Minnesota General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

If you desire to compile, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms, which are accessible online.

Employ the site’s straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for commercial and personal uses are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Minnesota General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to locate the Minnesota General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and select the Download option to obtain the Minnesota General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions outlined below.

- Step 1. Ensure you have selected the form for your correct city/state.

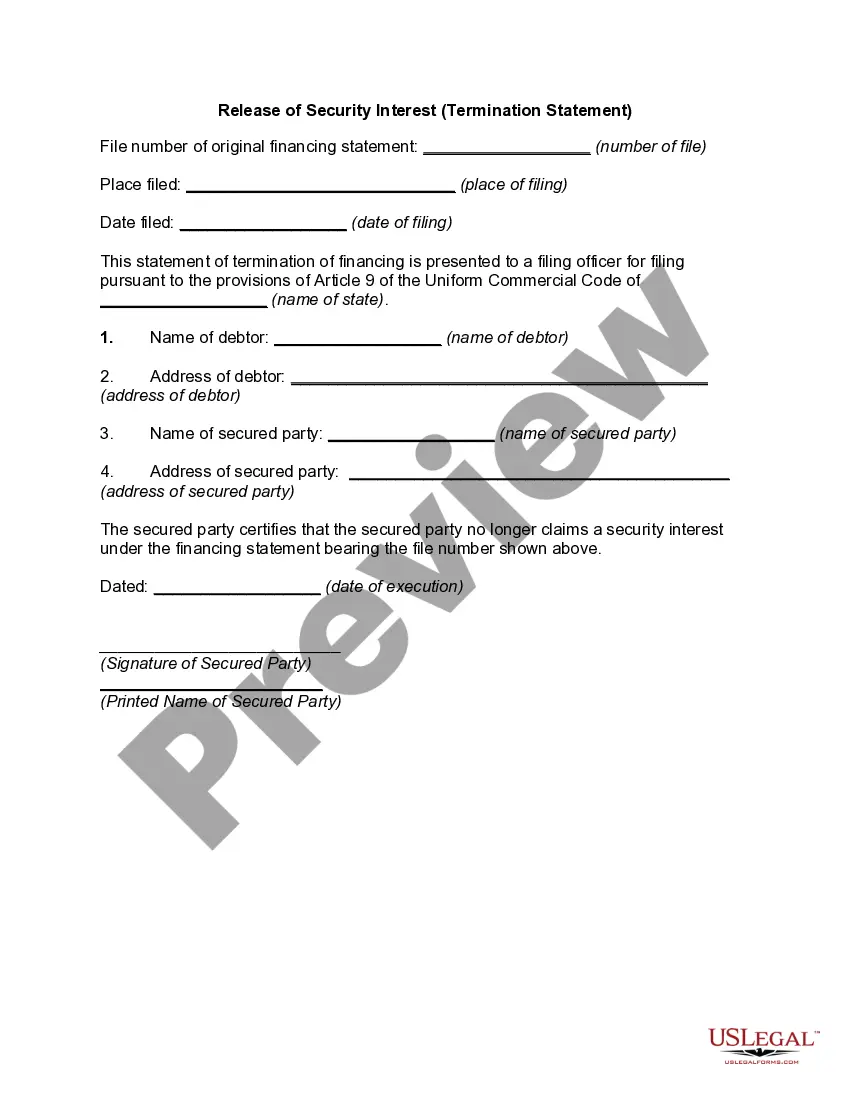

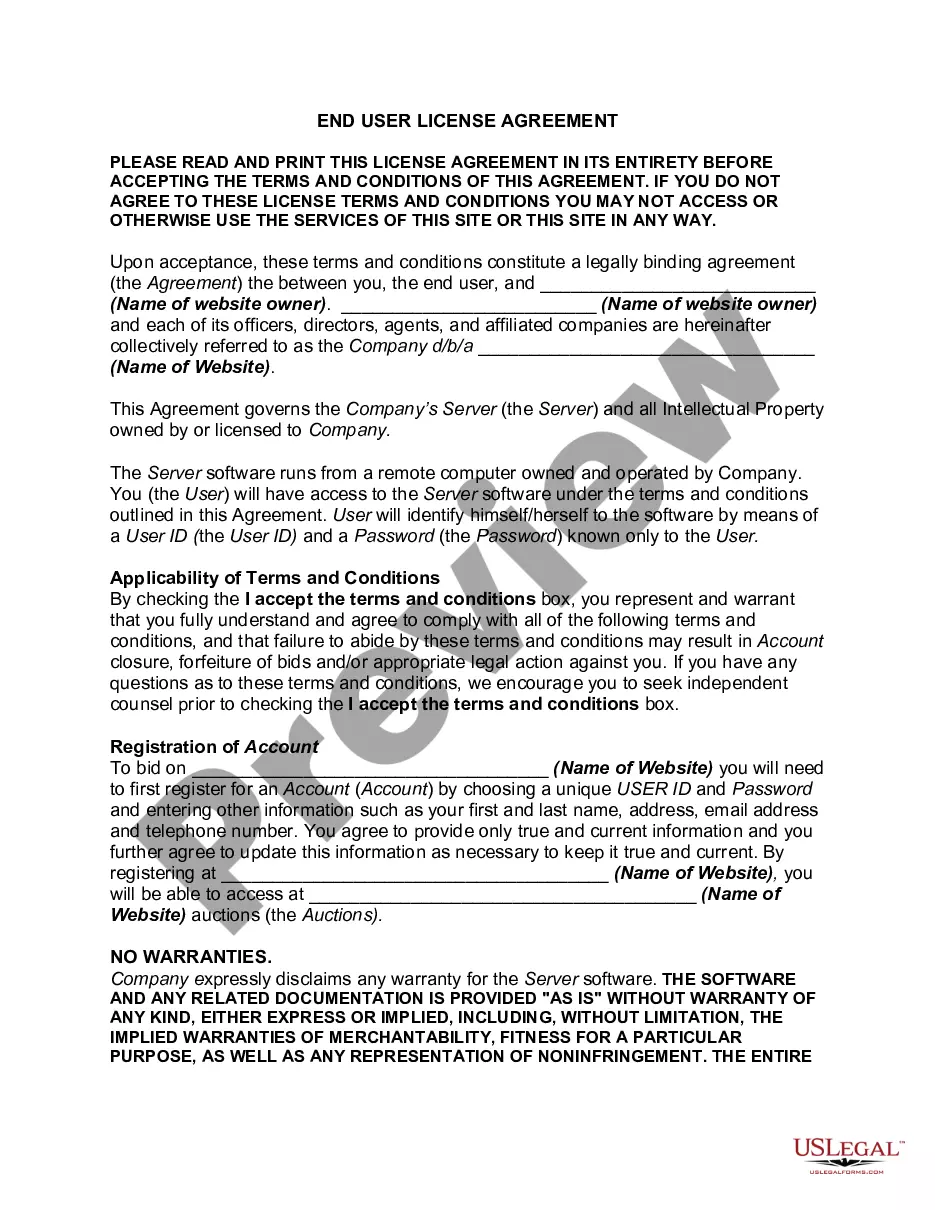

- Step 2. Use the Review option to scrutinize the form’s details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Select the payment plan you prefer and input your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Minnesota General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

Form popularity

FAQ

A Section 2503(c) trust allows all the principal and income to be used for the child until he reaches the age of 21, unlike the 2503(b) trust that extends beyond age 21 and requires income to be paid to the child annually. The trustee can pay the child's college expenses from the 2503(c) trust.

A 2503(c) trust, or minor's trust, is a trust established to hold gifts for one child until he or she attains age 21. A gift to this type of trust qualifies for the annual federal gift tax exclusion.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

2503(c) trust has one beneficiary, and the assets in the trust are irrevocably his or hers (i.e., the assets cannot be redirected to another beneficiary); Because the trust is irrevocable, the grantor gives up total control of the assets; The trust income tax rates may penalize those trusts that accumulate income; and.

Section 2503(b) is also known as a Qualifying Minor's Trust or Mandatory Income Trust. This is an irrevocable trust which requires distribution of income on an annual basis. Most often, distributed funds are placed into a custodial bank account until the child reaches legal age.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

The key difference between a 2503(c) trust and a 2503(b) trust is the distribution requirement. Parents who are concerned about providing a child or other beneficiary with access to trust funds at age 21 might be better off with a 2503(b), since there is no requirement for access at age 21.

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want.

A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount. One type of gift in trust is a Crummey trust, which allows gifts to be given for a specific period, establishing the gifts as a present interest and eligible for the gift tax exclusion.