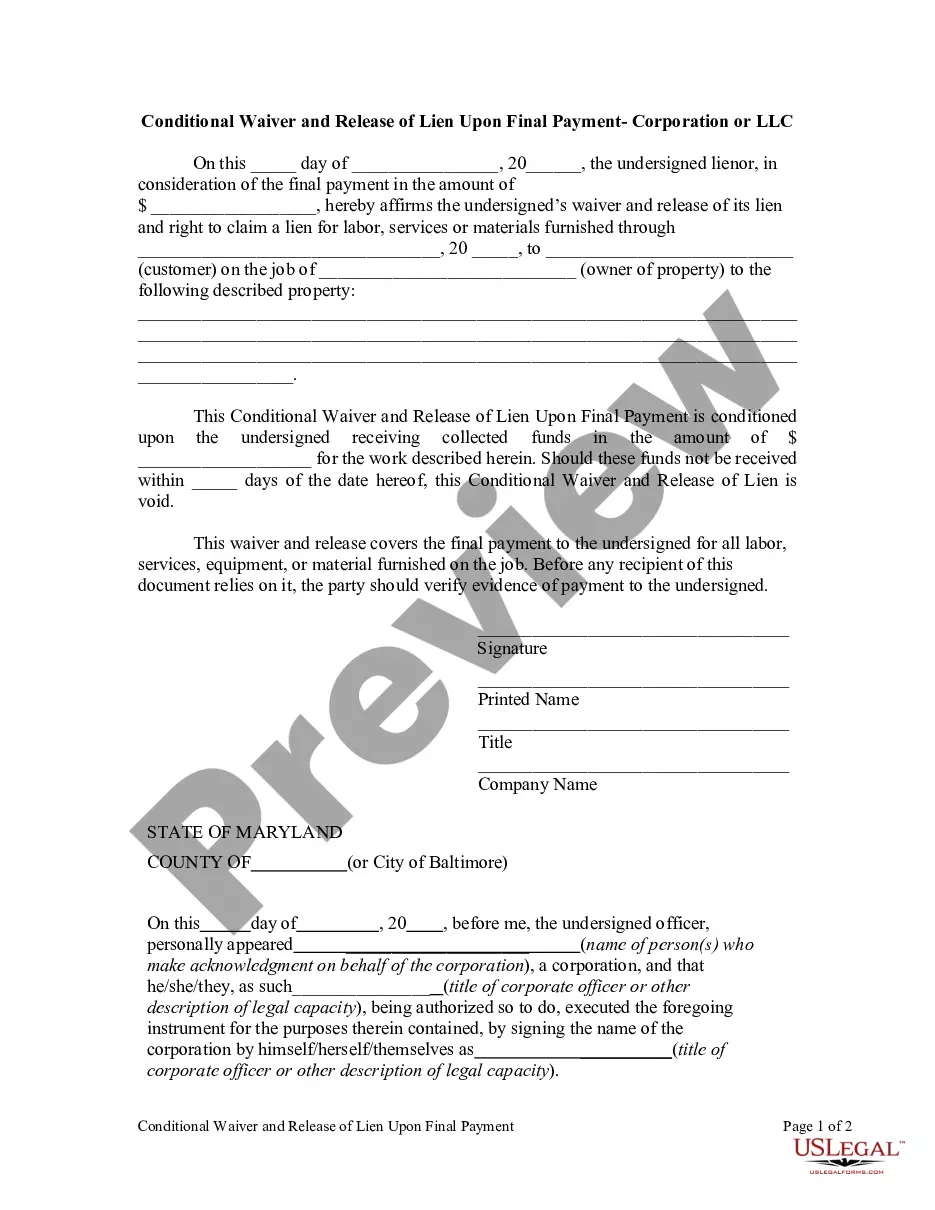

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Minnesota Check Disbursements Journal

Description

How to fill out Check Disbursements Journal?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms like the Minnesota Check Disbursements Journal in just moments.

Check the form summary to confirm that you have picked the appropriate form.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you possess a subscription, Log In and retrieve Minnesota Check Disbursements Journal from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously acquired forms from the My documents section in your account.

- To use US Legal Forms for the first time, here are some simple steps to assist you.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

The Minnesota Check Disbursements Journal is specifically designed for recording disbursements made by check. This journal provides a structured way to track payments and their purposes. Using this journal helps ensure that all details are captured accurately, maintaining clear records of all check disbursements. It's an essential tool for effective financial management.

In accounting, recording a disbursement requires precision. Start by entering the date and amount in the Minnesota Check Disbursements Journal. Then, classify the disbursement in your accounting system, ensuring each transaction is properly documented. This approach enhances financial management and provides a reliable audit trail.

Writing a disbursement involves three essential steps: detailing the amount, identifying the payee, and describing the transaction. If you're using the Minnesota Check Disbursements Journal, include the date and a brief memo about the purpose of the payment. This practice not only fosters clarity but also assists in tracking your expenditures effectively.

To record a disbursement, first enter the date of the transaction in your records. Then, document the amount spent and the payee involved. Make sure to categorize the expense correctly in the Minnesota Check Disbursements Journal. This method helps maintain a clear financial overview and keeps your accounts organized.

To write a disbursement, begin by identifying the amount being disbursed. Next, specify the purpose of the disbursement, whether it's for services rendered or goods purchased. Then, make a note in the Minnesota Check Disbursements Journal, detailing the date, payee, and method of payment. This documentation ensures transparency and accuracy in your financial records.

Statute 82.75 in Minnesota relates to the management and reporting requirements for financial records, specifically in the context of check disbursements. Understanding this statute is crucial for maintaining compliance when handling financial transactions through a Minnesota Check Disbursements Journal. This statute ensures transparency and accuracy in financial reporting, which ultimately benefits organizations and their stakeholders. You can find more straightforward tools and resources for tracking compliance on the US Legal Forms platform, making it easier to navigate these requirements.

A disbursement journal is a financial record that tracks all payments made by check. It serves as a detailed log of expenditures, which is essential for financial management. Utilizing the Minnesota Check Disbursements Journal allows you to monitor your organization's spending and maintain accuracy in your accounting practices.

To successfully fill out a disbursement journal, begin by writing the date of each transaction. Next, specify the check number, the name of the payee, and the amount dispensed. Finally, document the reason for the payment, ensuring that your Minnesota Check Disbursements Journal is comprehensive and aids in financial clarity.

Filling out a disbursement journal involves recording each check payment as it occurs. Include the date, check number, payee, amount, and the purpose of the payment in each entry. This process keeps your financial records organized and helps you track all expenses efficiently in the Minnesota Check Disbursements Journal.

To fill out a disbursement authorization form, start by entering the relevant details, such as the payee's name, the amount, and the purpose of the payment. Ensure you have the appropriate authorizations before submission. This form is essential for documenting payments, and using it correctly ensures that your records align with entries in the Minnesota Check Disbursements Journal.