An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

Minnesota Marital Deduction Trust - Trust A and Bypass Trust B

Description

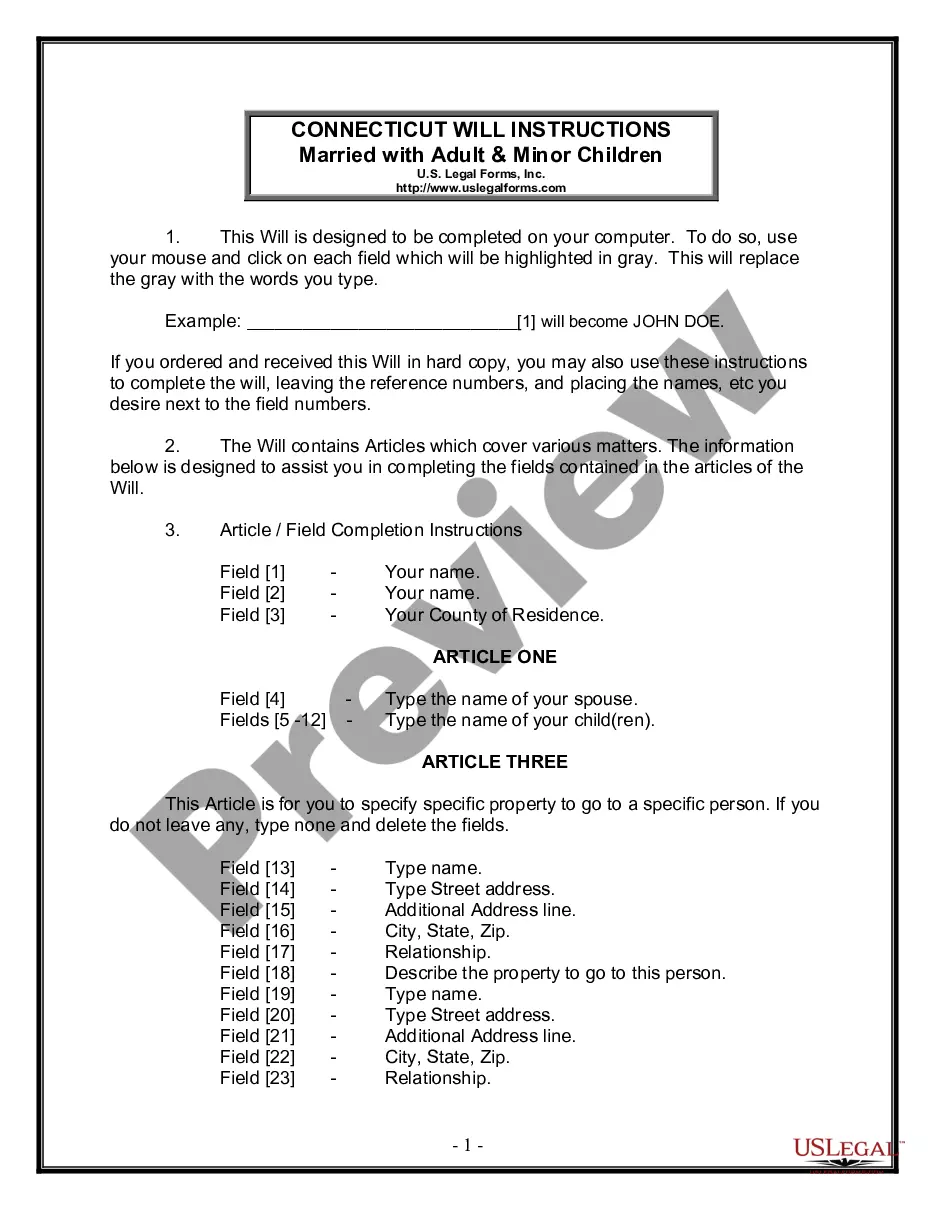

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

If you wish to total, download, or create official document templates, utilize US Legal Forms, the largest collection of legal forms, that are available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

A range of templates for business and personal uses are categorized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Minnesota Marital Deduction Trust - Trust A and Bypass Trust B with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Minnesota Marital Deduction Trust - Trust A and Bypass Trust B.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you’re using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Remember to read the information carefully.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of your legal form.

