The articles of amendment shall be executed by the corporation by an officer of the corporation.

Minnesota Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation

Description

How to fill out Articles Of Amendment To The Articles Of Incorporation Of Church Non-Profit Corporation?

It is feasible to invest time on the Internet seeking the legal document format that complies with the federal and state requirements you need.

US Legal Forms offers a vast array of legal documents that are evaluated by professionals.

You can readily download or print the Minnesota Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation from the service.

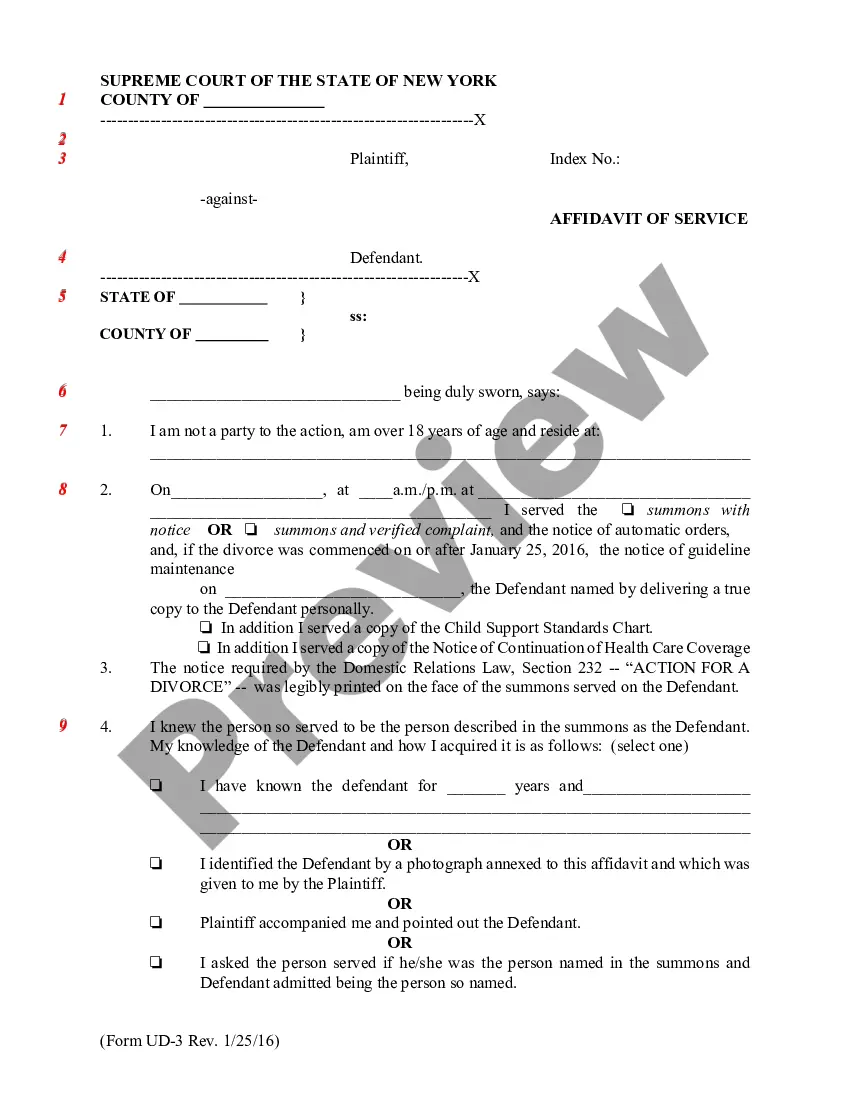

If available, utilize the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Minnesota Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

- Each legal document format you purchase is yours permanently.

- To get an additional copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the locality/city of your choice.

- Review the form details to confirm that you have selected the accurate form.

