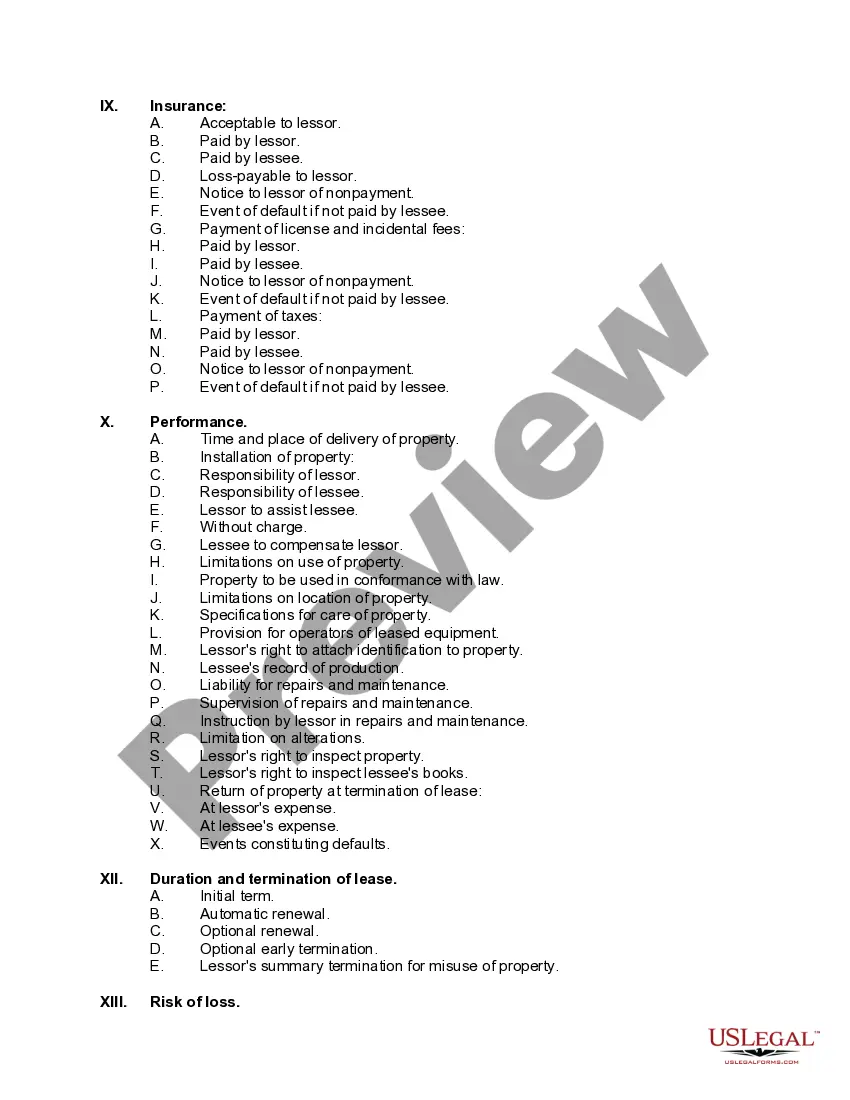

Minnesota Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

Selecting the optimal valid document format can be challenging.

Naturally, there are numerous templates available online, but how do you find the correct format you require.

Utilize the US Legal Forms website. This platform provides thousands of templates, including the Minnesota Equipment Lease Checklist, which you can utilize for professional and personal needs.

You can preview the template using the Preview button and review the document description to confirm it is suitable for your needs.

- All documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and select the Download button to access the Minnesota Equipment Lease Checklist.

- Use your account to browse through the legal documents you’ve previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct template for your locality.

Form popularity

FAQ

Signing a lease typically involves providing identification, proof of income, and any necessary references. Additionally, both parties should review the terms thoroughly to avoid misunderstandings later. Using the Minnesota Equipment Lease Checklist can simplify this process by outlining essential requirements and helping you prepare all needed documentation. Taking these steps ensures a smooth leasing experience.

When reviewing a lease, look for any red flags that could indicate potential issues. Unclear terms, vague clauses, or unusual fees can cause problems down the line. It's crucial to consult the Minnesota Equipment Lease Checklist to identify and address these red flags. This resource can help ensure that your lease remains fair and beneficial for both parties.

In Minnesota, a lease does not typically need to be notarized to be valid. However, certain situations may require notarization, especially if the lease exceeds a set duration. To ensure you have the proper documentation, it is wise to refer to the Minnesota Equipment Lease Checklist. This checklist will guide you through any specific requirements to ensure your lease meets all legal standards.

Recording leased equipment in accounting involves recognizing the asset on your balance sheet and tracking lease payments as they occur. You will need to calculate depreciation and interest based on the lease terms. The Minnesota Equipment Lease Checklist serves as a helpful resource, ensuring you capture all required details for a clear and accurate financial overview.

To record leased equipment, you will create journal entries that reflect the asset's value as well as ongoing lease obligations. Accurate entries help maintain the integrity of your financial statements. The Minnesota Equipment Lease Checklist can help streamline this process, guiding you through necessary documentation and entries.

The journal entry for a lease typically includes a debit to the leased asset account and a credit to the lease liability account. This entry reflects your responsibility for future lease payments. For effective record-keeping, consult the Minnesota Equipment Lease Checklist to ensure you follow proper accounting procedures.

To account for leased assets, you must recognize them in your financial records as both an asset and a liability. The Minnesota Equipment Lease Checklist provides guidance to help you track the lease terms, depreciation, and interest expense effectively, ensuring you maintain accurate accounts.

Yes, leased equipment is typically capitalized in financial reporting. This means you recognize the leased asset on your balance sheet along with a corresponding liability. Follow the Minnesota Equipment Lease Checklist to ensure you account for all aspects correctly, enhancing the clarity of your financial statements.

Finding lease documents can be straightforward if you utilize the right resources. You can start by checking online legal platforms like US Legal Forms, which provide a range of templates including a comprehensive Minnesota Equipment Lease Checklist. This checklist will guide you through the essential elements needed in lease agreements, ensuring you cover all necessary details.

Creating an equipment rental agreement requires outlining the parties involved, describing the equipment, and specifying rental terms. It's also important to include payment structure, rental duration, and conditions for damages or repairs. A Minnesota Equipment Lease Checklist can help you organize these details effectively. Utilizing US Legal Forms can streamline the creation of a legally sound rental agreement.