Form popularity

FAQ

A bypass trust is required to file a tax return if it generates income that is taxable to its beneficiaries. Generally, it must file Form 1041 to report its income, deductions, and credits. Understanding the tax obligations associated with a Minnesota Marital Deduction Trust - Trust A and Bypass Trust B can ensure that you adhere to relevant regulations. Utilizing platforms like uslegalforms can provide resources to navigate these requirements efficiently.

Yes, most trusts must file tax returns annually. A trust's requirement to file depends on its structure and whether it generates taxable income. For instance, a Minnesota Marital Deduction Trust - Trust A and Bypass Trust B will typically need to file a Form 1041 if it earns income. Ensuring proper filing can help avoid penalties and complications, making it essential to stay informed.

Pass-through trusts are taxed at the individual level, meaning the income is passed on to beneficiaries who then report it on their tax returns. This taxation method allows the trust itself to avoid paying income tax. In the context of a Minnesota Marital Deduction Trust - Trust A and Bypass Trust B, understanding how these trusts are taxed can help you plan accordingly. It can be beneficial to consult with tax professionals to gain clarity on this matter.

Yes, certain trusts may qualify for the marital deduction. A Minnesota Marital Deduction Trust - Trust A allows a surviving spouse to receive the trust assets without incurring estate taxes at the first spouse's death. However, the specific terms of the trust must meet IRS requirements to be eligible. Consulting with a legal expert can assist you in ensuring your trust qualifies for the marital deduction.

Income generated from a bypass trust is indeed taxable. When the trust earns income, that income typically gets distributed to the beneficiaries. Therefore, the beneficiaries must report this income on their personal tax returns. Understanding the tax implications of a Minnesota Marital Deduction Trust - Trust A and Bypass Trust B is crucial to ensuring compliance and effective tax planning.

The terms 'trust' and 'B Trust' refer to different concepts within estate planning. A trust generally manages assets for the benefit of designated recipients. In contrast, a B Trust, part of the Minnesota Marital Deduction Trust - Trust A and Bypass Trust B, serves a specific purpose in estate tax planning. It typically holds the assets of the deceased spouse to minimize taxes and protect wealth for future generations. Understanding this difference helps in choosing the right strategy for your estate.

A marital trust, often referred to in the context of the Minnesota Marital Deduction Trust - Trust A and Bypass Trust B, is designed to provide lifetime benefits to the surviving spouse. In contrast, a Bypass Trust aims to limit estate taxes by allocating a portion of the estate to beneficiaries other than the surviving spouse. The key difference lies in their objectives; marital trusts prioritize support for the survivor, while Bypass Trusts emphasize tax efficiency and wealth preservation. This distinction is crucial when planning your estate.

The purpose of an A/B trust, or the Minnesota Marital Deduction Trust - Trust A and Bypass Trust B, is to minimize estate taxes while providing for a surviving spouse. Upon the passing of one spouse, the trust separates into two parts: the A trust for the surviving spouse and the B trust, which holds the deceased spouse's assets. This setup helps reduce the taxable estate of the surviving spouse, thus preserving wealth for future generations. Such a trust structure allows families to maximize tax benefits effectively.

One downside of an AB trust, also known as the Minnesota Marital Deduction Trust - Trust A and Bypass Trust B, lies in its complexity. Maintaining these trusts can lead to increased administrative costs and responsibilities. Your trustee may need to file separate tax returns, which adds to tax preparation costs. Additionally, the need for ongoing management may make these trusts less appealing to some individuals.

If a bypass trust remains unfunded, it may lose its intended tax benefits and protective features, leaving your estate exposed to higher taxes. As a result, the key purpose of a Minnesota Marital Deduction Trust - Trust A and Bypass Trust B strategy may not be realized. To avoid this issue, it’s crucial to address funding as part of your estate planning process. Consultation and drafting services offered by platforms like US Legal Forms can enhance your understanding and execution of trust funding.