Form popularity

FAQ

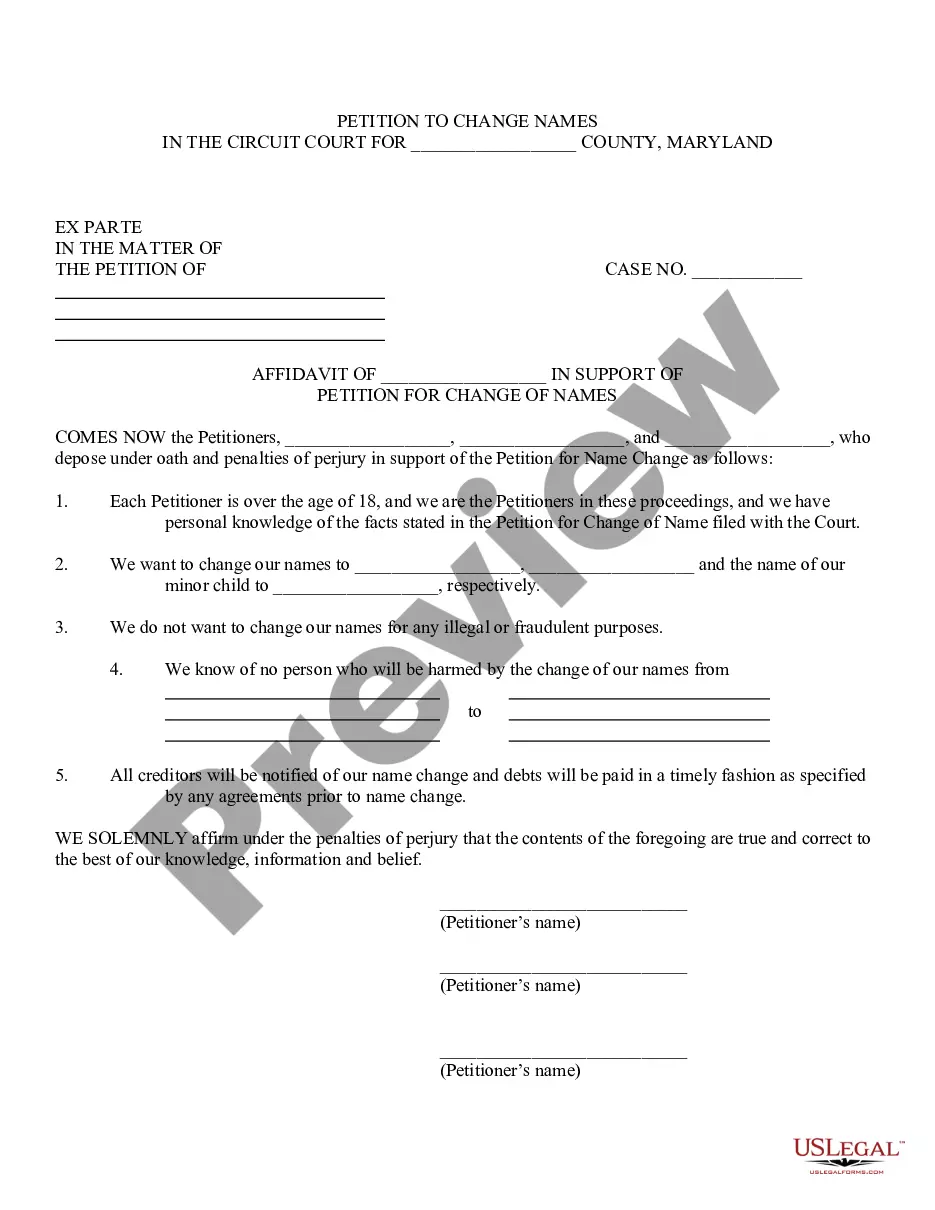

Filling out a certificate of amendment to the articles of organization requires specific information, including the current and amended details of your organization. You will need to provide the name of the corporation, the date of amendment, and a brief explanation of the changes being made. After completing the certificate, file it with the state to ensure your amendments are legally recognized. To streamline this process, consider utilizing the Minnesota Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

How to Start a Nonprofit in MinnesotaName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

How to Start a Nonprofit in MinnesotaName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

If you want to amend your California articles of incorporation, you must file a Certificate of Amendment of Articles of Incorporation form with the California Secretary of State (SOS) by mail or in person. Checks should be payable to the Secretary of State.

How to search business filingsGo to the Business Filings Online page to get started.Search by Business Name: type the Business Name in the search box, click SearchSearch by File Number: click File Number (above the search box), enter the file number, and click SearchMore items...

To file in person or by mail, submit the Amendment of Articles of Incorporation to the Minnesota SOS. The form you need to amend your articles of incorporation is in your online account when you sign up for registered agent service with Northwest. Keep the original copy and submit a legible photocopy to the SOS.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

Section 501(c)(3) is one of the tax law provisions granting exemption from the federal income tax to nonprofit organizations that exist for religious, charitable, scientific, literary, or educational purposes, among others. See the IRS's website for more information on the designation of charitable organizations.

Stat. ch. 317A. A nonprofit corporation's purpose and activities must serve the organization's mission to benefit the public, and may not be operated to profit other persons or entities.

To form a 501(c)(3) nonprofit organization, follow these steps:Step 1: Name Your Minnesota Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.More items...?