Spouses.

- Use your account to view the legal forms you have acquired previously.

- Navigate to the My documents section of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are basic steps you can follow.

- First, ensure you have selected the correct document for your city/region. You can preview the form using the Preview button and read the form description to verify it is suitable for your needs.

Form popularity

FAQ

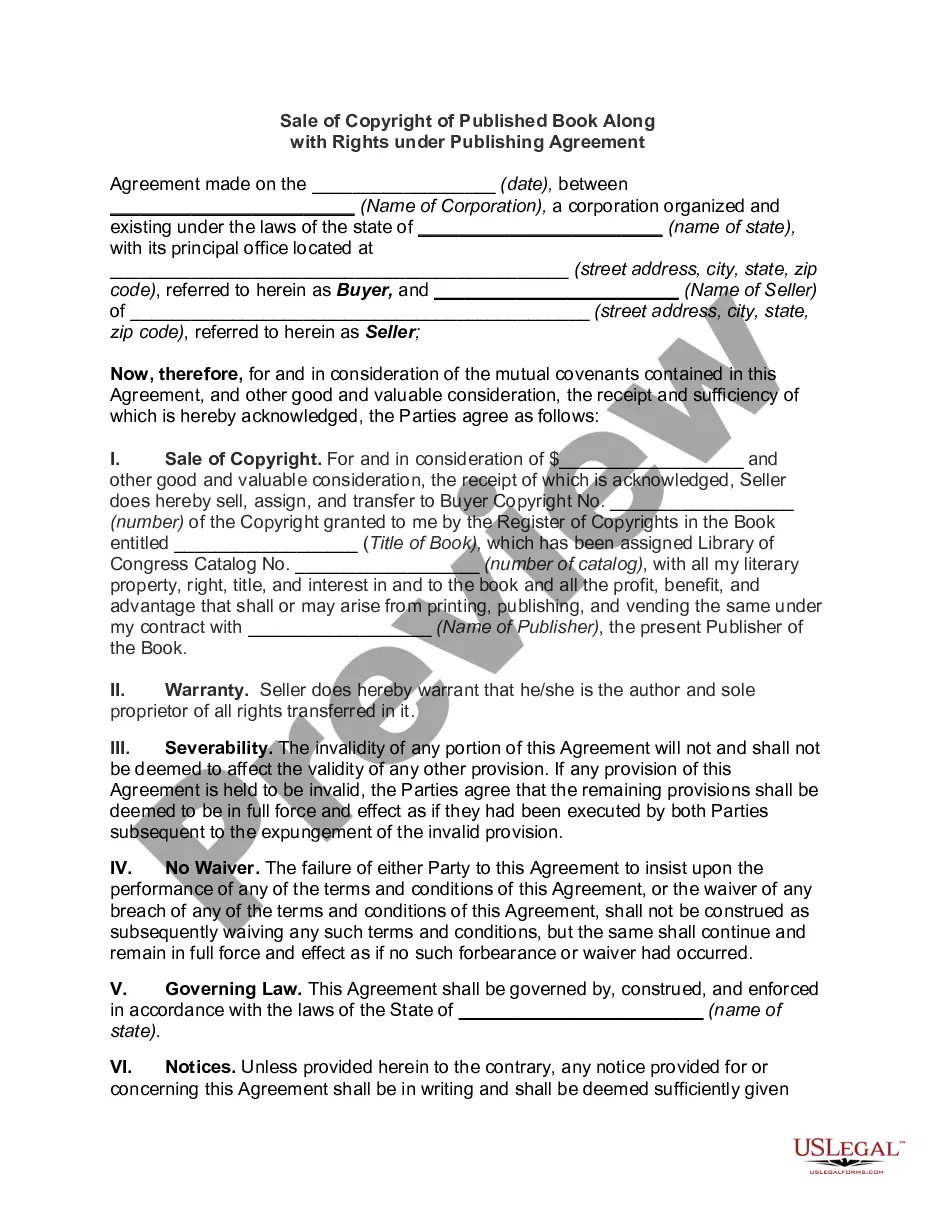

If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship or a corporation. If your LLC has more than one member, you can classify it as a partnership or corporation.

Note: If an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be "qualified joint ventures" (which can elect not be treated as partnerships) because they are state law entities.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

MCA means a Member Control Agreement adopted pursuant to Section 322B. 37 of Chapter 322B. operating agreement or bylaws means the bylaws adopted under Chapter 322B, pursuant to Section 322B. 603, which might be confusingly titled Operating Agreement.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

What should an LLC operating agreement include?The legal name of the company.Any fictitious business names or DBAs.The company address.Name and address of your registered agent (who accepts legal service of process on your behalf.) Every LLC must have a registered agent under state law.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.