Minnesota Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

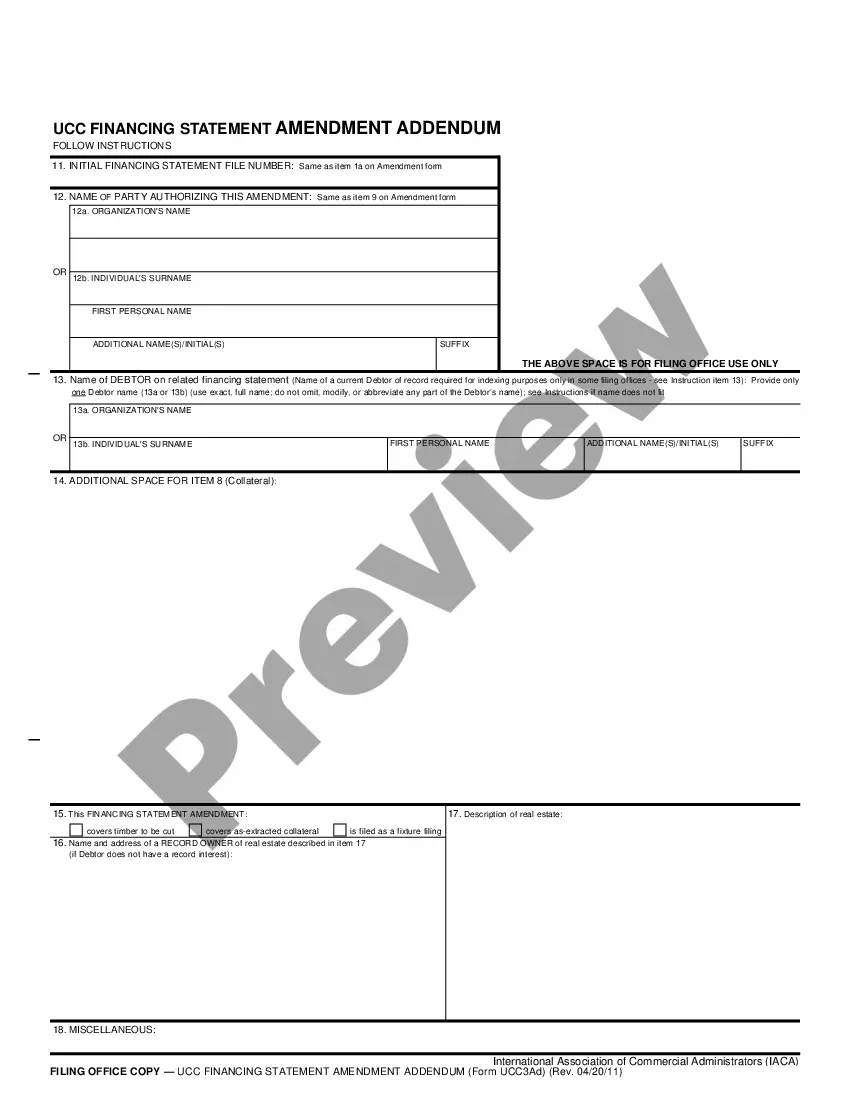

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

US Legal Forms - one of many biggest libraries of lawful types in the USA - gives a wide range of lawful document themes it is possible to obtain or printing. Utilizing the site, you will get thousands of types for business and person purposes, categorized by categories, suggests, or key phrases.You will discover the newest models of types such as the Minnesota Sample Letter regarding Information for Foreclosures and Bankruptcies within minutes.

If you already possess a monthly subscription, log in and obtain Minnesota Sample Letter regarding Information for Foreclosures and Bankruptcies from your US Legal Forms catalogue. The Download switch will show up on every single develop you perspective. You get access to all earlier acquired types inside the My Forms tab of the account.

If you would like use US Legal Forms initially, listed here are easy instructions to help you get started off:

- Make sure you have selected the proper develop for your metropolis/county. Click the Preview switch to check the form`s articles. See the develop explanation to ensure that you have selected the right develop.

- In case the develop doesn`t fit your demands, make use of the Look for discipline at the top of the display to find the one that does.

- In case you are happy with the shape, verify your option by simply clicking the Acquire now switch. Then, select the prices strategy you like and offer your accreditations to sign up for the account.

- Method the purchase. Make use of credit card or PayPal account to accomplish the purchase.

- Pick the structure and obtain the shape on the device.

- Make adjustments. Fill up, modify and printing and indicator the acquired Minnesota Sample Letter regarding Information for Foreclosures and Bankruptcies.

Each and every web template you put into your bank account lacks an expiry time and is also your own property eternally. So, if you wish to obtain or printing another copy, just go to the My Forms portion and click on about the develop you need.

Gain access to the Minnesota Sample Letter regarding Information for Foreclosures and Bankruptcies with US Legal Forms, one of the most substantial catalogue of lawful document themes. Use thousands of expert and express-certain themes that fulfill your company or person requires and demands.

Form popularity

FAQ

The sale is followed by a redemption period, which is usually six months. ingly, assuming there is no bankruptcy filing, a typical foreclosure by advertisement (including the typical six month redemption period) generally takes around eight to nine months.

Sale process Sheriff's deputies conduct foreclosure sales in an open bidding process. The mortgage company's or plaintiff's representative will bid first. Then others can bid. At the time of the sale, the successful outside bidder must pay the entire amount of their bid.

Alternately, the borrower may attempt to sell the home in order to take advantage of any equity built up in the home. If the borrower is unable to refinance or sell the home after the six-month redemption period, he or she must vacate the property.

Pursuant to Minnesota Statutes, most properties sold in a Mortgage Foreclosure action can be redeemed by the mortgagor. The published Notice of Mortgage Foreclosure sale usually contains a paragraph indicating the length of the redemption period. In most cases, this is 6 months.

For most properties it is a six month period. If you use the property for agricultural purposes you may be able to request that your redemption period be increased to one year. If you have paid off more than two-thirds of the loan amount, the redemption period must be increased to one year.

What Is the Foreclosure Process in Minnesota? If you default on your mortgage payments in Minnesota, the lender may foreclose using a judicial or nonjudicial method.

Notice of Default ? Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.

Ways to Stop Foreclosure in Minnesota Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Sell Out Your Home. ... Short Sale. ... Deed In Lieu of Foreclosure.