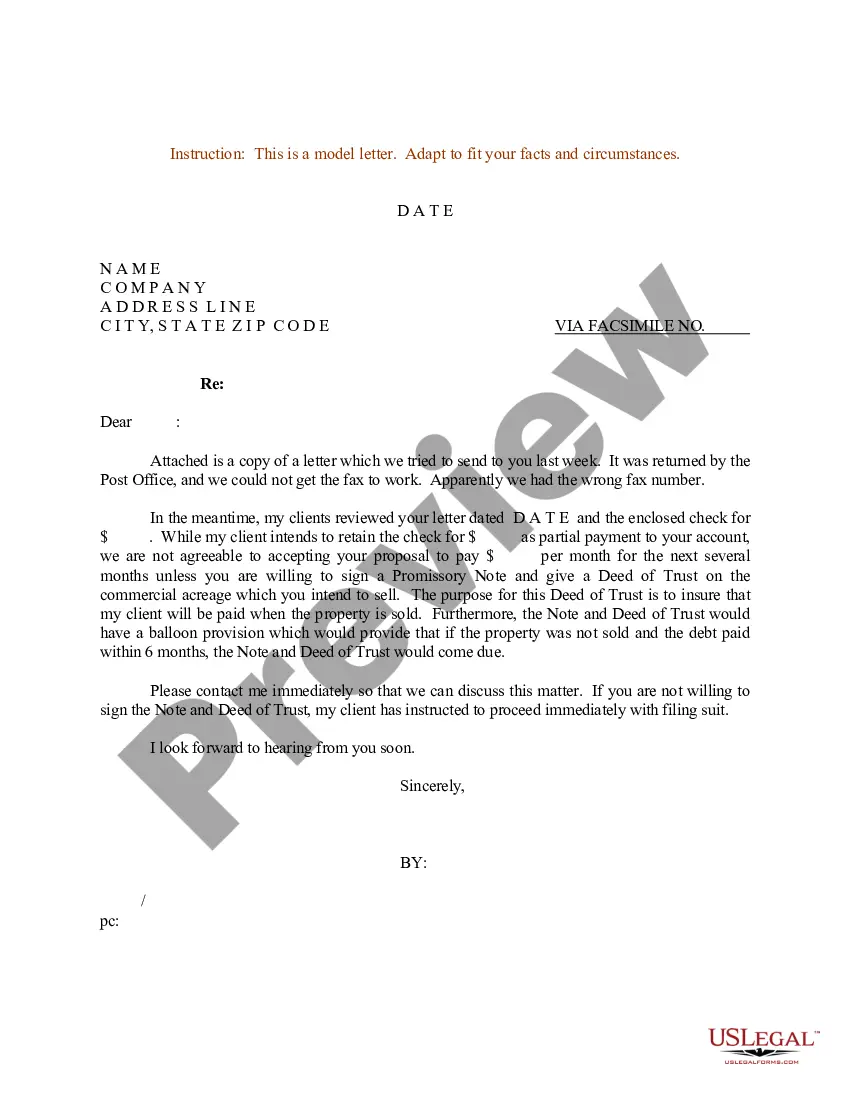

Minnesota Sample Letter for Deed of Trust

Description

How to fill out Sample Letter For Deed Of Trust?

Choosing the right legal file format can be quite a have difficulties. Naturally, there are plenty of layouts available on the net, but how will you find the legal kind you will need? Utilize the US Legal Forms site. The service gives a huge number of layouts, like the Minnesota Sample Letter for Deed of Trust, that can be used for business and personal demands. All of the types are checked by pros and meet up with state and federal specifications.

Should you be previously authorized, log in for your bank account and click on the Down load switch to have the Minnesota Sample Letter for Deed of Trust. Utilize your bank account to search through the legal types you might have purchased earlier. Check out the My Forms tab of the bank account and acquire one more copy in the file you will need.

Should you be a brand new user of US Legal Forms, listed here are easy directions that you can comply with:

- Initially, make sure you have chosen the appropriate kind for your personal town/region. You are able to look over the shape utilizing the Preview switch and look at the shape outline to make sure it is the right one for you.

- If the kind does not meet up with your needs, make use of the Seach field to discover the appropriate kind.

- When you are sure that the shape is proper, select the Get now switch to have the kind.

- Select the pricing prepare you want and type in the necessary info. Build your bank account and purchase the transaction with your PayPal bank account or charge card.

- Select the document formatting and down load the legal file format for your gadget.

- Full, edit and print and sign the acquired Minnesota Sample Letter for Deed of Trust.

US Legal Forms will be the greatest catalogue of legal types where you can find various file layouts. Utilize the service to down load professionally-made files that comply with express specifications.

Form popularity

FAQ

What Is Included in a Trust Deed? The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust. The terms of the loan, including principal, monthly payments, and interest rate.

Trust Deed must be properly drafted and intend the real interests of the parties forming the trust. If there are more than two purposes of creating the trust, then both the purposes must be valid. If one object is valid and another object is invalid, then the trust cannot be formed.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

The trust deed and rules set out the trustees' powers and the procedures trustees must follow. As a trustee, you must act in line with the terms of the trust deed and rules. The trust deed is a legal document that sets up and governs the scheme.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A Trust Deed is a voluntary but legally binding agreement between you and your creditors where you agree to pay back an affordable portion of what you owe, whilst protecting your home and car. This debt repayment model allows you to make payments towards your debt in a fixed timeframe, typically over 4 years.

A Minnesota deed of trust is used to secure real estate financing by placing the borrower's property in trust until the lender has been paid back.