Minnesota General Form of Agreement to Incorporate

Description

How to fill out General Form Of Agreement To Incorporate?

If you need to finish, obtain, or print legal document templates, use US Legal Forms, the best selection of legal forms, which are accessible online.

Utilize the site’s user-friendly and convenient search to find the papers you require. Numerous templates for business and personal purposes are organized by categories and states or keywords.

Employ US Legal Forms to access the Minnesota General Form of Agreement to Incorporate within just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you saved in your account. Review the My documents section and choose a form to print or download again.

Complete, obtain, and print the Minnesota General Form of Agreement to Incorporate with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to find the Minnesota General Form of Agreement to Incorporate.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

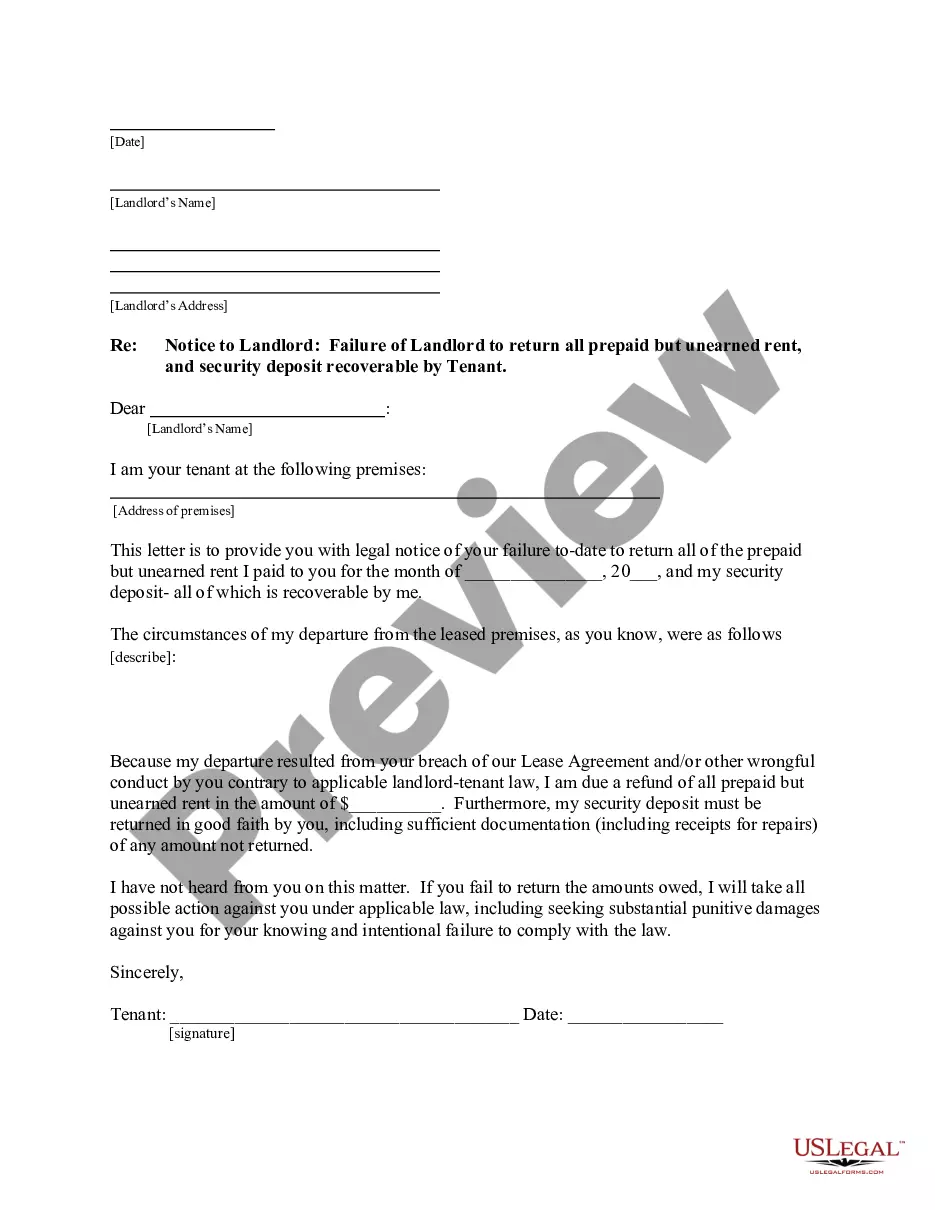

- Step 2. Utilize the Preview option to review the content of the form. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other models in the legal form format.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose your preferred payment plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format for the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Minnesota General Form of Agreement to Incorporate.

Form popularity

FAQ

Yes, you can search for Articles of Incorporation in Minnesota. The Secretary of State's office provides access to business entity filings, including Articles of Incorporation. This can be particularly useful if you want to verify the formation of a corporation or need details about its status, all part of navigating the requirements of the Minnesota General Form of Agreement to Incorporate.

Yes, an LLC can technically operate without an operating agreement. However, this can lead to operational confusion or disputes among members. To maintain clarity and cohesion within your LLC, it is wise to establish an operating agreement, thereby embracing the structure provided by the Minnesota General Form of Agreement to Incorporate.

No, Articles of Incorporation and EIN (Employer Identification Number) are not the same. Articles of Incorporation is a document filed to legally establish a corporation, whereas an EIN is a unique number assigned by the IRS for tax purposes. Both are necessary for different reasons in business formation and operations, lifting your business above just the Minnesota General Form of Agreement to Incorporate.

Yes, you can create your own operating agreement for your LLC in Minnesota. This flexibility allows you to tailor the agreement to meet the specific needs of your business. It is essential to ensure that it complies with state laws while also serving your LLC's interests, complementing the Minnesota General Form of Agreement to Incorporate.

While an operating agreement is not mandatory in Minnesota, it is advisable to have one in place. This document can help prevent misunderstandings among members and establish how your LLC will function. If you decide to draft an operating agreement, consider integrating elements that complement the Minnesota General Form of Agreement to Incorporate.

Minnesota does not legally require an LLC to have an operating agreement. However, having one is highly recommended. An operating agreement helps define the roles, responsibilities, and operational procedures within your LLC, providing clarity and legal protections. You can create a customized agreement that aligns with the Minnesota General Form of Agreement to Incorporate.

In Minnesota, an LLC does not receive Articles of Incorporation. Instead, it files Articles of Organization. This document serves as the official formation document for an LLC and is distinct from the Minnesota General Form of Agreement to Incorporate, which is used for corporations. If you are starting an LLC, you will need to focus on the Articles of Organization to ensure proper registration.

Setting up an S Corp in Minnesota involves choosing a unique business name, filing articles of incorporation with the Secretary of State, and electing S Corp status by submitting Form 2553 to the IRS. It is crucial to ensure all documentation is accurate and compliant to avoid delays. Leveraging the Minnesota General Form of Agreement to Incorporate can streamline this intricate process and provide clarity on your next steps.

Yes, you can be your own registered agent in Minnesota as long as you have a physical address in the state. This option allows you to save on fees associated with appointing a third-party service. Just be sure you are available during business hours to receive legal documents, and consider documenting this choice in the Minnesota General Form of Agreement to Incorporate.

An S Corp becomes beneficial when a business owner’s income level reaches a point where the savings on self-employment taxes outweigh the costs of maintaining the corporation. Generally, this threshold can be around $40,000 to $50,000, depending on various factors. Mindfully assessing your situation and consulting the Minnesota General Form of Agreement to Incorporate can provide insights tailored to your needs.