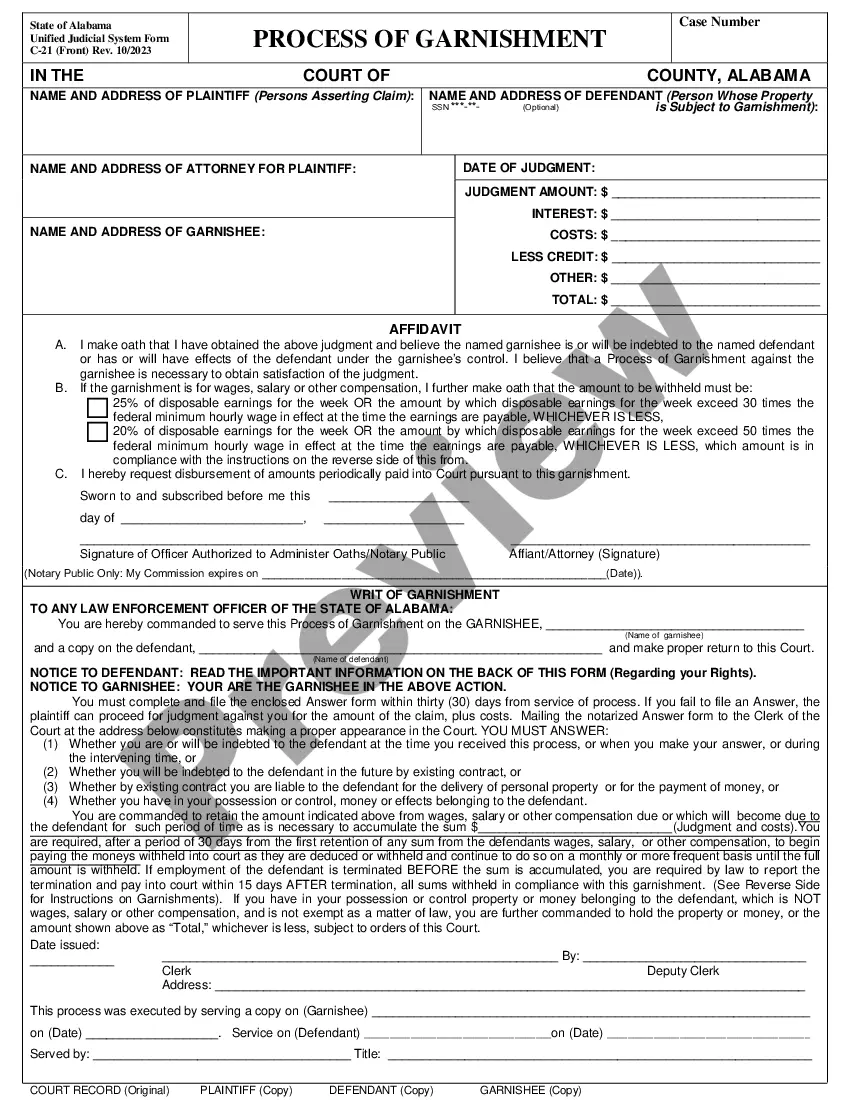

Minnesota Compensable Work Chart with Explanation

Description

How to fill out Compensable Work Chart With Explanation?

Selecting the correct legal template can be challenging. Clearly, there are numerous templates available online, but how do you find the legal document you require.

Utilize the US Legal Forms website. The platform offers a wide variety of templates, including the Minnesota Compensable Work Chart with Explanation, suitable for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to access the Minnesota Compensable Work Chart with Explanation. Use your account to navigate through the legal documents you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you need.

Select the file format and download the legal template to your device. Finally, complete, modify, print, and sign the Minnesota Compensable Work Chart with Explanation. US Legal Forms is the largest library of legal templates where you can find a range of document templates. Utilize the service to acquire professionally created documents that adhere to state requirements.

- Firstly, ensure you have selected the correct form for your area/state.

- You can review the form using the Preview button and read the form description to confirm it is the appropriate one for you.

- If the form does not fulfill your needs, use the Search field to find the correct form.

- Once you are confident that the form is suitable, click on the Purchase now button to obtain the document.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and complete your order using your PayPal account or credit card.

Form popularity

FAQ

To complete your workers' compensation claim, start by gathering all necessary information, including details about your injury and the circumstances surrounding it. Next, refer to the Minnesota Compensable Work Chart with Explanation to understand what qualifies for compensation. This chart aids in identifying your eligibility, allowing you to present accurate data. Finally, submit your claim through the US Legal Forms platform, where you can find easy guides and forms specifically tailored to streamline your process.

The maximum amount of compensation in Minnesota depends on various factors, including the type of injury and the severity of your case. To fully understand your potential compensation, reference the Minnesota Compensable Work Chart with Explanation, which outlines the specifics you need to consider. This chart serves as a valuable resource in helping you estimate your benefits. Utilizing tools like US Legal Forms can further streamline your understanding and access to relevant information.

Filing a workers' compensation claim in Minnesota involves several key steps to ensure a smooth process. First, report your injury to your employer promptly, and then complete the necessary claim forms. The Minnesota Compensable Work Chart with Explanation can guide you through the requirements and help you understand what information is needed for a successful claim. For added support, resources like US Legal Forms can facilitate this process by providing the necessary documentation.

In Minnesota, the maximum payment for workers' compensation benefits may differ depending on the case specifics and the nature of the injury. Employees can utilize the Minnesota Compensable Work Chart with Explanation to navigate through the payment structure effectively. This tool breaks down complex compensation details, making it easier to understand potential maximum payouts. Staying informed about this can help you ensure you receive the compensation you deserve.

The maximum comp rate in Minnesota for workers' compensation can vary yearly based on the state's economic factors. As of the latest updates, the Minnesota Compensable Work Chart with Explanation provides essential details about these rates. Understanding this chart is crucial for both employees and employers to ensure proper compensation rates are applied. Always refer to updated resources or consult a professional to get the most accurate figures.

The amount you can receive from a workers' comp settlement varies significantly based on the severity of your injury and the state's regulations. Factors such as lost wages, medical bills, and rehabilitation costs determine settlement amounts. Utilizing resources like the Minnesota Compensable Work Chart with Explanation can clarify potential compensation scenarios in your case. This tool can empower you to seek a fair settlement that meets your needs.

In Washington, workers' compensation protects employees from the financial burdens of workplace injuries. The state provides benefits such as medical care and wage loss payments. By examining the Minnesota Compensable Work Chart with Explanation, you can gain insight into the compensable factors that may apply in both states. This comparative understanding assists you in making informed decisions regarding your rights.

Tennessee workers' compensation operates to provide financial assistance to employees who suffer work-related injuries. It covers medical expenses, lost wages, and rehabilitation costs. Understanding the Minnesota Compensable Work Chart with Explanation can also highlight similar criteria used in Tennessee. This knowledge helps you compare your options and rights under your state's laws.

Workers' compensation in Minnesota serves to protect employees who suffer injuries or illnesses related to their jobs. It offers financial support for medical expenses and provides wage loss benefits. Understanding the process and the resources available, including the Minnesota Compensable Work Chart with Explanation, can significantly ease your experience when filing for benefits.

Calculating the average weekly wage for workers' compensation in Minnesota involves reviewing your earnings over a specified period before your injury. This figure is crucial, as it helps determine your benefit amount. For precise calculations, consider using the Minnesota Compensable Work Chart with Explanation, which simplifies this process and offers clarity.