Minnesota Articles of Association of Unincorporated Charitable Association

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

You can devote hours online searching for the legal document template that fulfills the federal and state criteria you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You are able to download or print the Minnesota Articles of Association of Unincorporated Charitable Associations from our platform.

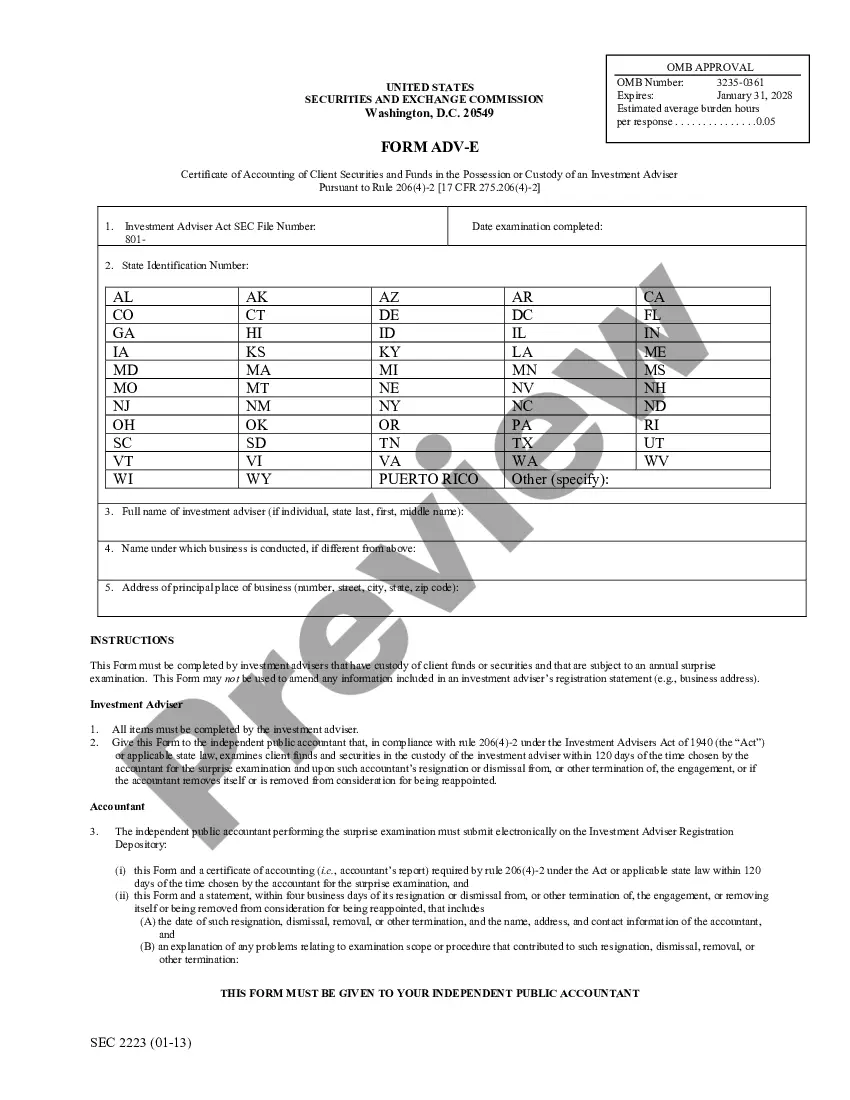

Firstly, ensure that you have selected the correct document template for your state/city of preference. Review the form description to confirm you have chosen the right template. If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Afterward, you can complete, modify, print, or sign the Minnesota Articles of Association of Unincorporated Charitable Associations.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

While both unincorporated associations and nonprofits serve charitable purposes, they differ significantly in structure and legal recognition. Unincorporated associations do not hold the same legal status as formal nonprofits, which are incorporated and have certain protections and privileges. If you're forming a group, reviewing the Minnesota Articles of Association of Unincorporated Charitable Association can help clarify your path forward.

Generally, unincorporated associations do not have to file a tax return unless they generate a certain amount of income or have specific tax obligations. However, rules can vary based on activities and revenue. Consulting with guidance from the Minnesota Articles of Association of Unincorporated Charitable Association can ensure compliance with tax regulations.

An unincorporated association may need an Employer Identification Number (EIN) if it has employees or if it plans to open a bank account. Obtaining an EIN is a straightforward process that can help facilitate financial operations smoothly. The Minnesota Articles of Association of Unincorporated Charitable Association can help clarify these requirements for your association.

Minnesota statute 317A governs the formation and operation of nonprofit corporations in the state. It outlines rules regarding governance, board structure, and member rights. For unincorporated associations, referring to the Minnesota Articles of Association of Unincorporated Charitable Association can provide key insights relevant to your organization.

Incorporating a nonprofit can protect its members from personal liability, offer tax-exempt status, and enhance credibility. Incorporation also provides a formal structure, which can be important for fundraising and grants. Understanding the Minnesota Articles of Association of Unincorporated Charitable Association can help determine if incorporation or remaining unincorporated aligns better with your goals.

Unincorporated associations offer flexibility and lower setup costs compared to incorporated entities. They allow members to operate collaboratively without the need for extensive regulatory compliance. For those interested in the Minnesota Articles of Association of Unincorporated Charitable Association, it provides a clear framework for establishing such an organization.

A nonprofit organization is a formal entity that operates for a purpose other than making a profit, and it must meet specific legal requirements. In contrast, an unincorporated association is a group of individuals who come together for a common purpose without formal incorporation. The Minnesota Articles of Association of Unincorporated Charitable Association can guide you in understanding how these associations function in Minnesota.

Minnesota statute 317A refers to the legal framework governing the operation of unincorporated charitable associations in Minnesota. It outlines essential provisions for establishing Minnesota Articles of Association of Unincorporated Charitable Association. This statute ensures that these associations adhere to specific guidelines, promoting transparency and accountability. By having a clear understanding of statute 317A, you can effectively manage your charitable organization and comply with Minnesota laws.

To file for a 501c3 status, you need to prepare and submit Form 1023 to the IRS, along with the required documentation that includes your Articles of Incorporation. These documents must demonstrate that your organization serves a charitable purpose, following the guidelines set forth in the Minnesota Articles of Association of Unincorporated Charitable Association. Ensure all your information is accurate to avoid potential delays in your application.

To register for charitable solicitation in Minnesota, you must complete the necessary forms and submit them to the Minnesota Attorney General's Office. This process ensures that your organization is properly registered to solicit donations in the state. The Minnesota Articles of Association of Unincorporated Charitable Association can serve as an important part of your registration, showing your commitment to transparency and compliance.