Minnesota Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

If you wish to accumulate, acquire, or produce authentic documents templates, utilize US Legal Forms, the premier repository of legal forms, accessible online.

Leverage the site's user-friendly and straightforward search feature to locate the documents you require.

Various templates for business and personal applications are organized by categories and states, or keywords.

Every legal document format you obtain is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay proactive and download, and print the Minnesota Pledge of Personal Property as Collateral Security with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to obtain the Minnesota Pledge of Personal Property as Collateral Security with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Minnesota Pledge of Personal Property as Collateral Security.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

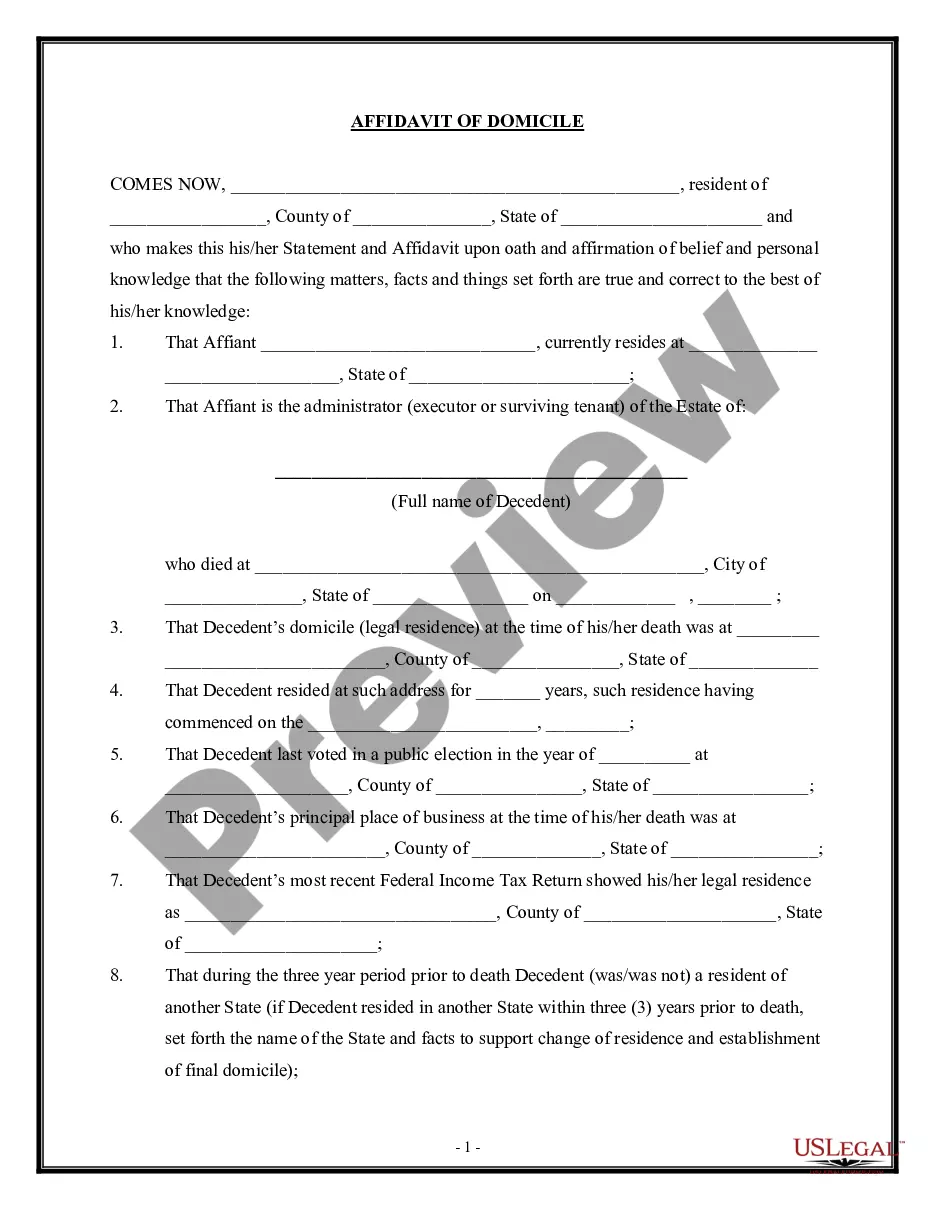

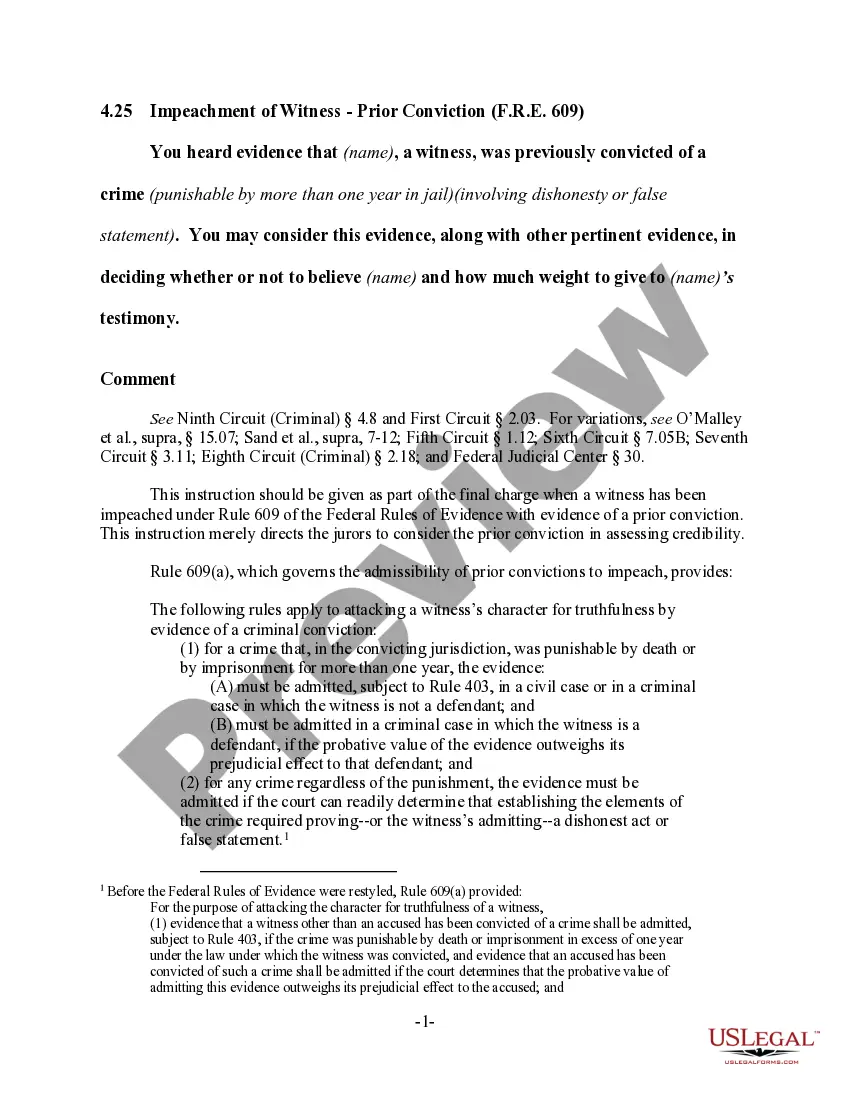

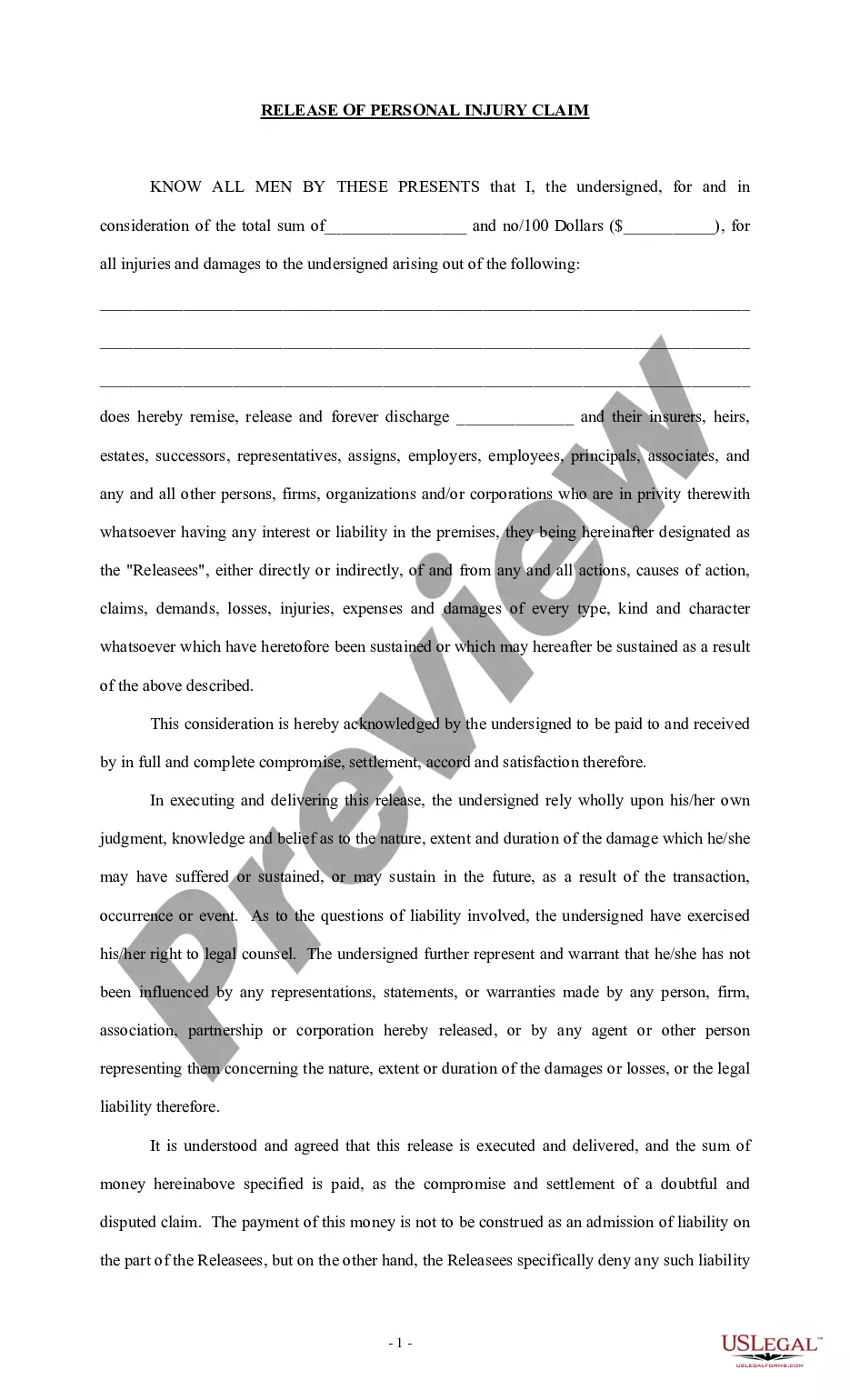

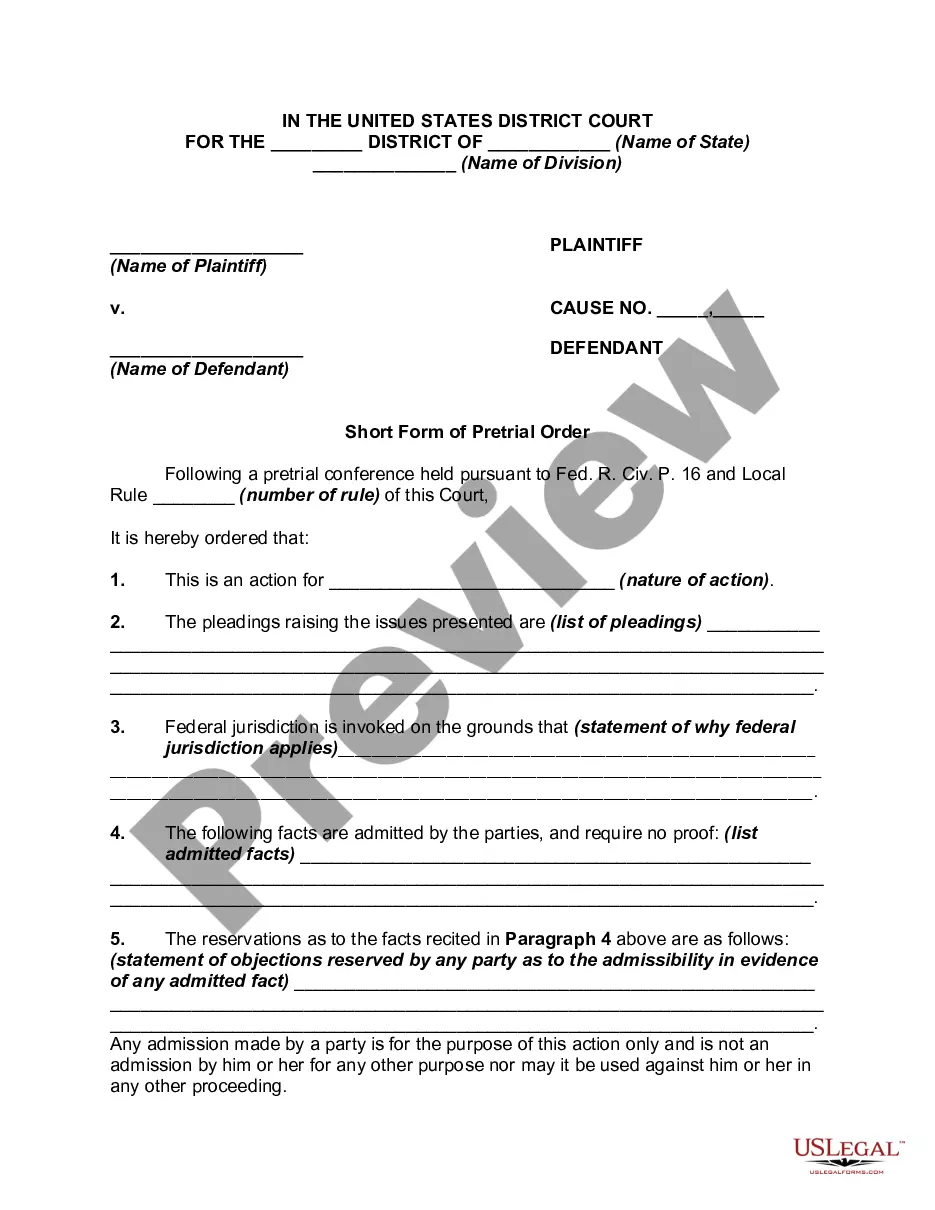

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Be sure to read through the information.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form format.

