Minnesota Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services

Description

How to fill out Provision Of Agreement To Devise Or Bequeath Property To Person Performing Personal Services?

Are you presently in a situation where you require documents for various professional or personal reasons most of the time.

There is a range of legitimate document templates available online, but obtaining versions you can trust can be challenging.

US Legal Forms offers a wide array of template formats, such as the Minnesota Provision of Agreement to Devise or Bequeath Property to Person Providing Personal Services, which can be tailored to comply with federal and state regulations.

Once you acquire the suitable form, click Buy now.

Choose the payment plan you want, enter the required details to create your account, and complete your purchase via PayPal or credit card.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Minnesota Provision of Agreement to Devise or Bequeath Property to Person Providing Personal Services template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Find the form you need and ensure it is for the correct city/state.

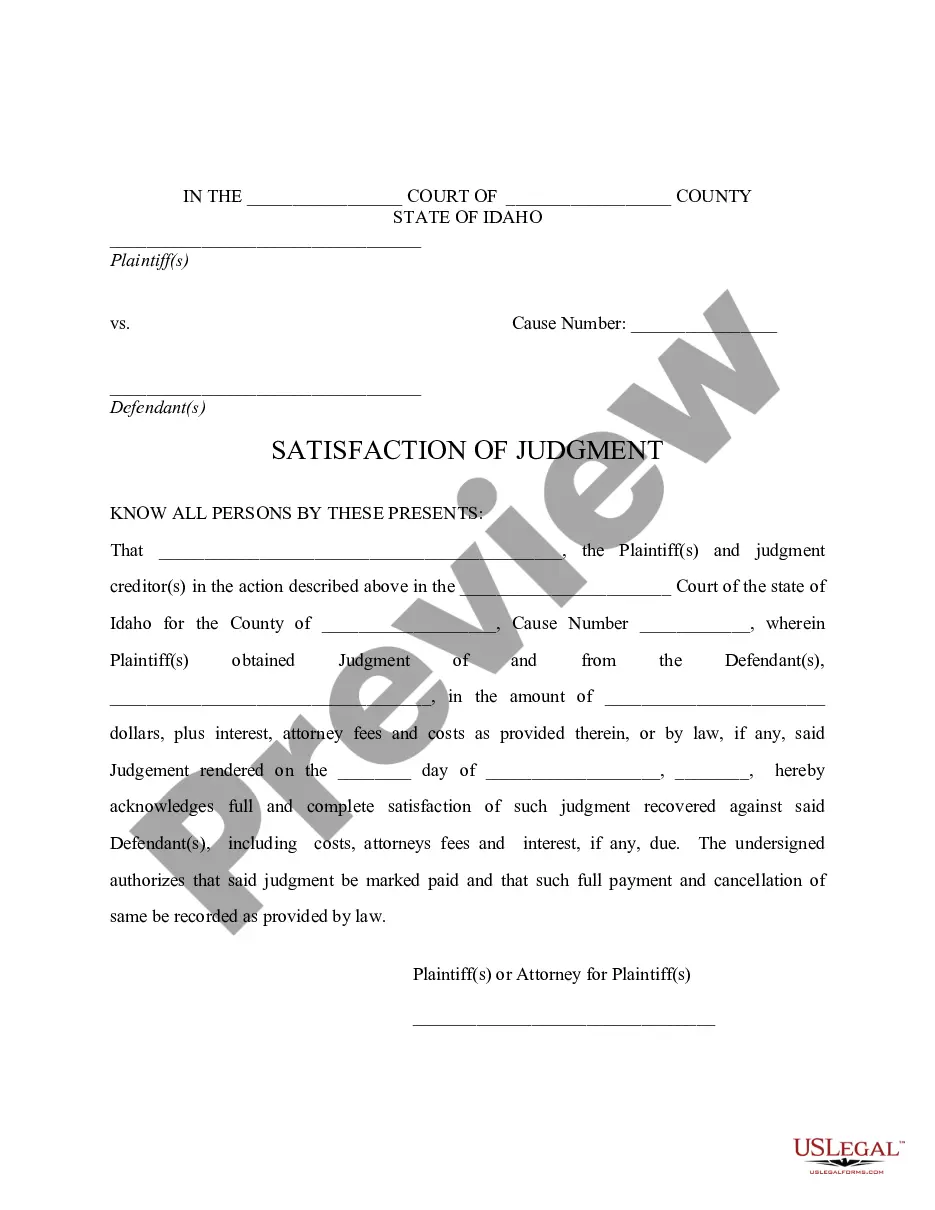

- Utilize the Review button to verify the form.

- Check the description to confirm you have selected the appropriate form.

- If the form does not match your needs, make use of the Search field to find the document that fits your requirements.

Form popularity

FAQ

Statute 524.2-404 deals with the requirements for revocation of wills in Minnesota. It outlines how a testator can change or invalidate previous wills, which is particularly important for those who have made agreements to bequeath property to persons performing personal services. Knowing this statute can provide you with peace of mind as it helps safeguard your agreements under the framework of the Minnesota Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services.

Statute 524.2-201 outlines the formal requirements for a will in Minnesota, emphasizing the importance of proper execution. This statute provides clear guidelines on how an individual can legally bequeath property, ensuring that even personal service agreements align with the Minnesota Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services. Familiarizing yourself with these requirements can help prevent disputes in the future.

Statute 524.3.916 addresses the disposition of property when a will is contested or when no valid will exists. It outlines the procedures for handling disputes among heirs and ensuring lawful distributions. For anyone considering how personal services may impact their property arrangements, the Minnesota Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services provides helpful direction in such cases.

Statute 524.3.204 deals with the determination of heirs in Minnesota estates, providing clarity on how beneficiaries are identified. This statute aids in ensuring the rightful heirs receive their due property. It is particularly significant when discussing estate planning and personal services. The Minnesota Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services can affect how property is allocated, emphasizing its importance in estate management.

Minnesota Statute 10A.07 relates to the management of campaign finance and public disclosure in political contexts. While this statute is not directly connected to property bequests, understanding its implications on ethical practices is essential for anyone involved in political responsibilities. For those interested in property transfer, the Minnesota Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services offers clear guidance on handling personal service agreements within estate frameworks.

How Long Do You Have to File Probate After a Death in Minnesota? Minnesota Probate Code requires that probate be opened on an estate within three years of the person's death.

It will not invalidate the will if your witnesses are also beneficiaries in your will. The state of Minnesota does not allow electronic or digital-only wills. After making an online will, you must print it out. While some states allow digital-only wills, Minnesota requires a paper copy with physical signatures.

There is no need to notarize a will in India and thus need not to notarize the signatures of the witnesses in the presence of a notary.

The law does not require that you have a will. However, a will is a useful tool that provides you with the ability to control how your estate will be divided. If you die without a will, Minnesota's inheritance laws will control how your estate will be divided.

In order to be valid under Minnesota law, a Will generally must: be in writing; signed by the testator (the person describing how they want their property distributed); and. signed by at least two witnesses over the age of 18.