Minnesota Sample Letter for Collection of Refund

Description

How to fill out Sample Letter For Collection Of Refund?

Are you in the situation in which you will need files for both company or individual purposes just about every day? There are a variety of authorized document themes available online, but finding versions you can rely on isn`t effortless. US Legal Forms provides a huge number of develop themes, much like the Minnesota Sample Letter for Collection of Refund, which are composed to satisfy state and federal requirements.

In case you are already knowledgeable about US Legal Forms internet site and have your account, merely log in. Afterward, you may download the Minnesota Sample Letter for Collection of Refund design.

If you do not have an bank account and would like to begin using US Legal Forms, follow these steps:

- Discover the develop you need and make sure it is for your correct metropolis/area.

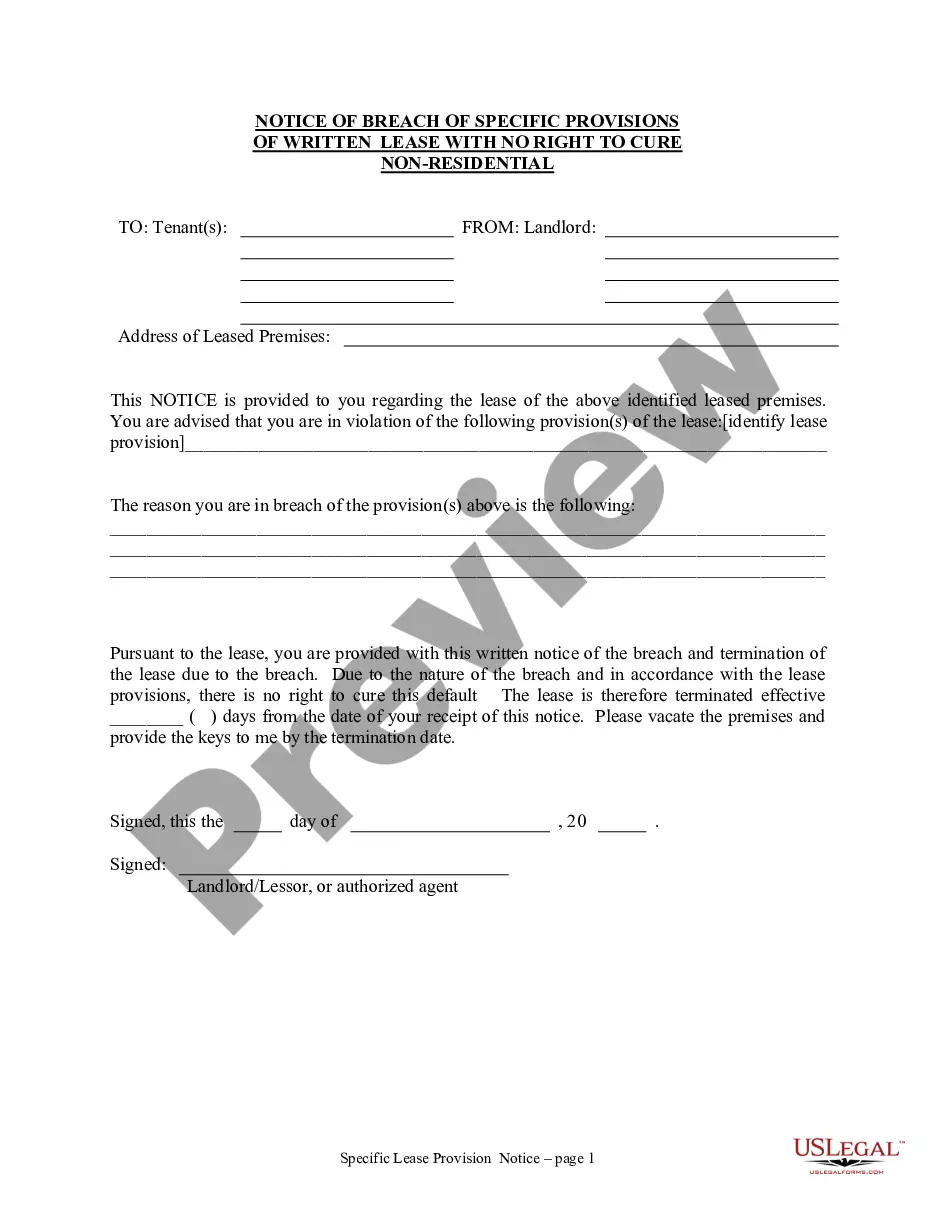

- Make use of the Review button to analyze the shape.

- See the information to actually have chosen the appropriate develop.

- When the develop isn`t what you`re trying to find, make use of the Search industry to get the develop that meets your requirements and requirements.

- Once you find the correct develop, click on Buy now.

- Choose the prices strategy you would like, fill in the necessary information to create your money, and purchase the transaction using your PayPal or charge card.

- Pick a convenient file format and download your version.

Find all the document themes you possess purchased in the My Forms menu. You can obtain a further version of Minnesota Sample Letter for Collection of Refund at any time, if needed. Just click on the necessary develop to download or produce the document design.

Use US Legal Forms, probably the most extensive variety of authorized forms, to save efforts and stay away from faults. The assistance provides expertly manufactured authorized document themes which can be used for a range of purposes. Produce your account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

You will have 60 days to pay the benefit overpayment in full or prove the overpayment is not owed. The Department of the Treasury will notify you by mail when a federal offset occurs. The letter includes the amount and date of the offset, and EDD contact information.

The ?Notice of Intent to Offset? is telling you that you have taxes owed and the government is going to seize part or all of your federal payments. The IRS commonly offsets Federal tax refunds, but they can also take other types of federal payments as well.

You may receive a letter from the Minnesota Department of Revenue indicating we received a suspicious Minnesota income tax or property tax refund return. In these cases, we stop processing the return to safeguard your information.

For example, with the Low and Middle Income Tax Offset (LMITO) for 2021-22, if your taxable income is $37,0000 or less, you will receive a $675 offset on your tax payable when you lodge your tax return. If your income is $48,001 to $90,000, however, the offset is worth $1,500.

The amount of my federal payment (e.g., income tax refund) has been reduced ("offset"). Why? If an individual owes money to the federal government because of a delinquent debt, the Treasury Department can offset that individual's federal payment or withhold the entire amount to satisfy the debt.

Many taxpayers in Minnesota, USA, are set to receive a tax refund over the coming days, thanks to a new tax rebate August 2023 law. Overall, over two million checks worth up to 1,300 dollars each will be sent out across August and September, thanks to a new initiative from Governor Tim Walz.

At the time of the tax refund offset, Treasury's Bureau of the Fiscal Service mails a Notice of Offset to the noncustodial parent stating that all or part of their federal tax refund has been intercepted. The Notice also provides direction on contacting the child support agency for further information.

One-Time Refund for Tax Year 2021. The Minnesota Department of Revenue has finished processing one-time tax rebate payments for eligible Minnesota taxpayers. We issued nearly 2.1 million rebates ? totaling nearly $1 billion ? under a law passed in May.