- Step 4. Once you have located the form you need, click the Acquire now button. Select the pricing plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Minnesota Pledge of Personal Property as Collateral Security.

Form popularity

FAQ

Pledging assets as collateral for a debt is commonly known as creating a security interest. In this transaction, the borrower offers their assets as a guarantee to secure repayment. When considering the Minnesota Pledge of Personal Property as Collateral Security, this legal concept establishes a clear relationship between the asset and the obligation. This provides borrowers with a structured way to access funds while reassuring lenders of their repayment.

Yes, you can utilize your property as collateral, especially when executing a Minnesota Pledge of Personal Property as Collateral Security. This arrangement supports your financial goals by allowing you to secure loans with your assets. Always consider professional advice to navigate this process smoothly. Our platform, uslegalforms, provides resources and documents to help you set up this agreement effectively.

Yes, personal property can be used as collateral for loans and financial agreements. Lenders often accept various types of personal belongings as security against potential defaults. The Minnesota Pledge of Personal Property as Collateral Security helps individuals navigate this process, making it easier to understand what qualifies as acceptable collateral. This flexibility can empower you to take control of your financial situation.

Personal property collateral consists of movable items that individuals can use to secure loans. This includes belongings like vehicles, jewelry, or equipment. The valuable aspect of the Minnesota Pledge of Personal Property as Collateral Security lies in its ability to transform ordinary possessions into financial leverage. By pledging personal property, you can gain access to funds while ensuring your assets remain in your possession.

When you pledge real estate as collateral without relinquishing possession, it is referred to as a 'mortgage.' In this case, the property remains under your control, while the lender holds a claim to it until the debt is settled. While the Minnesota Pledge of Personal Property as Collateral Security focuses on personal items, understanding how mortgages work can broaden your financial options. Both methods offer ways to secure financing through your valuable assets.

A pledge of property to secure a debt involves using assets to guarantee repayment. This means if you fail to meet your debt obligations, the lender has the right to take your pledged property as compensation. The Minnesota Pledge of Personal Property as Collateral Security allows individuals to leverage their personal belongings, ensuring that loans are backed by tangible assets. It's a practical way to gain financial support while maintaining ownership of your items.

You can use your property as collateral by entering into a formal agreement with a lender or financial institution. The Minnesota Pledge of Personal Property as Collateral Security allows you to leverage your personal property to secure loans or credit. First, assess the value of your property, and then engage in discussions with potential lenders about their requirements. Utilizing platforms like USLegalForms can help you draft the necessary agreements to ensure a smooth transaction.

No, it is not illegal to hold someone's personal property as collateral, provided that the agreement is documented and agreed upon by both parties. The Minnesota Pledge of Personal Property as Collateral Security offers a legal framework for such arrangements, ensuring that both lenders and borrowers understand their rights and obligations. It is essential to create a clear and transparent agreement to avoid any disputes. Always consult with a legal professional to ensure compliance with Minnesota laws.