Minnesota Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate

Description

How to fill out Sample Letter For Discharge Of Debtor And Order Approving Trustee's Report Of No Distribution And Closing Estate?

Choosing the right authorized record design could be a struggle. Naturally, there are a variety of web templates available on the Internet, but how do you get the authorized type you will need? Use the US Legal Forms web site. The service gives 1000s of web templates, like the Minnesota Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate, that you can use for business and personal requires. All of the forms are checked by pros and fulfill state and federal demands.

In case you are already authorized, log in in your profile and then click the Download option to get the Minnesota Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate. Use your profile to check with the authorized forms you might have bought in the past. Proceed to the My Forms tab of your own profile and acquire another copy in the record you will need.

In case you are a brand new customer of US Legal Forms, listed here are easy guidelines for you to comply with:

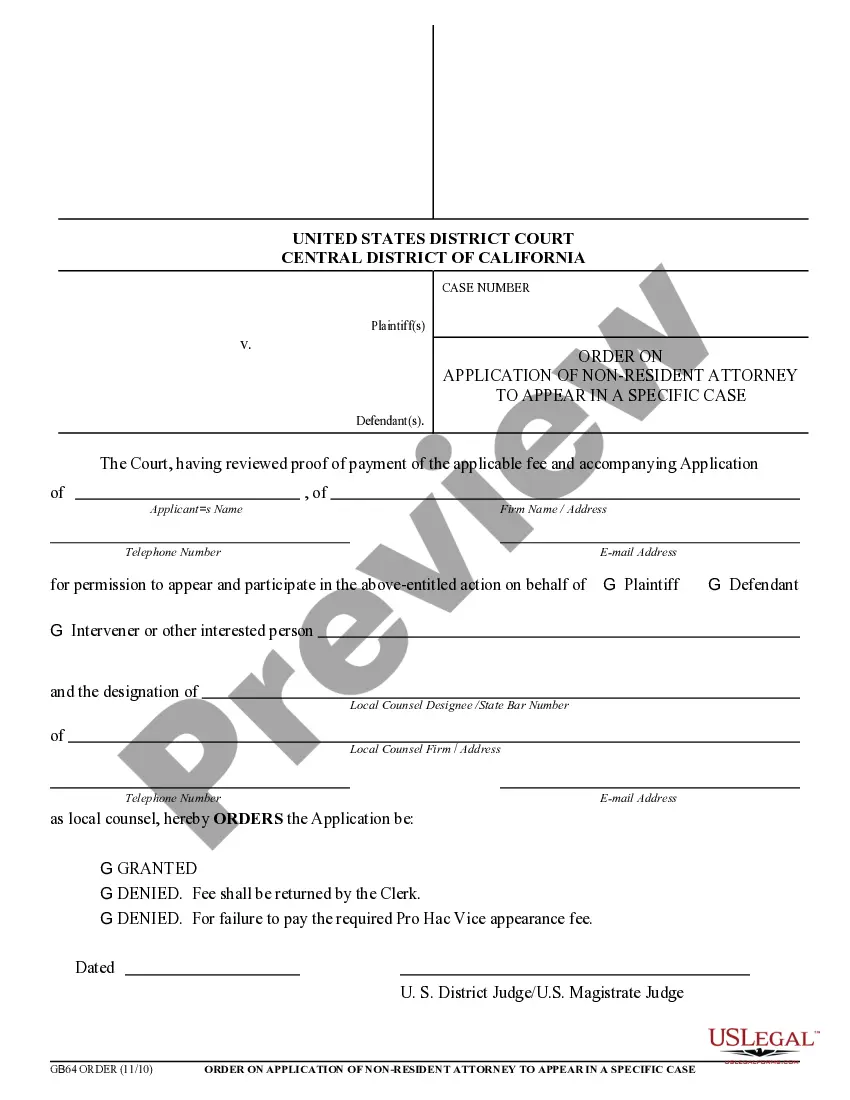

- Initially, make certain you have chosen the appropriate type for your personal town/region. You can look through the form making use of the Preview option and read the form outline to ensure it is the right one for you.

- In the event the type fails to fulfill your preferences, take advantage of the Seach industry to obtain the proper type.

- Once you are certain that the form would work, click on the Get now option to get the type.

- Select the rates plan you desire and enter in the essential information and facts. Build your profile and purchase the order utilizing your PayPal profile or bank card.

- Opt for the file structure and down load the authorized record design in your device.

- Complete, revise and printing and signal the acquired Minnesota Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate.

US Legal Forms may be the biggest library of authorized forms where you will find numerous record web templates. Use the company to down load skillfully-created paperwork that comply with status demands.

Form popularity

FAQ

Debts not discharged Some debts are not dischargeable in bankruptcy. See 11 U.S.C. 523 for the list of non dischargeable debts. Non dischargeable debts are unaltered by the bankruptcy discharge and remain just as valid as they were before the bankruptcy. The debtor's personal liability continues.

There are only a handful of reasons a chapter 7 bankruptcy will be dismissed by the court. However, what it usually boils down to is that the client didn't go to the hearing, finish the financial management course, or didn't tell the attorney about a valuable asset or stream of income..

For most filers, a Chapter 7 case will end when you receive your discharge?the order that forgives qualified debt?about four to six months after filing the bankruptcy paperwork. Although most cases close after that, your case might remain open longer if you have property that you can't protect (nonexempt assets).

A discharge releases a debtor from personal liability of certain debts known as dischargeable debts, and prevents the creditors owed those debts from taking any action against the debtor or the debtor's property to collect the debts.

Debts not discharged include debts for alimony and child support, certain taxes, debts for certain educational benefit overpayments or loans made or guaranteed by a governmental unit, debts for willful and malicious injury by the debtor to another entity or to the property of another entity, debts for death or personal ...

What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Closed Without a Discharge Cases are closed without discharge when the debtor does not complete the required debtor education required as a condition of discharge. The court may also close your case without discharge if you failed the last step for getting rid of debt. Your filing may not have been filed timely.

The Trustee's Report of No Distribution, or NDR, lets the court and all interested parties know that no money will be paid to creditors. If a NDR is filed, the court will close the bankruptcy case shortly after the discharge has been entered. Unfortunately, you can only find the NDR by reviewing your case docket.